Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 16, 2023

Week Ahead Economic Preview: Week of 19 June 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMI for June, Fed testimony and BOE meeting in view

Flash PMI for June will offer a first look into economic conditions across major developed economies while central bank meetings continue in Europe and APAC. This includes the Bank of England, Swiss National Bank, Norges Bank, Bank Indonesia and Bangko Sentral ng Pilipinas.

Fed chair Jerome Powell's semi-annual testimony to Congress will meanwhile provide further updates from the US central bank after the FOMC 'skipped' a rate hike at its June meeting. Inflation readings from the UK, Japan, Singapore and Malaysia will also be in focus.

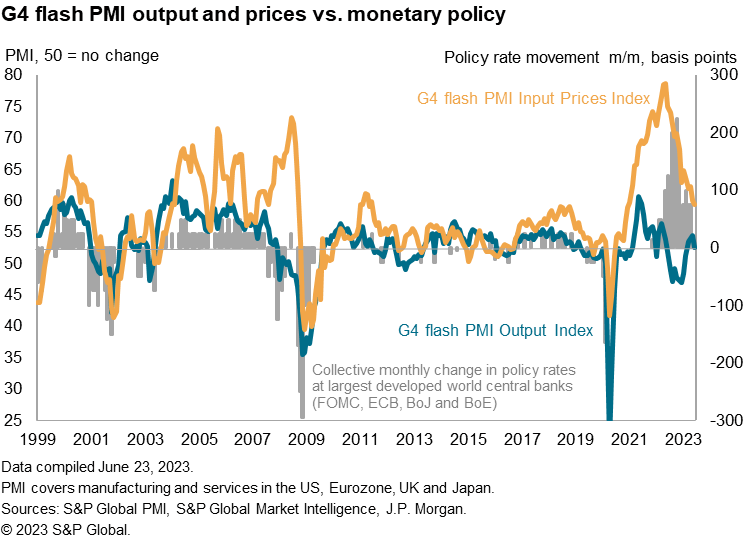

The first pause after 10 straight rate hikes in the US was no surprise, but the fact that it was accompanied by more hawkish than expected projections and rhetoric raised eyebrows after the latest US FOMC meeting. Powell signalled that more needs be done to bring inflation down to target, with the committee members' 'dot plots' signalling two more 25 basis points (bps) hikes by the end of 2023. The headscratcher here was the Fed's choice to pause when they have become more resolved in further raising rates. The takeaway here is perhaps that uncertainty continues to surround the Fed's path forward, making the FOMC increasingly data dependent. Next week's testimony to Congress by Fed Powell will be another opportunity to download more of the Fed's thoughts, but the emphasis on data-dependency by the Fed also places more focus on flash PMI data due next week, including from the US, for the earliest look at growth and inflation trends in June (see box).

In comparison, next week's Bank of England (BOE) meeting may be more clear cut with the BOE expected to lift rates again by 25 basis points (bps) and potentially taking things further thereafter. In the same week, the official inflation reading from the UK for May and flash PMIs for June offer further insights into economic conditions in the UK and help to shape expectations on the monetary policy front.

Finally in APAC, more central bank meetings are due though no surprises are expected from the Southeast Asian central banks meeting next week. Meeting minutes from June's RBA meeting and inflation numbers from Japan, Singapore and Malaysia will be closely watched instead. Japan's PMI data will be particular focus after May's ten-year survey high.

The descent of US inflation

Among the flash PMI releases due on 23rd June will be the updated US manufacturing and survey data from S&P Global. The 'composite' data, which weights the data from the two surveys together according to their GDP contributions, are especially useful in providing advance guidance on economic growth and inflation trends. The composite input cost index from the two sectors, mapped here against consumer price inflation in the US, has been a particularly valuable indicator.

As the survey measures

firms' costs, it naturally tends to lead retail price changes. It

anticipated the sharp slowing of inflation, and hints of a further

slowing to some. June's flash PMI price data are therefore highly

anticipated, especially as there have been some signs of service

sector cost inflation remaining stubbornly elevated, limiting the

speed of descent (ironically, in part linked to higher interest

rates - see special report).

As the survey measures

firms' costs, it naturally tends to lead retail price changes. It

anticipated the sharp slowing of inflation, and hints of a further

slowing to some. June's flash PMI price data are therefore highly

anticipated, especially as there have been some signs of service

sector cost inflation remaining stubbornly elevated, limiting the

speed of descent (ironically, in part linked to higher interest

rates - see special report).

The same PMI price index is overlaid below with the survey's output data, and FOMC policy changes. Clearly, history shows us that how these two survey indicators develop will provide important insights into whether we have reached terminal Fed Funds rate.

