Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 19, 2022

Worldwide PMIs to provide guidance on recession risks and inflation trends

July's upcoming PMI survey data will be eagerly assessed for clues as to recession risks and the persistence of elevated inflation rates.

Economic growth resilience under scrutiny

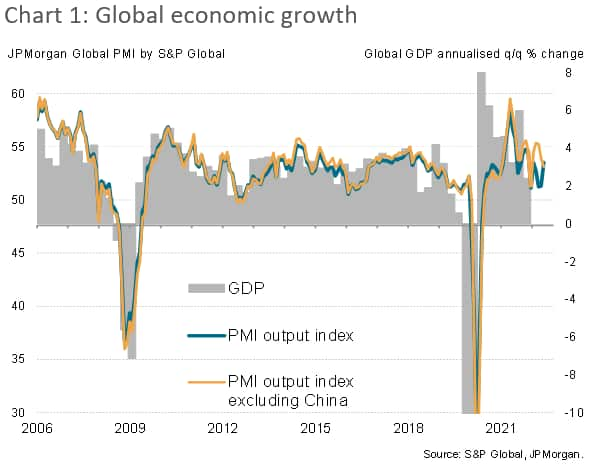

June's PMI output data had broadly come in below expectations, with a notable exception of mainland China, raising concerns that the cost-of-living crisis was dampening global growth more than anticipated -particularly in the US and Europe. Forward-looking indicators such as new orders, the output-orders differentials, orders-inventory ratios and future expectations indices all sent even gloomier signals, suggesting that output growth will cool further as we head into the third quarter.

While China and, to a lesser extent, Japan had reported improved economic performances in June, the July data will shed some light on the extent to which these gains simply reflected the reopening of these economies after Omicron or whether a more encouraging, fundamental improvement in demand is taking place. Expectations of the latter are especially low for China, where July has seen the reimposition of COVID-19 containment measures in some cities.

Employment gains unlikely to be sustained

While the survey's output and new orders indices will therefore provide an update on economic growth trajectories at the start of the third quarter, it will be also important to ascertain the direction of travel for capacity utilization, employment, inventories, supply chains and of course prices.

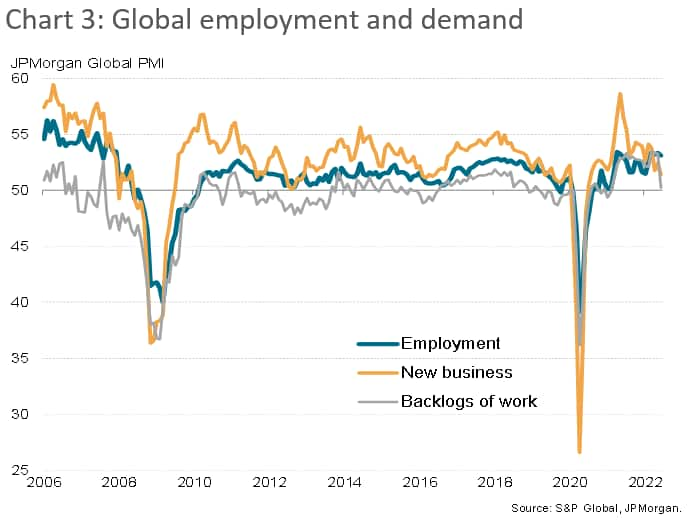

June had seen global employment growth generally holding up well, with many firms continuing to rebuild workforces that had been affected by the pandemic. However, as chart 3 shows, the persistence of such robust employment growth would be unusual given the recent cooling of demand growth. We will therefore be watching the survey gauges on new orders, backlogs of orders and employment to gauge the extent to which hiring is likely to persist in coming months and whether jobs growth might already be cooling amid concerns over recent demand growth.

