Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 22 Aug, 2023

By Sarah Cottle

Today is Tuesday, August 22, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

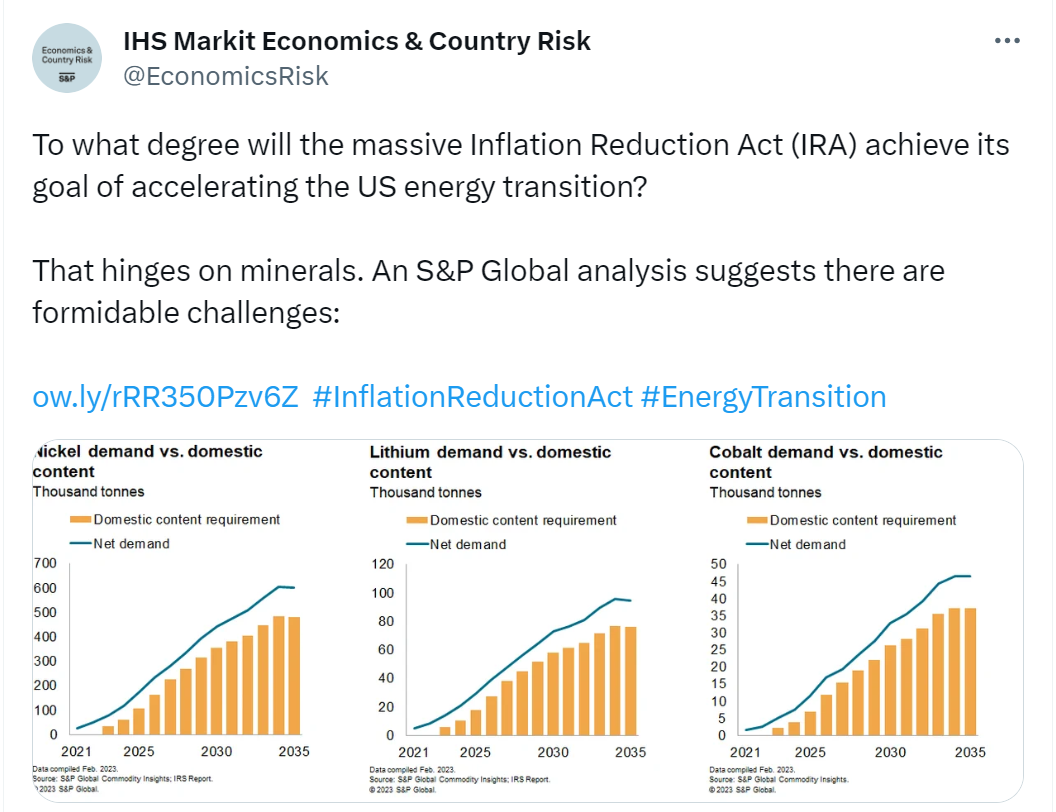

In this edition of Insight Weekly, we take a close look at the challenges facing the US Inflation Reduction Act (IRA) a year into its implementation. The IRA has contributed to a surge in domestic critical mineral project investments from miners and automakers due to the legislation's incentives, including tax credits for minerals processing and regulations requiring tax credit-eligible electric vehicles to source materials from certain countries. Despite the promise of the early investments, the IRA's long-term impact rests on US mine permitting rule changes and upcoming tax credit guidance, experts say. The legislation also authorized a tax credit for hydrogen producers. But of the 115 hydrogen projects announced in the US since President Joe Biden's inauguration, only 11 have secured capital commitments, according to S&P Global Commodity Insights. Elsewhere, offshore wind projects have shown signs of significant stress, with some developers renegotiating or terminating power purchase agreements with utilities due to global economic headwinds.

The US Treasury plans to issue a near-record $1.859 trillion of debt in the second half of 2023, $274 billion more than previously planned in May, as it refills its coffers after running down reserves to fund operations during recent debt ceiling negotiations between Congress and the White House. The increase in supply is expected to weigh on the price of bonds. However, some market watchers are not particularly concerned about the government's borrowing plans, saying the market can still absorb any new debt issuance, with the Federal Reserve's battle with inflation driving the future direction of prices.

New guidance from the Federal Deposit Insurance Corp. clarifying that banks must include intercompany and collateralized deposits in their uninsured deposit totals led to another round of revisions. Since that guidance was issued July 24, 46 banks have restated their fourth-quarter 2022 uninsured deposit totals and 65 banks have restated their first-quarter 2023 uninsured deposit call report data, according to an S&P Global Market Intelligence analysis. Now, 117 companies have restated their fourth-quarter 2022 uninsured call report data for a net decline of $281.39 billion since the original filings. For the first quarter, 98 banks have restated for a net decline of $79.58 billion.

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @EconomicsRisk on Twitter

Transform Your Tomorrow

A sustainable tomorrow starts with actionable intelligence today. Advance your sustainability journey with data, analytics and workflow solutions that help you take the next step. And the step after that.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Compiled by Deavelle Sauva

Theme