Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 18, 2023

Week Ahead Economic Preview: Week of 18 December 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Inflation updates for the US, UK, Eurozone, Japan and Canada

Into the final weeks of 2023, more inflation data will keep the markets occupied with CPI numbers out of the UK, Eurozone, Japan and Canada while the US updates core PCE data. Additionally, final Q3 GDP updates will also be due from the US and UK while central bank meetings in Japan and Indonesia are also anticipated.

The final Fed meeting of the year fuelled further rate cut expectations with the market having almost fully priced in 50 basis points of rate cut by May according to the CME FedWatch tool. This was as the Fed signalled the possibility of easing monetary policy by 75 basis points in 2024, recognising that inflation has eased in recent months. Indeed, the latest S&P Global Flash US PMI continued to outline the likelihood for CPI to head lower despite the economy gaining some momentum in December amid loosened financial conditions (see special report). US core PCE will therefore be in focus while other high frequency releases, including the US personal income and spending, durable goods orders, and building permits, are also updated for a check on November conditions. Separately, Q3 GDP will be updated, though this will be a backward-looking piece of data.

Meanwhile November UK, Eurozone and Japan inflation figures are anticipated with PMI price data having hinted at further cooling of underlying price pressures. Japan's inflation figures will be among the highlights, especially with the Bank of Japan (BoJ) widely expected to exit their negative interest rate regime, albeit not in the upcoming meeting on Friday, December 22. Rhetoric from the meeting coupled with the upcoming inflation indications from Japan will be closely watched for the yen - especially with the BoJ seen to be an outlier central bank, set to hike rates while global central banks including the Fed move in the opposite direction.

Besides the Bank of Japan, Bank Indonesia will also convene though no changes are expected. Meeting minutes from the Reserve Bank of Australia will also be due for insights into central bankers' thoughts amid still-elevated inflation in Australia and softening growth conditions.

Flash PMI data signal widening growth divergences

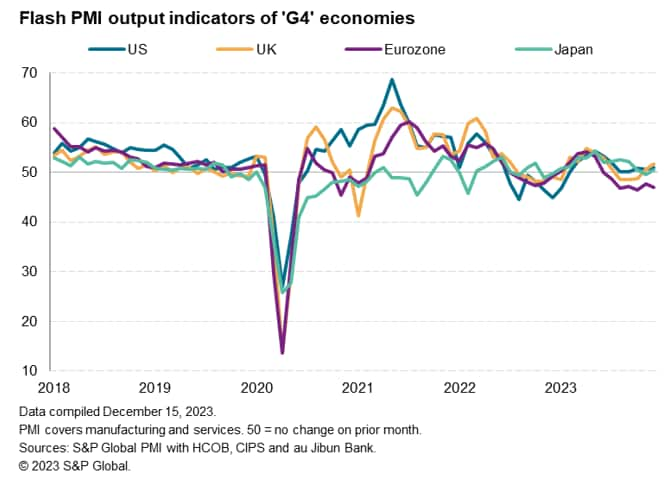

Early PMI survey data for December from S&P Global showed the major developed economies collectively stagnating. However, trends varied, with the eurozone slipping deeper into decline to signal a recession, but modest growth was seen in the UK, Japan and US.

The surveys continue to indicate that service sector growth remains very subdued in the G4 on average relative to the growth surge seen in spring and summer, but looser financial conditions - based on expectations of lower interest rates in 2024 - have benefitted the US and UK in particular as 2023 draws to a close. Manufacturing, in contrast, remains firmly in decline, with output falling across all four economies, dropping most notably in the eurozone.

Further falls in backlogs of work in both sectors meanwhile bode ill for the near-term outlook, but also hint at some potential further cooling of inflation. Service inflation remained elevated by historical standards, most noticeably in the UK, and the upcoming dataflow in this sector will be key to help assess policy developments in 2024.

For our full recap of the PMIs in 2023, download our "Shifting Sands" report.