Changing inventory focus

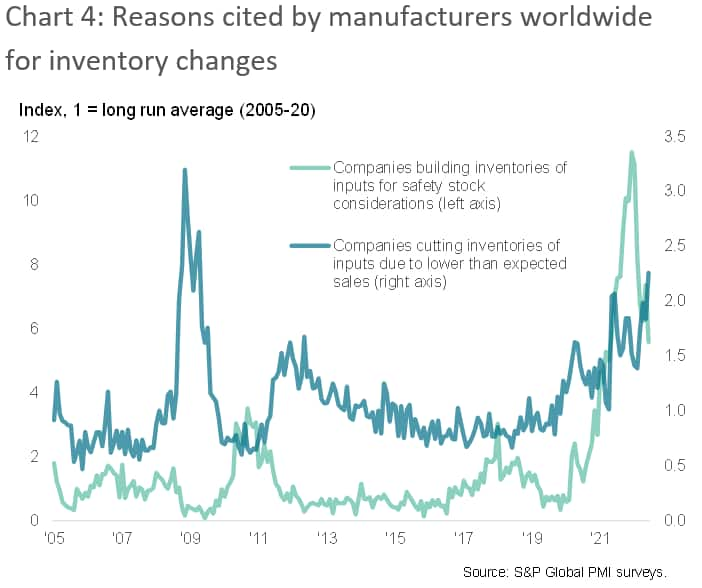

The moderation of demand growth - and in the case of global manufacturing a stalling of demand growth - had already led to a marked change in inventory management in June, with factories increasingly moving away from inventory building for safety and supply resilience concerns towards cutting inventories in response to weaker than expected sales (see chart 4).

The number of producers worldwide that have been cutting inventories of inputs due to lower-than-expected sales has in fact risen to the highest since the global financial crisis. Eyes should therefore be focused on how these inventory levels are changing, as this can exacerbate changes in final demand and affect supply chains.

Supply conditions and prices

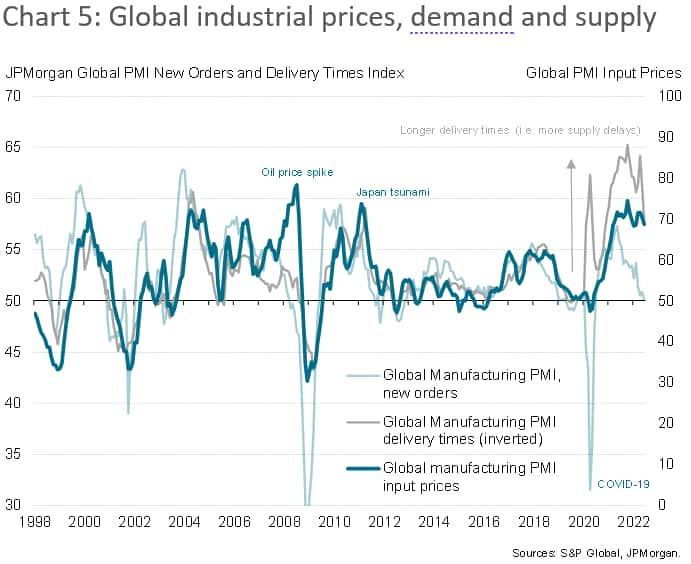

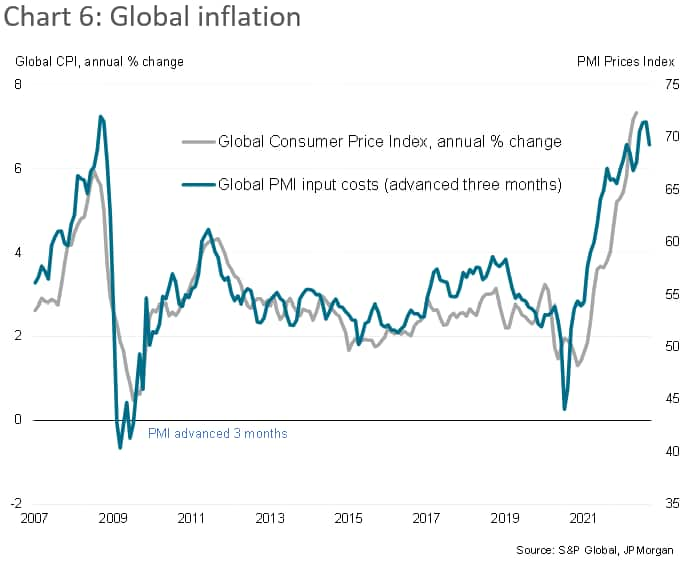

It is already evident that the deteriorating demand outlook had led to lower prices for many commodities, notably oil and copper, with a further lowering of prices triggered in part by the June PMIs. Hence, we would expect to see these lower industrial price pressures help to soften the inflation picture in July. Oil futures, for example, have fallen by around 20% since the June PMI data were collected.

