Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 21, 2023

Week Ahead Economic Preview: Week of 24 July 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMI, Fed FOMC, ECB, BOJ meetings and GDP data

Flash PMI data for July, due Monday, kickstarts economic data reporting for the second half of 2023, providing the earliest insights into economic conditions across major developed economies. Meanwhile central bank meetings in the US, Eurozone, Japan, Indonesia and Hong Kong SAR join in as highlights in a crowded week. Official GDP and inflation figures from the US, Eurozone, Germany, South Korea and Taiwan will also be eagerly anticipated.

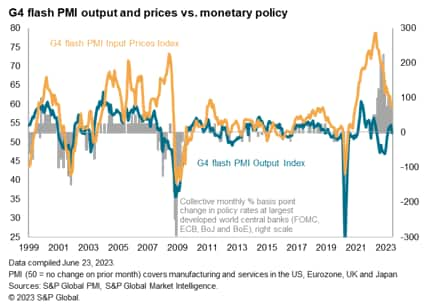

The focus next week is expected to be split between corporate earnings, monetary policy and macro data following a week where the attention had largely been dominated by earnings optimism. Positive earnings reports from US banks buoyed sentiment, helping to support equity prices. That said, economic fundamentals return to the spotlight with July flash PMIs set to outline the degrees to growth can remain resilient in the face of higher interest rates and price pressures continue to cool (see special report).

Meanwhile, it will also be a reality check for the market with next week's Federal Open Market Committee meeting. Hopes that the July meeting will be the final rate hike of this cycle has provided some support to risk assets. Any more hawkish than expected post-meeting rhetoric may easily dent sentiment, though recent inflation readings suggest a diminished likelihood of such. The European Central Bank will also be watched for their take on the path forward with a July hike having been priced in. Concurrently, their data-focus emphasis will also draw the spotlight to the PMIs and the upcoming eurozone inflation readings.

Similarly, the Bank of England will be eager to see UK PMI data for evidence that inflation continues to cool after the PMIs correctly anticipated the easing of CPI in June.

In APAC, the Bank of Japan is expected to stay put again with regards to interest rates, though speculation that yield curve control settings may be tweaked have led to increased yen volatility. Amid continued expansion of Japan's private sector economy and relatively elevated selling price inflation, as seen via the au Jibun Bank Japan Composite PMI, it will be of interest to examine the BOJ's choice of policy tools. This is especially as global central banks are widely expected to be at or near the end of their current rate hike cycles into the second half of 2023.

Peak rates in sight?

The coming week sees policy meetings at the FOMC, ECB and bank of Japan all preceded by the release of US, Eurozone and Japanese flash PMI data for July, with the Bank of England no doubt also keeping a close eye on the UK flash numbers.

Our special report on page 4 outlines the major themes to watch in the flash PMIs, which have sent important signals so far this year. From an economic growth perspective, manufacturing malaise has been countered by resurgent service sector growth amid a rebound in travel post-pandemic. Inflationary pressures have consequently shifted. Whereas the combination of surging demand and constrained supply lifted goods prices in the pandemic, these same forces have pushed up services prices in 2023. This time, it's not supply chain constraints that are the problem, but labour and capacity shortages.

However, even these service sector inflation pressures showed signs of easing across the major economies in June, so policymakers will be eager to see if this welcome trend has persisted into the second half of the year to help drive CPI rates lower.

More worrying might be the output and order book data, especially for the eurozone. At 49.9, the headline eurozone PMI fell marginally into contraction territory in June, and any further weakening of the data will add to concerns that a belated over-tightening of policy might drive economies into recession. While overall output growth in the G4 economies remains resilient, the pace of expansion is not historically consistent with tightening policy and the persistence of even this modest growth remains highly uncertain.