Key diary events

Monday 18 Dec

Singapore NODX (Nov)

Germany Ifo Business Climate (Dec)

United States NAHB Housing Market Index (Dec)

Tuesday 19 Dec

Australia RBA Meeting Minutes

Japan BOJ Interest Rate Decision

Malaysia Trade (Nov)

Eurozone Inflation (Nov, final)

United Kingdom CBI Industrial Trends Orders (Dec)

Canada Inflation (Nov)

United States Building Permits (Nov, prelim)

United States Housing Starts (Nov)

Wednesday 20 Dec

Japan Trade (Nov)

China (Mainland) Loan Prime Rate (Dec)

Germany GfK Consumer Confidence (Jan)

Germany PPI (Nov)

Turkey Consumer Confidence (Dec)

United Kingdom Inflation (Nov)

Switzerland Current Account

Taiwan Export Orders (Nov)

Eurozone Current Account (Oct)

Eurozone Consumer Confidence (Dec, flash)

United States Current Account (Q3)

United States CB Consumer Confidence (Dec)

United States Existing Home Sales (Nov)

Canada BoC Summery of Deliberations

Thursday 21 Dec

Indonesia BI Interest Rate Decision

France Business Confidence (Dec)

Hong Kong SAR Inflation (Nov)

Turkey TCMB Interest Rate Decision

Canada Retail Sales (Oct)

United States GDP (Q3, final)

Friday 22 Dec

Japan Inflation (Nov)

Japan BoJ Meeting Minutes (Oct)

Thailand Trade (Nov)

Malaysia Inflation (Nov)

United Kingdom Retail Sales (Nov)

United Kingdom GDP (Q3, final)

France Consumer Confidence (Dec)

Spain GDP (Q3, final)

Taiwan Unemployment Rate (Nov)

Italy Business Confidence (Dec)

Canada GDP (Oct)

United States core PCE (Nov)

United States Durable Goods (Nov)

United States Personal Income and Spending (Nov)

United States New Home Sales (Nov)

United States UoM Sentiment (Dec, final)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch

Americas: US core PCE, Canada inflation data and US building permits, personal income and spending and final Q3 GDP update

Post the December Fed meeting, US core PCE will be in focus in the coming week. This comes after US CPI eased to 3.1% in November while core CPI inched up slightly to show a 0.3% monthly increase, though both figures were in line with consensus expectations.

Separately, the US also releases a Q3 GDP update, in addition to building permits, durable goods orders, new home sales, consumer confidence and personal income and spending figures.

Meanwhile in Canada, November's inflation figure will be due Tuesday. Encouragingly, price indicators from the S&P Global Canada Composite PMI suggested that input cost inflation had eased in November.

EMEA: Eurozone, UK inflation data, UK retail sales and final Q3 GDP, German GfK, Ifo survey data,

In the UK, November's inflation figures will be released Wednesday. Likewise for the UK, PMI price indicators have hinted at a slight easing of price pressure into November, though some stickiness may be observed thereafter. Retail sales and final Q3 GDP will also be released, with the former closely watched for any improvements in activity into the final months of the year.

The eurozone will also update November inflation figures following the preliminary headline and core CPI readings of 2.4% and 3.6% respectively. Also watch out for Spain third quarter GDP release and producer prices in Germany.

APAC: BoJ, BI meetings, RBA meeting minutes, Japan inflation and trade data

In APAC, final central bank meetings of the year unfold in Japan and Indonesia. The Bank of Japan will be in focus despite no changes to the current negative interest rate setting being anticipated at the upcoming meeting, as hinted by officials. This is as the BoJ is set to hike rates by the end of April according to market expectations, though central bankers remain vigilant of data developments, placing the focus also on Japan's inflation and trade releases in the coming week.

Special reports

US flash PMI ends 2023 at highest since July amid looser financial conditions - Chris Williamson

APAC manufacturing sector rebounds in late 2023 - Rajiv Biswas

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-december-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-december-2023.html&text=Week+Ahead+Economic+Preview%3a+Week+of+18+December+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-december-2023.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 18 December 2023 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-december-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+18+December+2023+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-december-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}