Key to the price outlook, however, will be the supply situation. Although global supplier delivery times lengthened in June to the smallest degree since November 2020, shortages remain prevalent and continue to hand pricing power to the seller in many cases. As such, the PMI suppliers' delivery times index will be a major barometer to watch in terms of supply chain pricing power.

The surveys' broader indicators of price trends will also need to be monitored to assess the pass through of higher energy, wage and material costs through to the consumer. Recent months have seen a broadening out of the inflation picture, with initial price rises for goods passing through to services to the extent that, in May and June, global service sector input cost inflation exceeded that of manufacturing.

However, more encouragingly, there have been signs of input cost inflation starting to cool which, on the back of recent commodity price falls, could gain momentum in July to add to tentative hopes of a peaking of inflationary pressures.

United States

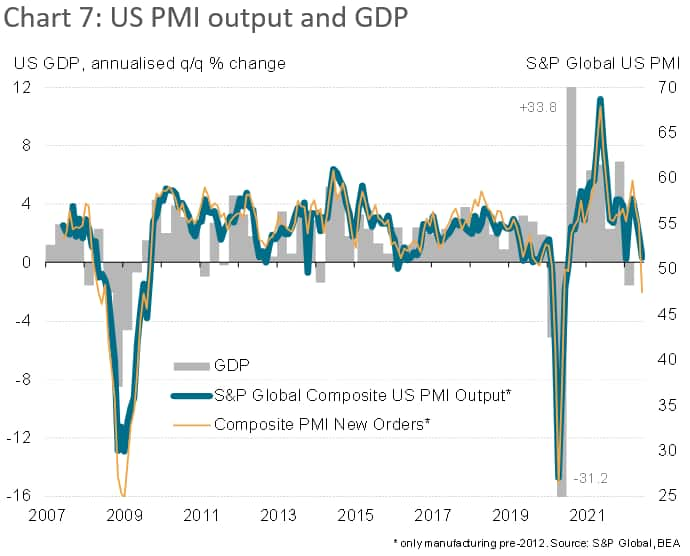

June saw the S&P Global US composite PMI fall to a five-month low of 52.3, and the second-lowest since July 2020. The service sector output gauge has lost considerable momentum while manufacturing growth has stalled. Most worrying is the new orders index, which signalled the first decline in demand for goods and services for two years. This index paints the gloomiest picture of the US demand environment since the global financial crisis barring only the initial pandemic downturn in early 2020. Not surprisingly, the consensus according to Refinitiv estimates, is for both US manufacturing and services growth to weaken further when the flash estimates are published on 22nd July.

