Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 11, 2022

Using PMI sub-indices to forecast the headline manufacturing PMI

PMI sub-indices have been shown to provide a considerable amount of value beyond the market-sensitive headline PMI figure, which is designed to be a barometer of manufacturing business conditions and a gauge of overall economic health. In practice, PMI sub-indices also hold the potential to assist in forecasting the highly-watched headline manufacturing PMI figures, providing even earlier signals and indications of economic conditions than the headline PMI itself.

The headline PMI and its sub-indices

The headline manufacturing PMI aggregates five survey indicators (sub-indices) into a single-figure diffusion index to provide an overall barometer of manufacturing business conditions.

Calculation of the manufacturing PMI

While not all of the manufacturing PMI sub-indices are used in the headline PMI calculation, they all provide valuable information in shedding further light on economic conditions in the manufacturing sector. For example, the PMI backlogs of work sub-index is a key indicator of capacity utilisation, providing useful insights into investment, hiring and inflation.

Furthermore, given the timeliness attribute of capturing changes taking place in the manufacturing sector, PMI sub-indices can also be useful in helping to forecast the upcoming month's headline PMI.

Forecasting the headline PMI

Forecasting as a technique is one that uses historical data to make predictions on future conditions. While a vast number of economic indicators relevant to manufacturing sector conditions for the forecasting of the headline manufacturing PMI may exist, they vary in availability, timeliness and relevance. PMI sub-indices therefore present themselves as ideal candidates in forecasting the headline PMI, detailing the specific manufacturing sector conditions, as they are available on the first working day of each month and can be easily integrated into one's modelling setup.

For the purpose of predicting the upcoming months' headline manufacturing PMI, we will demonstrate a simple model utilising a linear regression and using the PMI sub-indices of the country in study and a trade weighted headline index of major trading partners.

This model assumes the following generic equation:

where, S={1,…,n} refers to the country's PMI sub-indices and X refers to the weighted headline PMI of key trading partners.

The time-lag for the independent variables may also be adjusted in accordance to the forecast period one is interested in.

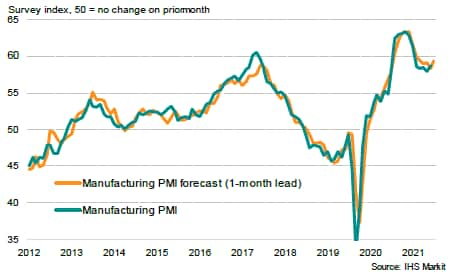

Forecasting Eurozone Manufacturing PMI

To sieve through the array of manufacturing PMI sub-indices available for ones that are found to be of the highest statistical significance, we first ran a regression of all the sub-indices against the headline PMI with a one-month lead. Using the last 10 years of Eurozone Manufacturing PMI data, four sub-indices were found to be statistically significant - Future Output, Input Prices Index, Output Index and Suppliers' Delivery Times. The model was further enhanced with another independent variable made up of headline PMI performance, equally weighted across the eurozone's top three trading partners - namely US, UK and China - to capture changing external conditions.

Results showed an R-squared value of at least 91% for this model with data assessed between 2012 and January 2022, which is a strong model for predicting the closely followed month ahead headline manufacturing PMI.

Eurozone Manufacturing PMI and model forecast with 1-month lead

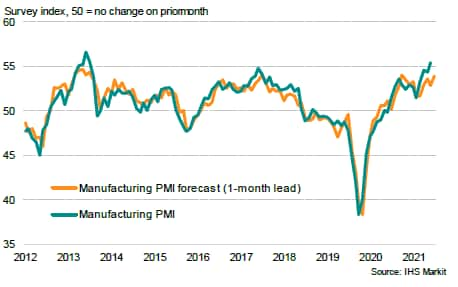

Forecasting Japan Manufacturing PMI

Repeating the same methodology for the forecasting of Japan Manufacturing PMI, the sub-indices found to be statistically significant for a one-month lead is noted to be different from that of the eurozone. Future Output, New Orders and Stocks of Finished Goods indices presented themselves in the case of Japan. Additionally, the external trade component had also been added, making a total of four independent variables for this model.

While the R-squared value had declined slightly in comparison to the eurozone case, down to 87% for the model with one-month lead, it remains a strong reading.

Japan Manufacturing PMI and model forecast with 1-month lead

Why forecast the headline PMI?

The ability to accurately anticipate a market-moving economic statistic clearly has obvious value for those engaged in short-term trading strategies around economic statistics and highlights the value of looking "below the hood" of the headline PMI statistics for clues on the future trajectory of sector or country performance. Further aspects of the broader usefulness of the headline PMI in work across economics, financial markets and supply chain management is more fully documented in our PMI use-case library.

One of our latest research notes on estimating the short-term FX equilibria using the headline manufacturing PMI - also utilising the Eurozone Manufacturing PMI looking at EUR/USD - extends the purpose of forecasting the headline PMI in giving an early indication of what could be the short-term fair value for various currency pairs.

Jingyi Pan, Economics Associate Director, IHS Markit

jingyi.pan@ihsmarkit.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fusing-pmi-subindices-to-forecast-the-headline-manufacturing-pmi-feb22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fusing-pmi-subindices-to-forecast-the-headline-manufacturing-pmi-feb22.html&text=Using+PMI+sub-indices+to+forecast+the+headline+manufacturing+PMI+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fusing-pmi-subindices-to-forecast-the-headline-manufacturing-pmi-feb22.html","enabled":true},{"name":"email","url":"?subject=Using PMI sub-indices to forecast the headline manufacturing PMI | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fusing-pmi-subindices-to-forecast-the-headline-manufacturing-pmi-feb22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Using+PMI+sub-indices+to+forecast+the+headline+manufacturing+PMI+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fusing-pmi-subindices-to-forecast-the-headline-manufacturing-pmi-feb22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}