Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 21 Feb, 2023

By Sarah Cottle

Today is Tuesday, February 21, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition of Insight Weekly, we put a spotlight on the decline of M&A deals in technology, media and telecommunications in January. Information technology M&A activity in North America had a lukewarm start to 2023, with aggregate deal values sinking 57.42% year over year, according to S&P Global Market Intelligence data. U.S. and Canadian media and telecom companies saw total deal values plummet to $150.0 million from $97.80 billion a year ago. In Europe, no infotech transaction crossed the $1 billion mark during the month. Wireless services, advertising and movies and entertainment were among the media and telecom subsectors that dominated dealmaking in the region.

Analysts covering the largest U.S. banks curtailed their expectations for 2023 earnings growth The estimate changes were fairly consistent across banks in all categories, though analysts lowered net interest margin and net charge-off estimates the most for banks with $10 billion to $100 billion in assets and lowered EPS growth estimates the most for banks with less than $10 billion in assets.

U.S. shoppers spent more than economists expected in January. The strong retail sales performance helps lower the odds the economy will slide into recession this quarter, according to Market Intelligence economists. The sales figures are not adjusted for inflation, which rose 0.5% on a monthly basis in January. Annual consumer price rises slowed during the month to 6.4% from a summertime peak of more than 9%.

The Big Number

Trending

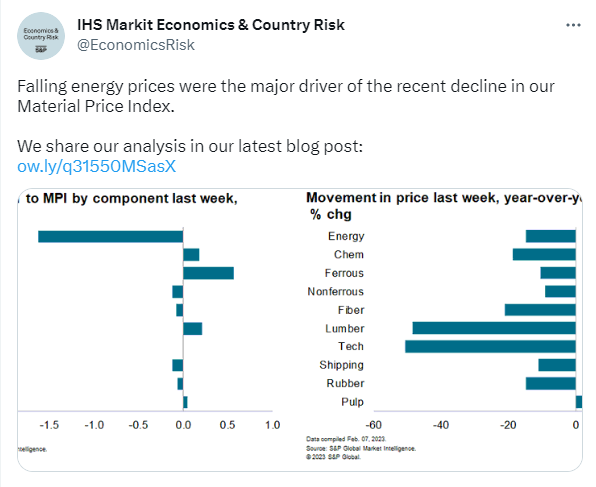

—Read more on S&P Global Market Intelligence and follow @EconomicsRisk on Twitter

Data That Delivers

When markets are unpredictable, get transparent insight with our integrated ecosystem of data, analytical solutions, and delivery channels. We help clients navigate market volatility, achieve their digital transformation goals, and automate workflows.

Explore the S&P Global Marketplace to find fundamental and alternative datasets available seamlessly via Cloud, Data Feed, API Solutions, and Capital IQ Pro, along with expert analysis you won´t find anywhere else.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Roma Arora

Theme