Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 23, 2024

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Inflation readings out of the US and eurozone will be the highlights in the coming week as the market seeks near-term rates guidance. GDP updates will also be eagerly awaited, notably including from the US, Canada, Germany and India. A more up-to-date indication of economic conditions in mainland China will meanwhile be provided by the NBS PMI.

The attention turns back to economic data post the Jackson Hole Symposium, with July's US core PCE data to be especially keenly assessed. This follows prior CPI indications of softening inflationary pressures in the US, while the latest August flash PMI further showed that selling price inflation dipped to a seven-month low to hint at lower readings across official inflation gauges in the coming months. An easing inflation trend, alongside a weakening jobs trend in August (according to flash PMI data) are expected to be supportive of the Fed lowering rates, given recent FOMC meeting minutes showed members were generally supportive of a cut if the data behaved. Uncertainty regarding the size of the September cut remains, but signs of still-solid growth conditions observed via the latest flash PMI err towards 25 rather than 50 basis points. Additionally, the US also updates consumer confidence, personal income and spending data that will help shape the inflation picture and thereby steer monetary policy expectations for the market.

Over in the eurozone, preliminary August inflation figures will also offer insights into the European Central Bank's path forward as expectations gather for a September rate cut. The HCOB Flash Eurozone PMI signalled falling cost inflation, notably in the keenly-watched services sector where the input prices gauge hit a 40-month low.

Following the release of August flash PMI data for major developed economies and India, mainland China's PMI from the National Bureau of Statistics will be due over the weekend ahead of worldwide manufacturing and services PMI releases at the start of September. Growth and inflation conditions updates will be key as central bankers around the world contemplate rate cuts in line with the trajectory expected for the US Fed.

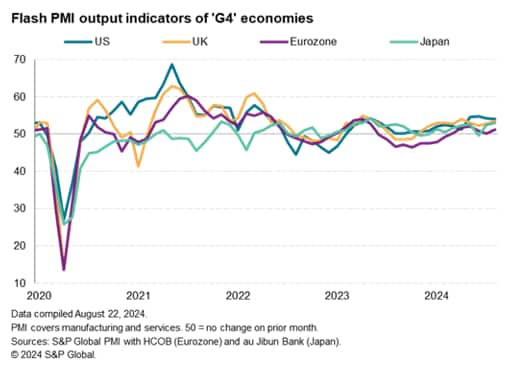

Flash PMI data for August from S&P Global brought some encouraging news on developed world economic growth midway through the third quarter. A sustained robust expansion was seen the US, with growth also accelerating to solid rates in both the UK and Japan. Even the struggling eurozone reported an improved rate of growth, albeit still lagging behind. Measured across the G4 largest developed economies, output growth accelerated to the second fastest seen over the past 15 months.

Beneath the surface, however, the PMI data send some warning signals that growth is not as healthy as it seems. First, manufacturing is looking increasingly weak, as output fell sharply across the G4 as a whole amid slumping trade flows to leave growth dependent on the services economy. The latter saw August's expansion flattered in part by increased activity around the Olympics in France. Worryingly, backlogs of orders in the service sector fell across the G4 at the sharpest rate for eight months and future output expectations hit a nine-month low.

It's possible therefore that weakness from manufacturing will spread to services, though there is hope that lower interest rates will spur demand to help support the expansion. In this respect, the flash PMIs generally brought encouraging news, especially in relation to service sector inflation, the stickiness of which has been the greatest concern to policy hawks. Across the G4 economies, average prices charged for services rose at the slowest rate since December 2020, the rate of increase most notably cooling in the US to help open the door further for the FOMC to start cutting interest rates.