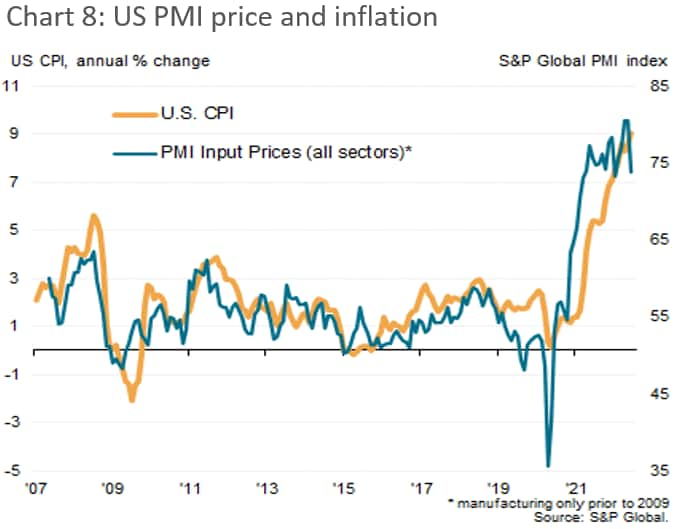

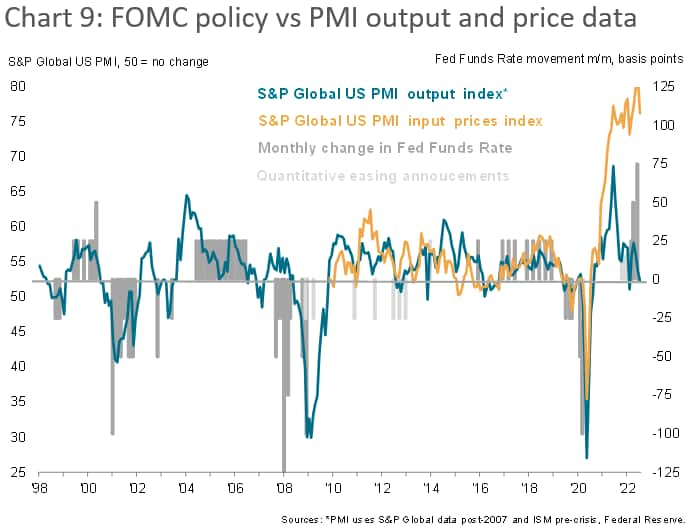

While June saw US inflation surge to a 40-year peak of 9.1%, the US PMI's input cost index - which tends to lead changes in CPI inflation - turned sharply lower. Although signalling still elevated inflationary pressures, any further cooling of cost growth in the July PMI survey will bode well for CPI in the coming months.

With the FOMC expected to hike by 75 basis points (bp) or more at its July meeting, the flash PMI data will help understand the likelihood of further policy tightening through the second half of the year and into 2023. Note that the futures markets are already pricing in rate cuts in 2023. Any significant worsening of the demand picture and associated cooling of price pressures could see some further revising of interest rate expectations.

Eurozone

Economists are also anticipating weaker PMI numbers to come out of the eurozone when the flash data are issued on 22nd July. Manufacturing output contracted for the first time in two years in June and the expansion in service sector activity cooled considerably, easing most notably for consumer-facing services. June's headline number covering manufacturing and services of 52.0 was consequently the lowest since the lockdowns of February 2021. However, as with the US PMI data, it was the forward-looking details which caused most consternation.

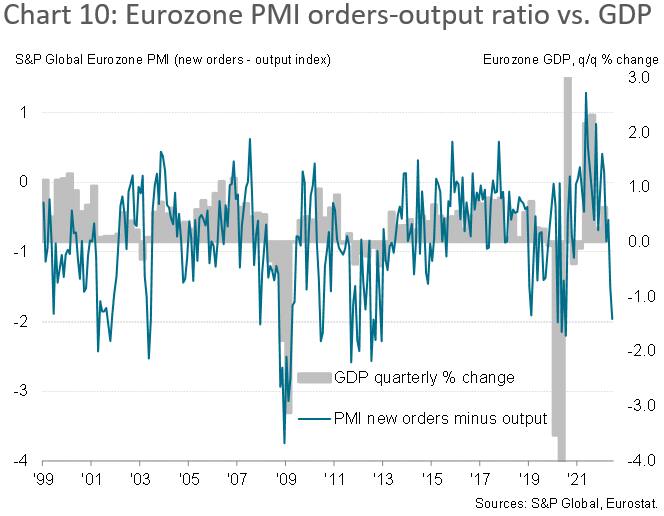

As chart 10 illustrates, even the reduced rate of output growth outpaced order book growth in June to a degree rarely seen, and indicative of economic growth weakening in the third quarter as companies adjust to weakened demand.

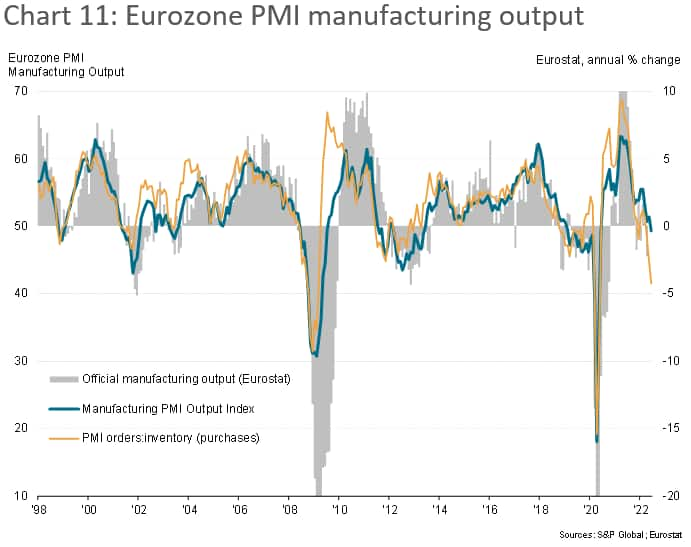

A more severe weakening is signaled for eurozone manufacturing alone, as depicted by the survey's new orders/inventory ratio, which has fallen to a level only ever before seen during the initial pandemic lockdowns and the global financial crisis.

