Brazil Economic Forecasts and Risk Ratings

April 2017 Forecast Highlights

- March Purchasing Managers’ Index (PMI) figures for manufacturing amounted to 49.6; although they still show Brazil is in contraction (below 50), this is the best result since February 2015 and shows the industry may soon exit the recession. The PMI for services amounted to 47.7, the best result since March 2015.

- Significant revisions to the methodology on measuring commerce and other sector activity might imply that Brazil’s GDP actually expanded in the first quarter of 2017, which would mean the end of a deep and long-lived recession. S&P Global forecasts the recession will end in the second quarter, but the aforementioned changes may bring forward growth.

- Inflation will drop further, allowing Brazil’s central bank to continue cutting the policy rate aggressively

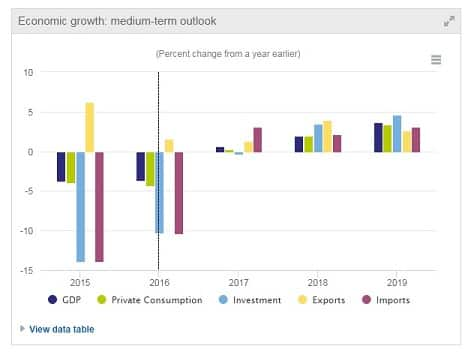

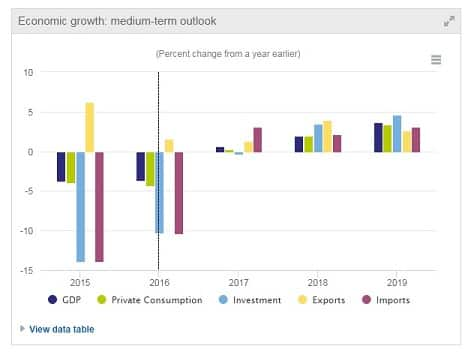

Medium- and Long-Term Forecast

- While the medium-term outlook is mixed, long-term prospects for the Brazilian economy remain relatively positive

- High domestic interest rates constrain growth prospects for Brazil

- On a more positive note, unlike the rest of Latin America, Brazil has a diversified industrial base and remains a major force in the region

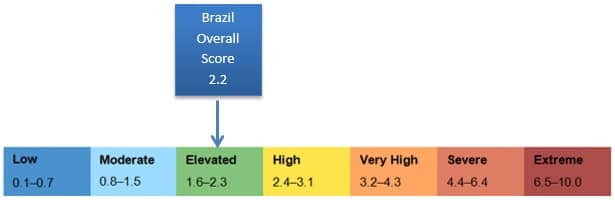

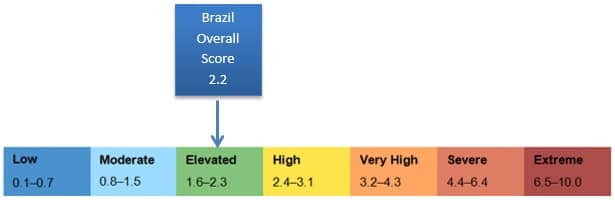

Country Risk Rating for Brazil

Following Dilma Rousseff’s impeachment, Michel Temer was officially sworn in as president on August 31. He is expected to serve until 2018, but fresh corruption allegations are threatening his stay in office. While Brazil’s economy is starting to show signs of recovery, it has been going through a deep and prolonged recession. GDP contracted by 3.6% in 2016 and unemployment surged to 11.3%; anemic growth of just 0.2% is forecast for 2017. Temer will prioritize maintaining political stability and tackling an unsustainable fiscal deficit that will require the approval of an unpopular austerity program by Congress. Fiscal retrenchment efforts will open the door for the privatization of airports and power distributors. Foreign investment is constrained by heavy taxation, outdated labor laws, corruption and an excessive state bureaucratic burden.

A note on our risk ratings: S&P Global derives country risk ratings for 206 countries, based on six separate ratings in each country: political, economic, legal, tax, operational and security with 22 detailed sub-aggregate risks. These ratings allow you to quantify risk with greater specificity with a scoring system based on a 0.1-10 logarithmic scale. Seven risk bands, from low to extreme, allow you to compare and contrast risk between countries and regions.

{"items" : [

{"name":"facts","url":"","enabled":false,"desc":"","alt":"","mobdesc":"PDF","mobmsg":""},{"name":"login","url":"","enabled":false,"desc":"Product Login for existing customers","alt":"Login","large":true,"mobdesc":"Login","mobmsg":"Product Login for existing customers"},{"name":"sales","override":"","number":"[num]","enabled":true,"desc":"Call Sales [num]","proddesc":"[num]","alt":"Call Sales</br>[num]","mobdesc":"Sales","mobmsg":"Call Sales: [num]"}, {"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fsolutions%2fbrazil-economic-forecasts-risk-ratings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fsolutions%2fbrazil-economic-forecasts-risk-ratings.html&text=Brazil+Economic+Forecasts+and+Risk+Ratings+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fsolutions%2fbrazil-economic-forecasts-risk-ratings.html","enabled":true},{"name":"email","url":"?subject=Brazil Economic Forecasts and Risk Ratings | S&P Global&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fsolutions%2fbrazil-economic-forecasts-risk-ratings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brazil+Economic+Forecasts+and+Risk+Ratings+%7c+S%26P+Global http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fsolutions%2fbrazil-economic-forecasts-risk-ratings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}