Key diary events

Monday 24 Jul

Australia Judo Bank Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash Manufacturing PMI*

UK S&P Global/CIPS Flash PMI, Manufacturing &

Services*

Germany HBOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Malaysia Inflation (Jun)

Singapore CPI (Jun)

Taiwan Industrial Production, Retail Sales (Jun)

Tuesday 25 Jul

South Korea GDP (Q2, advance)

Indonesia BI Interest Rate Decision

Hong Kong Trade (Jun)

Germany Ifo Business Climate (Jul)

United States House Price Index (May)

United States Consumer Confidence (Jul)

Wednesday 26 Jul

Australia Inflation (Q2)

Singapore Industrial Production (Jun)

United States New Home Sales and Building Permits (Jul)

United States FOMC Interest Rate Decision

Thursday 27 Jul

Australia Import and Export Prices (Q2)

China (mainland) Industrial Profits (Jun)

Hong Kong HKMA Interest Rate Decision

Taiwan Consumer Confidence (Jul)

Thailand Trade and Industrial Production (Jun)

Eurozone ECB Interest Rate Decision

United States GDP (Q2, advance)

United States Durable Goods (Jun)

United States Initial Jobless Claims

United States Wholesale Inventories (Jun, advance)

United States Goods Trade Balance (Jun, advance)

United States Pending Home Sales (Jun)

Friday 28 Jul

South Korea Industrial Production and Retail Sales (Jun)

Australia Retail Sales (Jun, prelim)

Australia PPI (Q2)

Singapore Unemployment Rate (Q2, prelim)

Japan BOJ Interest Rate Decision

France GDP (Q2, prelim)

France Inflation Rate (Jul, prelim)

Germany PPI (Jul)

Taiwan GDP (Q2, advance)

Eurozone Economic Sentiment (Jul)

Germany Inflation (Jul, prelim)

Canada GDP (May, prelim)

United States Personal Income and Spending (Jun)

United States Core PCE Index (Jun)

United States UoM Sentiment (Jul, final)

What to watch

Flash PMI release for July

July's flash PMI for major developed economies, including the US, UK, Eurozone, Japan and Australia will be released at the start of the week. Further insights into inflation and economic growth developments at the sat of the third quarter will be sought with these early economic data releases.

Specifically, whether manufacturing output continued to decline in July will be a key question to consider in the flash PMIs alongside the issue of whether the services rebound has peaked. Additionally, although service sector output price inflation eased in the June surveys, policymakers will remain worried about any persistent elevated rates of increase. Read more in our special report.

Americas: Fed FOMC meeting, Q2 GDP (adv), core PCE, durable goods, new home sales, personal income and spending data, plus consumer confidence

The Fed convenes in the coming week and will update their monetary policy decision at the end of the two-day FOMC meeting on Wednesday. According to indications from the CME FedWatch tool, the Fed is widely expected to raise rates by another 25 basis points (bps) in July but this will potentially be the last of 2023. As such, the focus will be on the Fed's rhetoric from both the statement and press conference.

A busy US economic calendar also notably includes Q2 GDP data with the consensus pointing to a rate of growth comparable to that seen in the first quarter of 2023.

Europe: ECB meeting, German Ifo Business Climate, Eurozone, Germany and France GDP and inflation

In addition to the Fed, the ECB is also expected to lift rates next week and the focus will likewise be on the rhetoric addressing the path forward. A series of tier-1 data, including euro area GDP and inflation readings, will follow flash PMIs and will similarly guide expectations on the European monetary policy front.

Asia-Pacific: BOJ, BI, HKMA meetings, South Korea, Taiwan GDP

Various central bank meetings also unfold in APAC. Although no surprises on interest rates are expected, the BOJ will be closely watched for any indications of change on the yield curve control front this month.

Special reports

Inflation and Growth Signals: What to Watch for in the Upcoming July PMI Surveys - Chris Williamson

Singapore Economic Growth Weakens in First Half of 2023 - Rajiv Biswas

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-july-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-july-2023.html&text=Week+Ahead+Economic+Preview%3a+Week+of+24+July+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-july-2023.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 24 July 2023 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-july-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+24+July+2023+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-july-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}