Eurozone companies also scaled back their business expectations for output over the coming year to the lowest since October 2020. Both the stagnation of demand and worsening outlook were widely blamed on the rising cost of living, tighter financial conditions and concerns over energy and supply chains linked to the Ukraine war and ongoing pandemic.

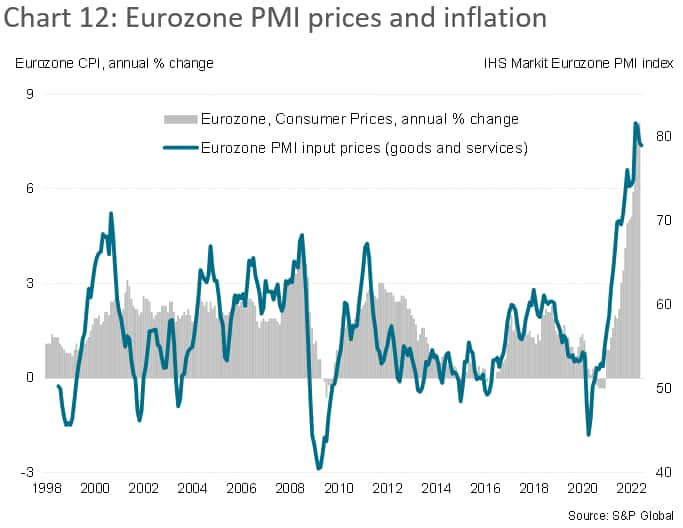

Price pressures meanwhile remained elevated at levels not seen prior to the pandemic, though a moderation of cost growth for a third successive month in June hinted at a peaking in the rate of inflation.

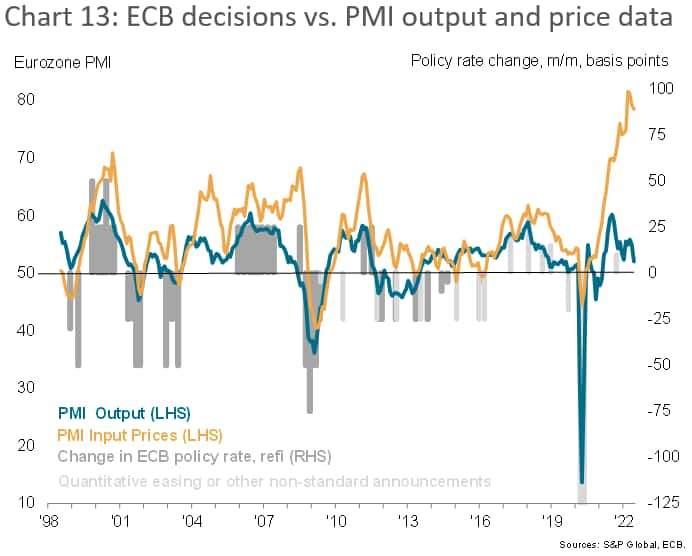

The flash PMI data will follow a day after the ECB announces its latest policy decision, for which at least a 25 basis point hike has been pre-announced (its first rate rise for a decade), to be followed by another 50bp hike at the following September meeting if the data support such a move. The flash PMIs will therefore be in the spotlight in terms of the guidance on whether the data are conducive to an increasingly aggressive ECB tightening path.

