Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 06, 2023

Worldwide employment stalls as businesses report further weakness of demand

Global output remained largely stalled in November, according to the S&P Global PMI surveys. The data point to weak global growth momentum for a fourth month running after a marked acceleration earlier in the year, which had been fuelled by a short-lived post-pandemic surge in service sector activity.

Demand conditions remained subdued globally, notably among consumers as well as for financial services and basic manufactured goods, albeit the latter showing some signs of a reduced inventory drag.

Employment growth has meanwhile also stalled as firms grow increasingly concerned about excess capacity in the face of subdued demand and gloomy prospects. Business expectations about growth in the year ahead eased to the lowest since December 2022.

Global PMI signals largely stalled business activity in November

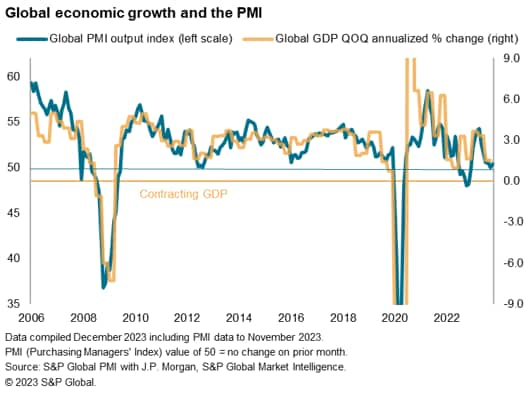

Worldwide business activity rose only very modestly in November, according to the Global PMI data compiled by S&P Global. The headline PMI, covering manufacturing and services across over 40 economies and sponsored by JPMorgan, rose from 50.0 in October to 50.4, indicating a continuation of the largely-stalled picture presented by the PMI over the past four months.

The current reading leaves the PMI below the survey's long-run average of 53.2 and is broadly consistent with annualized quarterly global GDP growth of approximately 1%, well below the pre-pandemic ten-year average of 3.0%.

Prior to the pandemic, and the tightening of financial conditions seen late last year, the recent performance over the past four months has been the weakest spell registered by the PMI since 2012.

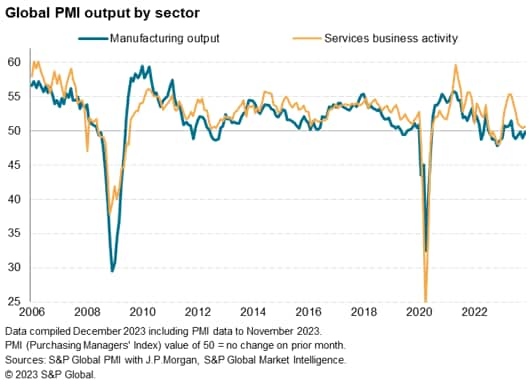

Manufacturing in the doldrums, services growth far weaker than earlier in the year

Manufacturing output edged marginally lower globally in November, down for a sixth successive month. Service sector growth also remained largely stalled, in stark contrast to the growth spurt seen earlier in the year, despite registering a modest overall expansion.

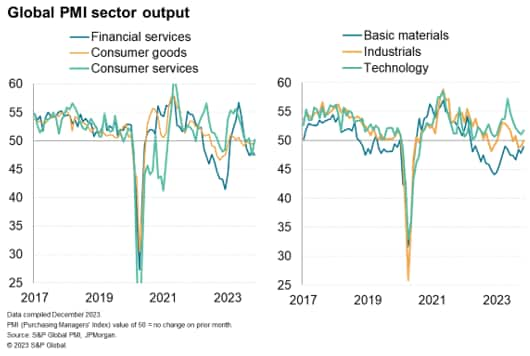

Looking across broad global industries, output continued to rise in technology, healthcare and telecom services in November, and a return to growth was seen for industrials (which includes business services) after two months of decline.

Output meanwhile continued to fall for consumer goods, consumer services and basic materials, with activity also falling in financial services for the first time since August.

Consumer services and financial services have seen especially large swings in growth this year, both having enjoyed strong expansions earlier in the year but more recently seeing a mounting impact from higher interest rates and, in terms of consumer services, the increased cost of living.

A notable cooling in the downturn of basic materials was meanwhile evident in November, linked in part to fewer cases of inventory reduction by customers.

