Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 24, 2023

Week Ahead Economic Preview: Week of 27 February 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

February's worldwide manufacturing and services PMI update

Global manufacturing and services PMI data will be released in the coming week, following the updates from the February flash figures. A series of GDP figures will also be due from Canada, Switzerland, Australia and India. Meanwhile inflation numbers from the eurozone, Germany and Indonesia will be closely watched amid ongoing scrutiny of the inflation trend. Finally, comments from various central bankers through the week, including Fed speakers, will be important to follow for further insights into likely interest rate trajectories.

Concerns over a persistent tightening of monetary conditions have been fuelled by the latest flash PMI data surprises from major developed economies. The surveys allayed some recession fears but also fanned worries of further rate hikes, especially in the UK and US, but also in the eurozone. The FX market embodied the surprise with the GBP/USD pair trading higher post the release of better-than-expected S&P Global/CIPS UK Composite PMI figures as investors positioned for greater possibilities of Bank of England (BoE) hikes. This was even as UK PMI price indices indicated receding inflation, though the important aspect of which was that inflation remained elevated and sticky enough to keep the BoE acting. Whether the improving growth and sticky inflation trends extends globally will be watched with the complete set of February PMI data due in the coming week.

Meanwhile in APAC, a key issue had been the demand dearth situation which was again presented in the February flash PMI figures from Australia and Japan. The early figures also suggested limited impact from the easing of restrictions in mainland China in February with business confidence in Australia having declined once again. It will be of interest to see how the wider APAC region fares amid the mixed signals from the flash PMI releases thus far, though the PMI data from mainland China will likely take centre stage.

Finally, the series of official inflation releases and GDP figures will be important economic data to track, although we do have an early sense of the expected trend from the PMI indications (see below).

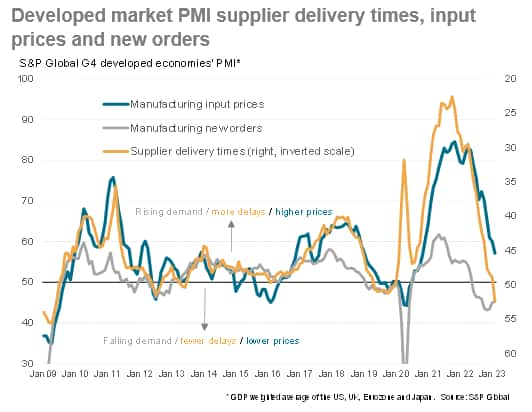

Improving supply chains lead to lower price pressures, but are a cause for concern

A key development in the flash PMI data for February, besides a surprising surge in service sector activity, was an improvement in supply chains. Measured across the major developed economies, average supplier delivery times quickened in February to a degree not seen since the economic collapse of 2009.

Faster delivery times are welcome news in the sense that fewer pandemic-related supply shortages are facilitating higher output, notably in Germany and the UK, and are helping move pricing power from suppliers to buyers. This is clearly having a beneficial impact on inflation, pushing down industrial price pressures. Manufacturers reported the slowest rate of input cost inflation for two years.

However, the bigger picture of faster deliveries is more worrying. Suppliers have often been able to supply inputs into factories for the simple reason that demand has slumped. Faced with a further fall in new orders, manufacturers reduced their input buying at one of the sharpest rates seen over the past decade in February. Both manufacturers and their suppliers are focused on reducing inventory levels, meaning shipping goods to customers faster than before, and often offering reduced prices. This is clearly not a sign of broader economic health.