United Kingdom

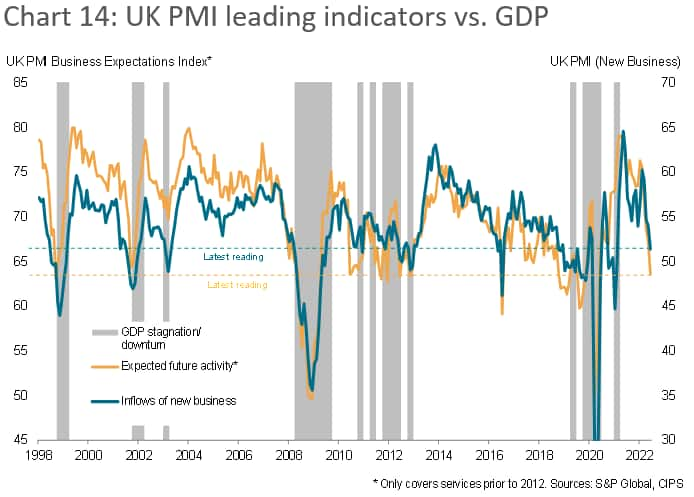

The July UK flash PMI comes after the June survey showed surprising resilience in terms of output, with the final reading of the headline composite PMI in fact rising from 53.1 in May to 53.7 in June. However, this index was running over 60 back in March, underscoring the severity of the UK's recent downshifting in its growth rate. As seen in the US and the eurozone, the UK also saw a worrying deterioration in the leading indicators, notably new orders and future output expectations, both of which have slumped to levels which have historically tended to be commensurate with economic decline (see chart 14).

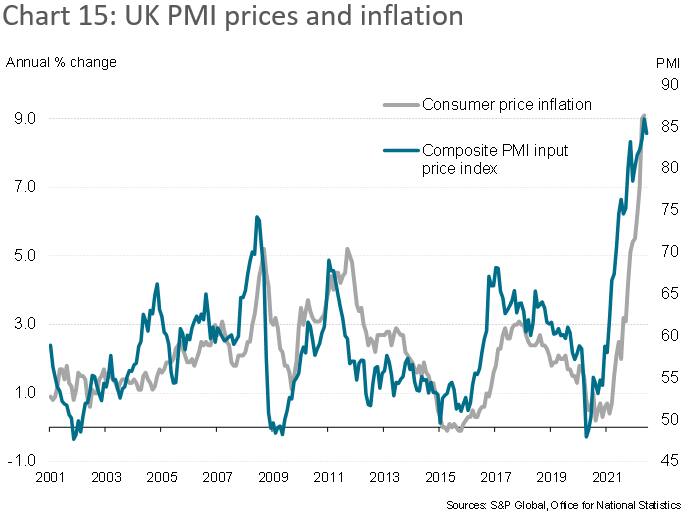

Like the US and eurozone, the UK is seeing a natural moderation of growth after the initial reopening of the economy from Omicron-related health precautions. However, like the US and eurozone, the UK is also experiencing its worst cost of living crisis for four decades, which saw CPI rise at an annual rate of 9.1% in May. There were some signs in the June survey data that hinted of the rate of inflation potentially peaking soon, but it's clear that inflationary pressures remain especially elevated in the UK, with the survey's input cost gauges running ahead of that seen in the eurozone and US.

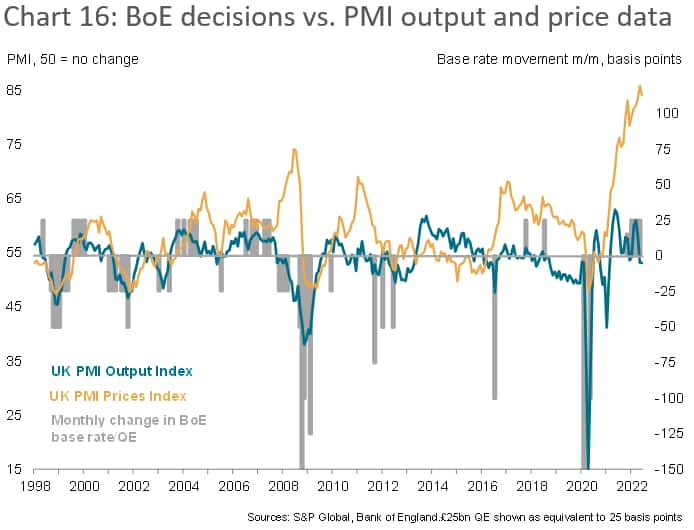

The July UK PMI data come after the Bank of England has chosen to hike interest rates at each of its last five meetings, albeit not yet risking anything higher than a 25bp rise. However, three of the nine policymakers voted for a 50bp rise at the latest meeting, and recent rhetoric has generally become more hawkish as the Bank grows more concerned about inflation expectations. The July data will therefore set the scene for the August 4th MPC meeting, and in particular reveal whether - like the FOMC and ECB - tightening policy is adding to recession risks. Economists are expecting only a modest slowing the pace of expansion, according to Refinitiv data.

