Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 08, 2023

Our banking risk experts provide insight into events impacting the financial sector in emerging markets in February.

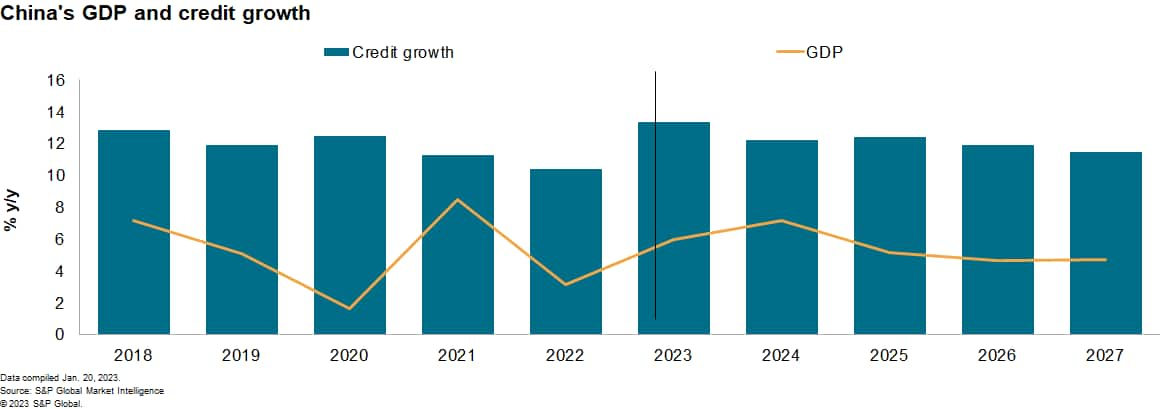

Post-COVID-19 economic support policies in China will likely boost credit growth in the first half of 2023. There have been tentative signs that the Chinese authorities are easing lending conditions for the real estate sector, a trend that Market Intelligence expects to become more widespread, with more economic support policies granted to infrastructure projects as well. It is therefore expected that credit growth in China this year will be more broad-based than our earlier forecasts projected, with most of the lending growth likely to be concentrated in the first half of the year.

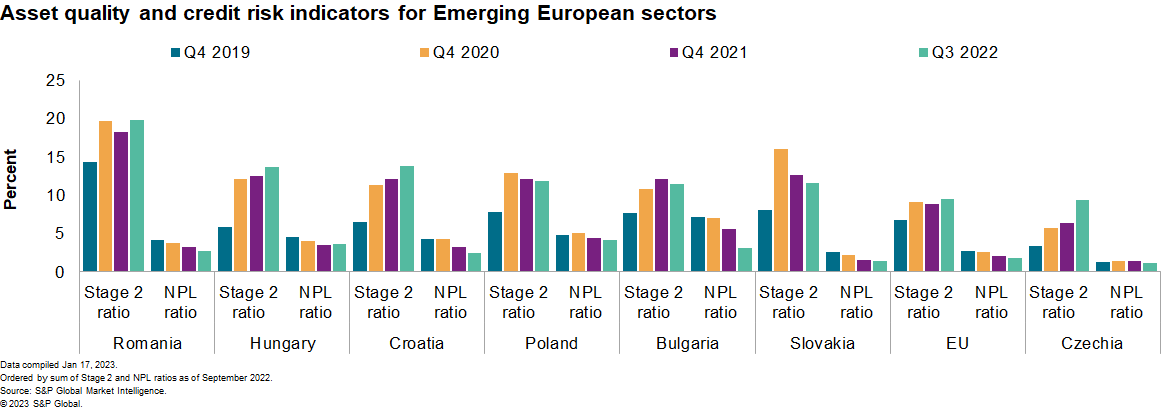

Growing asset-quality vulnerabilities for our scored Emerging European banking sectors mean that extended or expanded loan support measures are likely in 2023. The share of Stage 2 loans to total credit stood at 9.5% for the European Union in the third quarter of 2022 and is largely unchanged from the previous quarter. However, our scored sectors either exhibit higher Stage 2 ratios relative to December 2021 (Czechia), elevated shares relative to the EU (Bulgaria, Poland, and Slovakia), or both (Croatia, Hungary, and Romania) as of September 2022. Still-elevated price growth or volatile commodity prices will continue to threaten borrowers' debt-service capacities in Emerging Europe, likely incentivising authorities to extend or widen the applicability for existing loan support measures further into 2023 - more so if adverse developments materialise and affect banks' loan books, particularly in the areas of economic activity, unemployment, or national house prices.