Key diary events

Monday 19 Jun

US Market Holiday

Hong Kong Unemployment Rate (May)

Canada PPI (May)

Tuesday 20 Jun

China (Mainland) Loan Prime Rate (Jun)

Australia RBA Meeting Minutes

Malaysia Trade (May)

Japan Industrial Production (Apr, final)

Japan Capacity Utilization (Apr)

Germany PPI (May)

Eurozone Current Account (Apr)

Taiwan Export Orders (May)

Hong Kong SAR Inflation (May)

United States Building Permits (May, prelim)

United States Housing Starts (May)

Wednesday 21 Jun

South Korea PPI (May)

Japan BOJ Meeting Minutes (Apr)

United Kingdom Inflation (May)

Canada Retail Sales (Apr)

Thursday 22 Jun

China (Mainland), Hong Kong SAR, Taiwan Market

Holiday

New Zealand Trade (May)

Philippines BSP Interest Rate Decision

Indonesia Loan Growth (May)

Indonesia BI Interest Rate Decision

Norway Norges Bank Interest Rate Decision

Switzerland SNB Interest Rate Decision

United Kingdom Bank of England Interest Rate Decision

Eurozone Consumer Confidence (Jun)

United States Current Account (Q1)

United States Initial Jobless Claims

United States Fed Powell Testimony

United States Existing Home Sales (May)

Friday 23 Jun

China (Mainland), Taiwan Market Holiday

Australia Judo Bank Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash Manufacturing PMI*

Germany HBOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

UK S&P Global/CIPS Flash PMI, Manufacturing &

Services*

US S&P Global Flash PMI, Manufacturing & Services*

Japan Inflation (May)

Thailand Trade (May)

Malaysia Inflation (May)

Singapore Inflation (May)

United Kingdom Retail Sales (May)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

June flash PMI

Based on around 85% of responses, the flash PMI surveys covering US, UK, Eurozone, Japan and Australia will offer a first look into economic conditions across major developed economies in June. The upcoming releases will be especially closely watched ahead of the mid-year market assessment.

The latest batch of PMI data from May indicated that the global expansion hit the fastest pace in 18-months, albeit driven primarily by services as the gap between services and manufacturing new orders opened to the widest since 2009. Any changes on this front will be eagerly watched especially as the longevity of the ongoing services expansion - typically highly sensitive to interest rate changes - remains in question. Developments on the inflation front will also be scrutinised amid easing price pressures globally, though still elevated by historical standards in the service sector.

Americas: Fed Powell testimony, US building permits, housing starts data, Canada retail sales

Following the Fed meeting this week, US Fed chair Jerome Powell will be appearing before the US Senate Banking Committee next Thursday for the Fed chair's twice-yearly report to Congress. While expected, the latest pause by the Fed still leaves questions on the monetary policy path going forward and any further guidance from the Fed chair next week will add colour to the latest terminal rate projection.

Europe: BOE, SNB, Norges bank meetings, UK inflation

A series of central bank meetings continues to be anticipated next week. Of special focus will be the Bank of England (BOE) interest rate decision with another 25 basis points (bps) hike anticipated according to consensus. Recent official and PMI data revealed that tight labour market conditions continue to keep wage inflation elevated, particularly in the UK, providing impetus for the BOE to act. UK May inflation data will also be released with further easing of the headline and core inflation rates expected according to forecasts. Also watch out for UK retail sales.

Asia-Pacific: China loan prime rate, BOJ, RBA minutes, BI, BSP meetings, Japan, Singapore, Malaysia CPI

A series of central bank updates will be due from the APAC region including mainland China's loan prime rate, which is expected to shift following the lowering of short-term lending rate. Inflation data will also be updated for Japan, Singapore, Hong Kong SAR and Malaysia.

Special reports

Financial Services Lead Global Growth Higher in May, Stoking Inflation - Chris Williamson

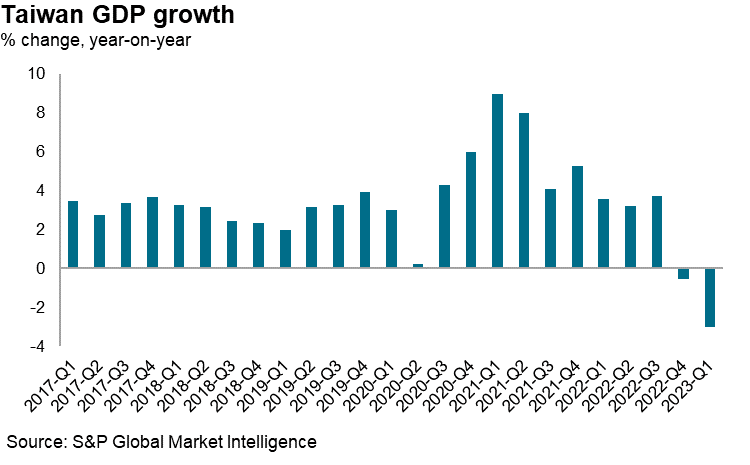

Taiwan Economy Continues to be Hit by Slumping Exports - Rajiv Biswas

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-june-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-june-2023.html&text=Week+Ahead+Economic+Preview%3a+Week+of+19+June+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-june-2023.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 19 June 2023 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-june-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+19+June+2023+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-june-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}