Japan

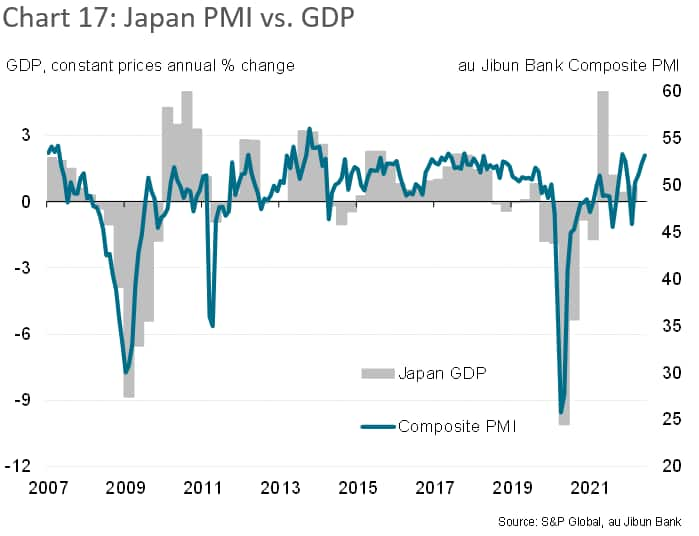

Policymakers at the Bank of Japan will have meanwhile been encouraged by the sharper pace of economic recovery signalled in June by the PMIs, but would have also noted the further acceleration in firms' selling price inflation.

The flash au Jibun Bank composite PMI™ rose from 52.3 in May to 53.2 in June (later revised to 53.0), its highest level since last November and the fourth-best reading since the start of 2014. June's improvement pushed the average PMI reading for the second quarter up to 52.2 against 48.7 in the first quarter, signalling a return to growth for the economy after GDP contracted 0.1% at the start of the year.

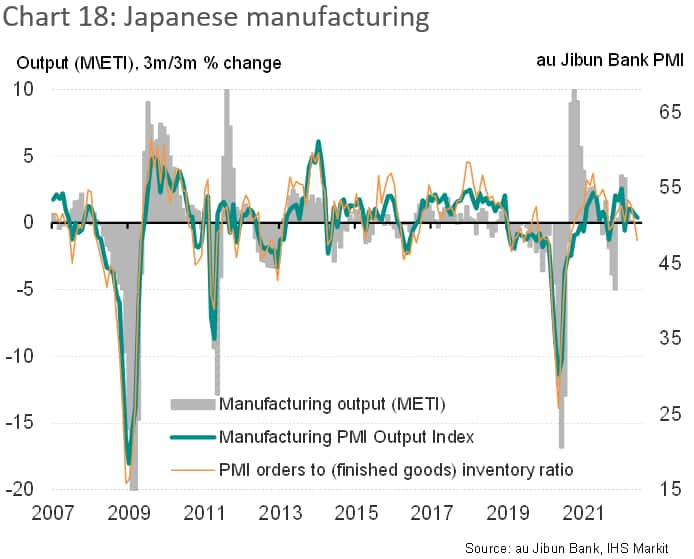

However, any doves could point to the fragility of the demand situation and in particular worrying reliance of the economy on what could prove a temporary rebound in demand for services, which could soon ease as pent-up pandemic demand fades. A key concern is the prospect of a renewed downturn in manufacturing, with June already seeing output growth almost stall and forward-looking indicators such as the orders-inventory ratio turning down further.

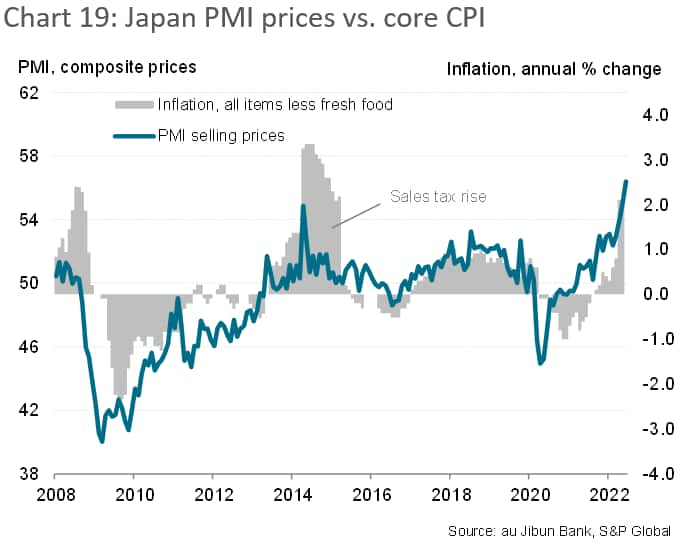

A steep rise in firms' selling prices in June meanwhile suggested that consumer price inflation has further to rise. Headline CPI reached 2.5% in April and May with the core rate up to 2.1%, the latter exceeding the Bank of Japan's 2% target for the first time since 2015. However, these rates are clearly well below those of the US and Europe, and have been a key reason why the yen has come under pressures against the US dollar, with BoJ policymakers intent on focusing on the need for potential stimulus if conditions deteriorate, rather than tightening policy.