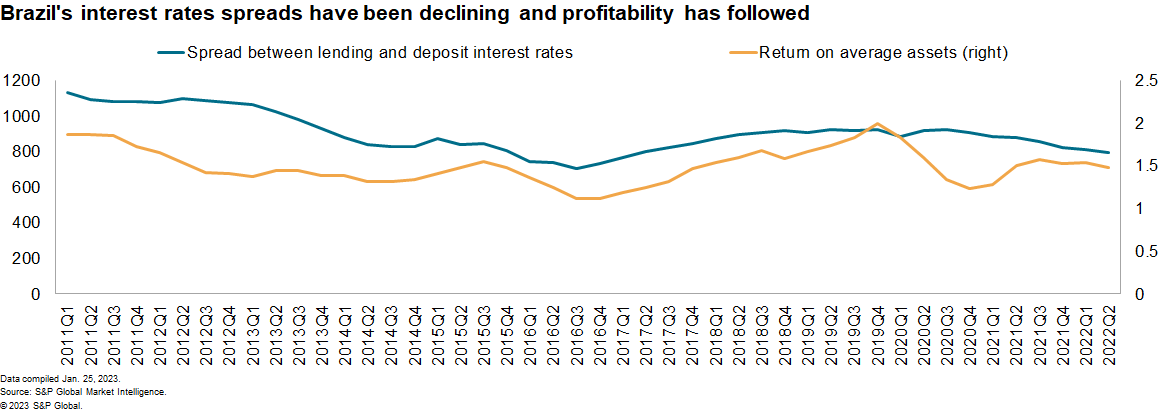

The development of a Brazilian project to set maximum interest rates for credit cards, hampering some of the sector's profitability. The Brazilian Congress is discussing the potential legislation for setting a maximum interest rate on credit card interest. The proposal intends to cap the interest rate to 8% per month from an approximate 14.5% (or 400% annualised). The proposal was likely introduced to contain some of the pricing power that some banks can exert, given the sector's large concentration among a few actors. While the bill has yet to be approved and could be subject to changes, in its current form it would lower interest rates significantly, likely limiting some of banks' interest income and lowering their profitability.

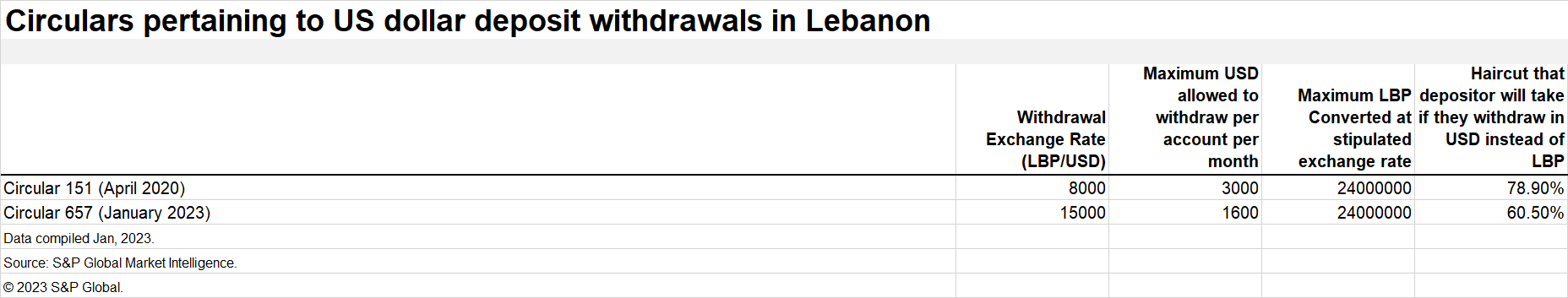

The modification of Lebanon's official exchange rate to LBP15,000/USD1 will benefit foreign exchange depositors, but official balance sheet reporting will be unaffected. Lebanon's new Circular 657 will go into effect in February 2023, increasing the deposit withdrawal exchange rate for foreign exchange depositors to LBP15,000/USD1. This allows depositors who have US dollar accounts to withdraw banknotes in Lebanese pounds from such accounts at a fixed exchange rate of LBP15,000/USD1, with a ceiling of USD1,600 per account per month, instead of the previous exchange rate of LBP8,000/USD1 on up to USD3,000 per account. Although the deposit withdrawal rate reflects the modification of the official exchange rate, the maximum amount of Lebanese pounds allowed to be withdrawn remains unchanged at LBP24 million. Despite the effective depreciation of the Lebanese pound pertaining to deposit withdrawals, total Lebanese pounds that can be converted from US dollar deposits remains unchanged from the previous Circular, at LBP24 million per month. The effective haircut that depositors will take on foreign exchange accounts due to the Sayrafa rate conversion will fall to 60% from 78% prior to Circular 657, due to a lower monthly withdrawal limit per account of USD1,600. However, further adoptions of the new exchange rate remain unspecified, and bank balance sheets will continue to use the old exchange rate of LBP1507/USD1, which continue to obscure balance sheet losses and delay recognition of true losses on banks' foreign exchange liabilities.

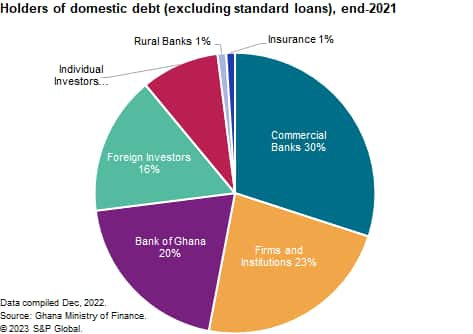

An update on Ghana's domestic debt-exchange programme deadline, with banks expected to participate. The deadline for registration to participate in the Domestic Debt Exchange Programme (DDEP) was set to expire on 31 January 2022, following three previous extensions. The government's target is for 80% of government debt holders to participate in the exchange. In our view, banks will ultimately participate in the exchange programme given that, if they hold their existing bonds, they would experience an increase in the capital risk weighting for old bonds to 100% - compared with 0% for the new bonds - thus requiring non-participant banks to significantly raise capital to comply with regulatory minimum capital requirements. However, we view it as unlikely that the current deadline will be met, as banks hold back on participation in order to attain better terms in the DDEP.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.