Manufacturers report signs of easing inventory drag

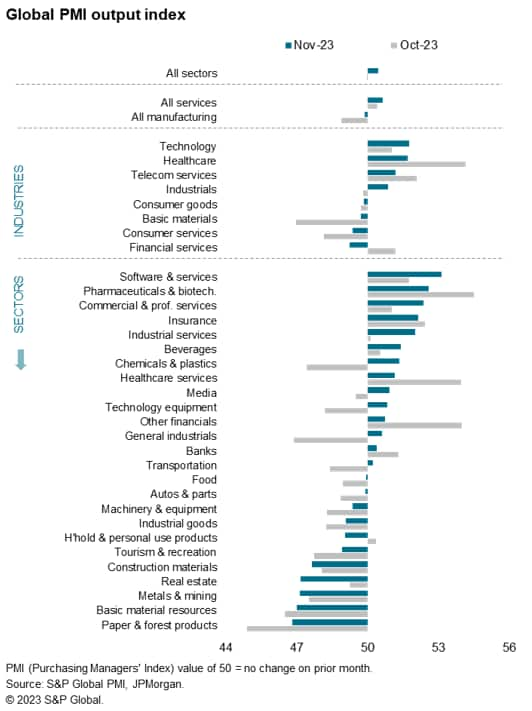

Drilling down into more detailed sub-sectors, the top five fastest growing sectors were all services-related, led by software followed by pharma and biotech.

Besides the notable exceptions of real estate and tourism & recreation, the bottom slots of the rankings were meanwhile dominated by raw material or basic input producers, such as paper & forest products, basic materials, metals & mining and construction materials.

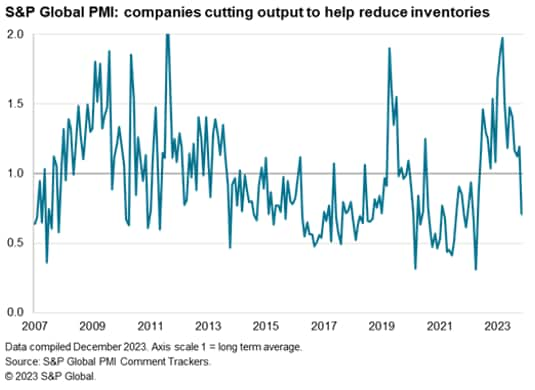

The relatively poor performance of these primary manufacturing sectors largely reflected ongoing inventory reduction policies, with global inventories of inputs continuing to fall at one of the fastest rates seen over the past decade. However, reports from survey contributors indicate that this inventory drag is starting to ease: the number of producers worldwide reporting lower output due to inventory reduction policies fell in November to a one-and-a-half-year low.

Order books weaken and business gloom intensifies

Forward-looking indicators remained subdued at the global level. Inflows of new business stagnated and have now failed to grow for four months. Backlogs of orders meanwhile fell for a seventh straight month as firms relied on previously-placed orders to sustain current operating levels.

The worsening order book situation contributed to a further pull-back in business expectations about growth in the year ahead to the lowest since last December, albeit with a slight improvement in manufacturing helping to offset a worsening service sector outlook.

Jobs growth stalls

In this environment of falling order books and gloomier prospects, jobs growth slowed to near-stagnation globally in November. The fractional rise in global employment was the smallest since January 2021, reflecting a third successive month of job losses in the factory sector (pointing to one of the worst factory jobs trends seen over the past decade) and the weakest service sector jobs gain in 2023 to date.

Access the global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-employment-stalls-as-businesses-report-further-weakness-of-demand-Dec23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-employment-stalls-as-businesses-report-further-weakness-of-demand-Dec23.html&text=Worldwide+employment+stalls+as+businesses+report+further+weakness+of+demand+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-employment-stalls-as-businesses-report-further-weakness-of-demand-Dec23.html","enabled":true},{"name":"email","url":"?subject=Worldwide employment stalls as businesses report further weakness of demand | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-employment-stalls-as-businesses-report-further-weakness-of-demand-Dec23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Worldwide+employment+stalls+as+businesses+report+further+weakness+of+demand+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-employment-stalls-as-businesses-report-further-weakness-of-demand-Dec23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}