Summary

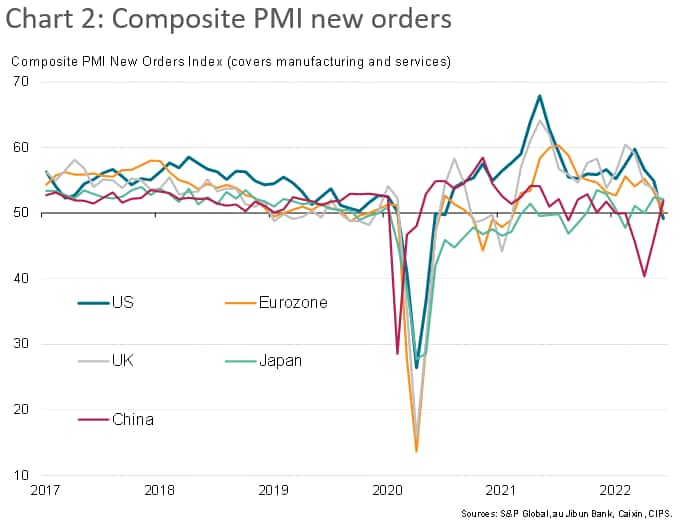

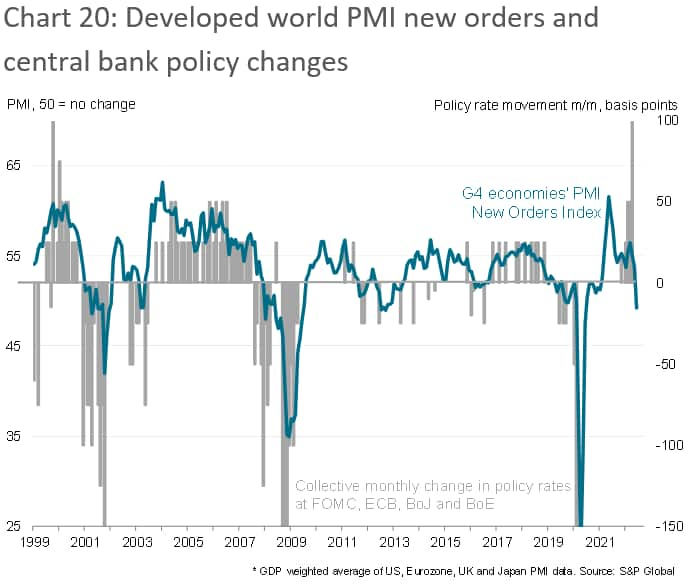

In summing up what to look out for with July's PMIs, and the flash numbers in particular, we bring attention to the demand environment in the developed world's four major economies, as indicated by the PMI's new orders index. When mapped against central bank policy decisions, as in chart 20, it is clear that policymakers are in unprecedented territory, tightening policy in a demand environment which has already turned gloomier to a degree that would already being flashing warning signs of recession. The trend in new orders in July will therefore be critical in assessing the extent to which these recession risks have changed.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-pmis-to-provide-guidance-on-recession-risks-and-inflation-trends-july22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-pmis-to-provide-guidance-on-recession-risks-and-inflation-trends-july22.html&text=Worldwide+PMIs+to+provide+guidance+on+recession+risks+and+inflation+trends+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-pmis-to-provide-guidance-on-recession-risks-and-inflation-trends-july22.html","enabled":true},{"name":"email","url":"?subject=Worldwide PMIs to provide guidance on recession risks and inflation trends | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-pmis-to-provide-guidance-on-recession-risks-and-inflation-trends-july22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Worldwide+PMIs+to+provide+guidance+on+recession+risks+and+inflation+trends+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-pmis-to-provide-guidance-on-recession-risks-and-inflation-trends-july22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}