Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 13, 2019

Weekly Pricing Pulse: Trade deal hopes unfulfilled

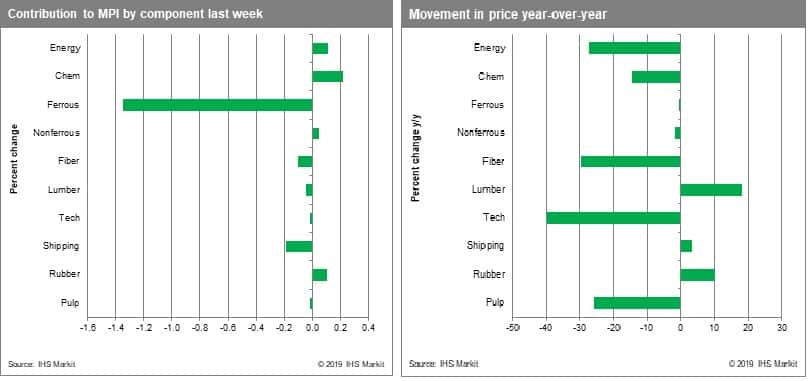

Commodity prices, as measured by our Materials Price Index (MPI), fell 1.2% last week, their seventh straight weekly decline. Prospects for a "phase-one" US-China trade agreement, with a promise of selected tariff reductions, were enough to rally equity prices, lift bond yields, and even lift material prices through mid-week. However, strength in commodity markets dissipated by week's end on President Trump's statement denying reports that a trade deal had been reached.

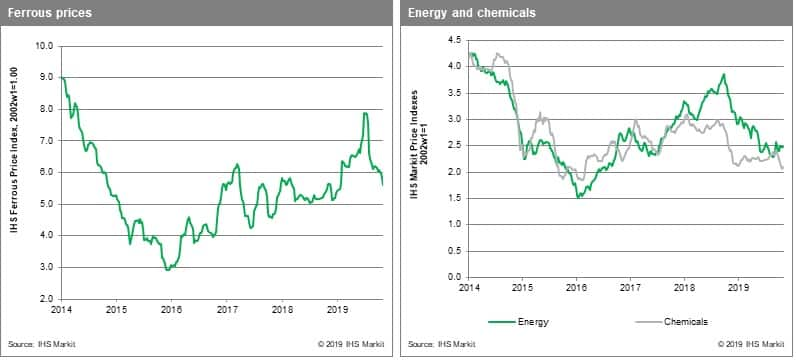

Ferrous prices led the MPI lower, falling 3.8%, as cautious buyers waited on the side-lines to see if Beijing will tighten winter output restrictions. Iron ore prices fell 5.7% to $79, the lowest price since January. Scrap prices conversely rose 5.4%, rallying from recent three-year lows tied to weak finished steel prices in Europe, Turkey and the US. Freight prices fell 3.7% on the weakness in iron ore and coking coal demand. DRAMs price declines over the past 14 weeks accelerated last week, falling 3.6% on news that Samsung would be increasing production in early 2020. This move took the DRAMs price back to a new all-time low. Fiber prices are also flirting with multi years lows - the fiber sub-index fell 1.9% last week to the lowest level since 2009. Weak feedstock costs for synthetic fibers and a consolidation in the cotton market after October gains pulled the index lower. Chemicals prices increased 1.3% following six weeks of decline whilst energy prices rose 0.6%. This muted move masks the volatility of the LNG market. US gas prices jumped another 7.2% last week after an even stronger 16.0% move the week before whilst strong inventories and cargoes in Asia dragged prices 8.3% lower.

Last week saw key economic 'bellwethers' make some bullish moves, suggesting that recent policy stimulus may be beginning to shift the mood in markets. Gold prices fell sharply to $1,460 /troy oz. after trading around $1,500 since August, copper prices briefly broke above $6,000 per metric ton and US 10-year treasury yield pushed to 1.94%, up almost 50 basis points from September. Uncertainty surrounding a final Brexit outcome and an eventual US-China trade agreement remains, but recent manufacturing Purchasing Manager Index data and the behaviour of equity, bond and commodity markets suggest that conditions may be stabilizing and potentially offering some good news looking ahead to 2020.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-deal-hopes-unfulfilled.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-deal-hopes-unfulfilled.html&text=Weekly+Pricing+Pulse%3a+Trade+deal+hopes+unfulfilled+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-deal-hopes-unfulfilled.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Trade deal hopes unfulfilled | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-deal-hopes-unfulfilled.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Trade+deal+hopes+unfulfilled+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-trade-deal-hopes-unfulfilled.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}