Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 6 Jun, 2023

By Sarah Cottle

Today is Tuesday, June 6, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition of Insight Weekly, we examine loan delinquencies at US banks. The commercial real estate (CRE) loan delinquency rate increased sequentially by 12 basis points to 0.77% at the end of March, the highest since the third quarter of 2021, according to an S&P Market Intelligence analysis. Delinquencies on credit card and auto loans rose year over year in the first quarter and continued to inch closer to levels seen during the early stages of the COVID-19 pandemic. Meanwhile, the overall commercial and industrial loan delinquency ratio stood at 0.98% in the first quarter, down 9 basis points from the same period in 2022. Most bankers presenting at the annual S&P Community Bankers Conference seemed hesitant to grow their loan portfolios at this point. As economic uncertainty and liquidity pressures increased, lending slowed, with total loans falling 0.2% on a sequential basis, compared to the 1.9% linked-quarter increase in the previous quarter.

The supply of money in the US economy is dropping at the fastest rate ever, potentially helping slow stubbornly high inflation. Cash, personal savings and market accounts accessible to consumers — collectively referred to as the "M2" money supply — fell to $20.673 trillion in April, a drop of $1.031 trillion from a peak in July 2022, according to the latest Federal Reserve data. The unprecedented drop in M2 is being fueled by the Fed's aggressive monetary policy tightening, a decline in credit availability, turmoil in the banking sector and the end of COVID-19 government stimulus efforts.

The number of US coal miners increased 1.3% in the first quarter of 2023 from the prior quarter to an average of 45,473 employees, according to an S&P Global Commodity Insights analysis. However, US coal production was flat year over year in the first quarter at 148,875 short tons, dipping 399 tons, or 0.27%.

The Big Number

Trending

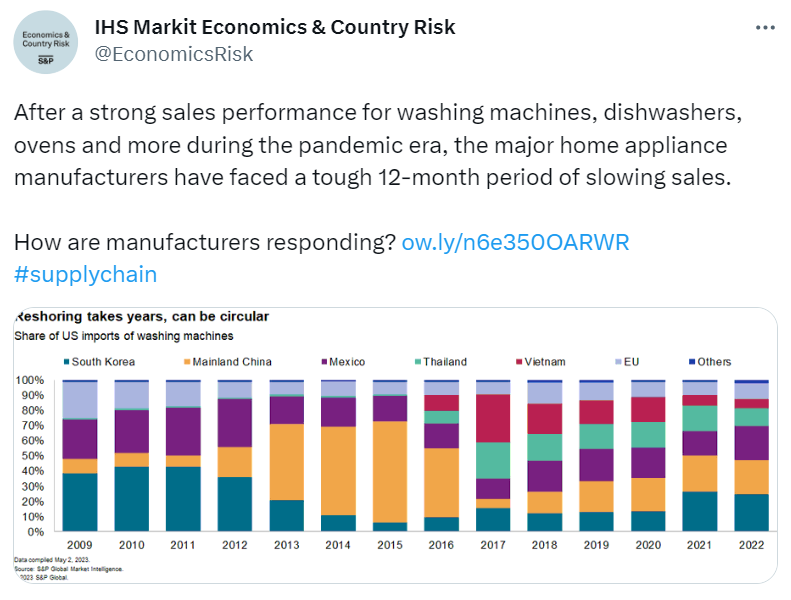

—Read more on S&P Global Market Intelligence and follow @EconomicsRisk on Twitter.

Transform Your Tomorrow

A sustainable tomorrow starts with actionable intelligence today. Advance your sustainability journey with data, analytics and workflow solutions that help you take the next step. And the step after that.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Compiled by Alex Virtucio

Theme