Key diary events

Monday 27 February

Taiwan Market Holiday

New Zealand Retail Sales (Q4)

Japan Leading Indicator (Dec)

Eurozone Business Climate (Feb)

Eurozone Consumer Confidence (Feb, final)

United States Durable Goods (Jan)

Canada Current Account (Q4)

United States Pending Home Sales (Jan)

Thailand Customs-Based Trade Data (Jan)

United Kingdom Nationwide House Price (Feb

Tuesday 28 February

Taiwan Market Holiday

Japan Industrial Output and Retail Sales (Jan)

Australia Current Account (Q4)

Australia Retail Sales (Jan, final)

Thailand Manufacturing Production (Jan)

Germany Import Prices (Jan)

Thailand Current Account (Jan)

Switzerland GDP (Q4)

India GDP (Q3)

Canada GDP (Q4)

United States Consumer Confidence (Feb)

Wednesday 1 March

South Korea Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Feb)

Australia GDP (Q4)

China (Mainland) NBS Manufacturing PMI (Feb)

Indonesia Inflation (Feb)

United Kingdom Mortgage Lending and Approvals (Jan)

Germany CPI (Feb, prelim)

United States Construction Spending (Jan)

United States ISM Manufacturing PMI (Feb)

United Kingdom Halifax House Prices* (Feb)

Germany Industrial Orders and Manufacturing Output (Jan)

Thursday 2 March

New Zealand Import and Export Prices (Q4)

South Korea Industrial Output and Retail Sales (Jan)

South Korea Retail Sales (Jan)

Australia Building Approvals (Jan)

South Korea S&P Global Manufacturing PMI* (Feb)

Hong Kong Retail Sale (Jan)

Eurozone HICP (Feb, flash)

Eurozone Unemployment Rate (Jan)

United States Initial Jobless Claims

Friday 3 March

Worldwide Services, Composite PMIs, inc. global PMI* (Feb)

Japan Unemployment Rate (Jan)

Germany Trade (Jan)

Eurozone Producer Prices (Jan)

United States ISM Non-manufacturing PMI (Feb)

United Kingdom Reserve Assets Total (Feb)

What to watch

Worldwide manufacturing and services PMI for February

February manufacturing, services and composite PMI data will be released globally following the flash PMI updates from major developed economies. Early indications from the flash PMIs pointed to easing global recession fears as major developed economies showed signs of reviving economic growth in February. Specifically, recession fears can be seen fading in the eurozone, and also in the UK. While the US stabilised, it was concerning to see some heating up of inflation. It will therefore be of interest to observe where else in the world are there signs of persistent elevated inflationary pressures. Clues will also be sought as to the extent to which the services-driven improvements in the US and European PMIs could be attributed to warmer than usual weather.

Meanwhile for APAC, Japan and Australia continued to show signs of lacklustre demand, which remains a lingering issue for the wider APAC region even after the easing of pandemic restrictions in mainland China. The PMI data for the latter will therefore be a major release of the week, but also watch out for the manufacturing PMI for the ASEAN bloc.

Americas: US consumer confidence, ISM PMIs and Canada Q4 GDP

Besides the S&P Global PMIs, we also have US consumer confidence, construction spending, home sales and ISM survey releases in the coming week. Q4 GDP from Canada will also be closely eyed for the latest official growth trend.

Europe: Eurozone inflation, consumer confidence and unemployment data, German inflation manufacturing output, UK Halifax house prices

The eurozone and Germany updates CPI figures in the coming week for February. This follows indications from S&P Global PMI data which showed softening manufacturing price pressures contrasting with higher costs experienced by service providers in the eurozone.

Asia-Pacific: Australia and India GDP, Indonesia inflation

In APAC, Australia releases Q4 GDP while India updates growth figures for fiscal Q3. Japan also updates its industrial output and retail sales data. Other tier-1 data releases include inflation readings from Indonesia, although the attention is likely to be with the series of PMI data out for various APAC economies.

Special reports:

Global Recession Fears Subside as Flash PMI Data Signal Revival of Economic Growth in February - Chris Williamson

Singapore Budget 2023 Highlights Impact of Demographic Ageing - Rajiv Biswas

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-27-february-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-27-february-2023.html&text=Week+Ahead+Economic+Preview%3a+Week+of+27+February+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-27-february-2023.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 27 February 2023 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-27-february-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+27+February+2023+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-27-february-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}