Monday 26 Aug

UK, Philippine Market Holiday

Thailand Trade (Jul)

Singapore Industrial Production (Jul)

Germany Ifo Business Climate (Aug)

United States Durable Goods Orders (Jul)

United States Dallas Fed Manufacturing Index (Aug)

Tuesday 27 Aug

China (Mainland) Industrial Profits (Jul)

Germany GDP (Q2, final)

Mexico Trade (Jul)

United States S&P/Case-Shiller Home Price (Jun)

United States CB Consumer Confidence (Aug)

United States Richmond Fed Index (Aug)

Wednesday 28 Aug

Australia Monthly CPI Indicator (Jul)

Germany GfK Consumer Confidence (Sep)

France Consumer Confidence (Aug)

France Unemployment Benefits Claims (Jul)

Thursday 29 Aug

New Zealand ANZ Business Confidence (Aug)

Spain Inflation (Aug, prelim)

Eurozone Economic Sentiment (Aug)

Spain Business Confidence (Aug)

Germany Inflation (Aug, prelim)

United States GDP (Q2, second estimate)

United States Wholesale Inventories (Jul, adv)

United States Pending Home Sales (Jul)

Friday 30 Aug

South Korea Industrial Production (Jul)

Japan Unemployment Rate (Jul)

Japan Industrial Production (Jul, prelim)

Japan Retail Sales (Jul)

Australia Retail Sales (Jul)

Thailand Industrial Production (Jul)

Japan Consumer Confidence (Aug)

Japan Housing Starts (Jul)

France Inflation (Aug, prelim)

France GDP (Q2, final)

Germany Unemployment Rate (Aug)

Italy Unemployment Rate (Jul)

United Kingdom Mortgage Lending and Approval (Jul)

Eurozone Inflation (Aug, flash)

Italy Inflation (Aug, prelim)

India GDP (Q2)

Canada GDP (Q2)

United States Core PCE Price Index (Jul)

United States Personal Income and Spending (Jul)

United States Michigan Consumer Sentiment (Aug, final)

Saturday 31 Aug

China (Mainland) NBS PMI (Aug)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Americas: US Q2 GDP, core PCE, durable goods orders, home prices, consumer confidence, personal income and spending data; Canada Q2 GDP

Second quarter GDP data will be released in both the US and Canada, with the former following the initial 2.8% estimate. In Canada, a better performance is forecasted for the second quarter with PMI data having alluded to a higher Q2 average, though the more up-to-date July data signalled some weakness into the start of the third quarter.

US core PCE, the Fed's preferred inflation gauge, will also be updated for July amid increasing market hopes that tamed inflation will enable the Fed to lower rates in September. Besides which, the series of official releases including personal income and spending, durable goods orders and consumer confidence, will be scrutinised and assessed for insights into how much the Fed will lower rates at the September meeting.

EMEA: Eurozone inflation; Germany inflation, Ifo, GfK surveys, UK mortgage lending

Preliminary August inflation figures from the eurozone will be due Friday. This follows the August HCOB Flash Eurozone PMI which showed an easing of easing cost inflation, the softest in eight months, most notably in the service sector.

Germany also updates its preliminary August CPI data, in addition to the Ifo Business Climate and GfK Consumer Confidence data. The August HCOB Flash Germany PMI Future Output Index pointed to a slight easing of business confidence in the latest survey period amid deteriorating output and demand conditions.

APAC: Australia CPI; India Q2 GDP; Japan industrial production, unemployment rate and consumer confidence figures; China's NBS PMI data

In APAC, Australia releases its July CPI data, which are expected to show still-elevated inflation, albeit at a softer pace than June. The latest August Judo Bank Flash Australia PMI meanwhile showed a further cooling of selling price inflation, but rising cost inflation continued to pose a risk for the inflation outlook.

India's GDP for the April to June quarter will be due Friday. A slightly softer, but still substantial, growth rate has been signalled by the HSBC India PMI data, with the latest flash data further showing that the Indian private sector economy continued to thrive in August.

Additionally, key Japan data including industrial production and retail sales will be watched, while PMI data from mainland China's National Bureau of Statistics (NBS) will also be updated over the weekend.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.