Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 25, 2023

US soft landing hopes boosted as flash PMI lifts higher and price pressures abate

Hopes of a soft landing for the US economy will be encouraged by an improved situation seen in October, with headline flash PMI rising to a three-month high.

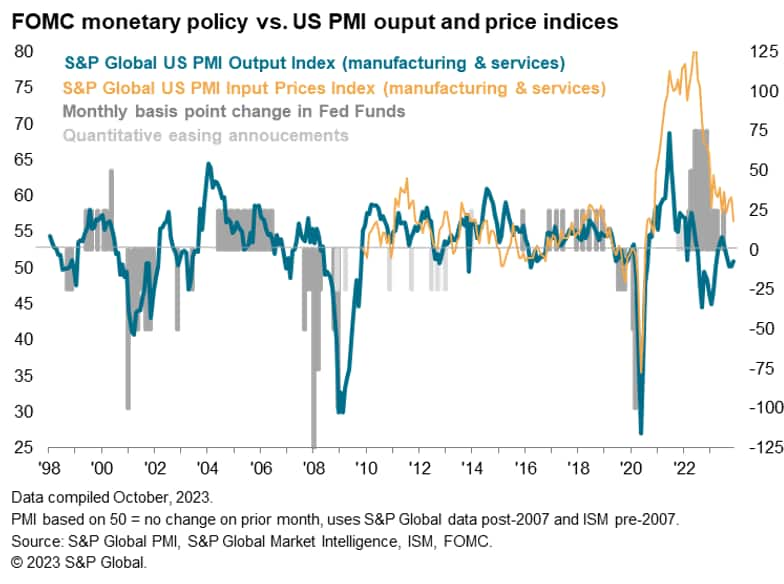

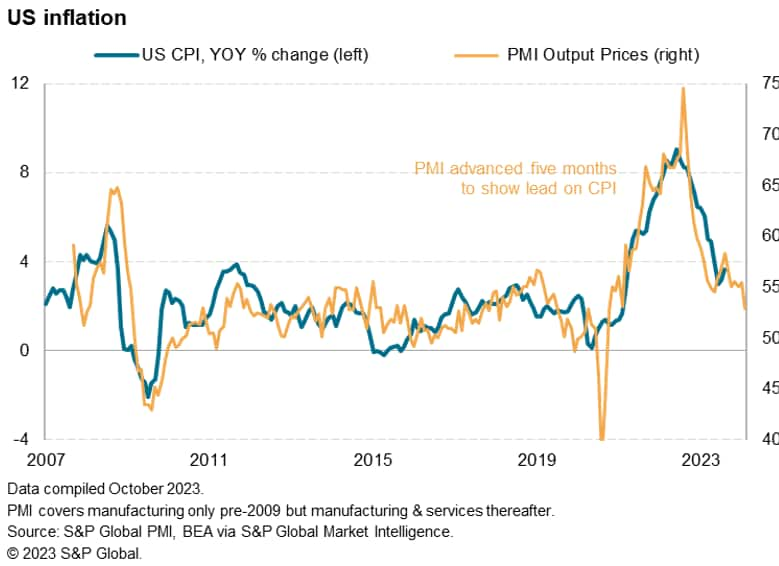

Future optimism also improved, in part due to hopes of interest rates having peaked, something which looks increasingly likely given a further cooling of inflationary pressures signaled in October.

The survey's selling price gauge is now close to its pre-pandemic long-run average and consistent with headline inflation dropping close to the Fed's 2% target in the coming months, something which looks likely to be achieved without output falling into contraction. That said, the tensions in the Middle East pose downside risks to already-weak growth and upside risks to inflation, adding fresh uncertainty to the outlook.

Slower growth

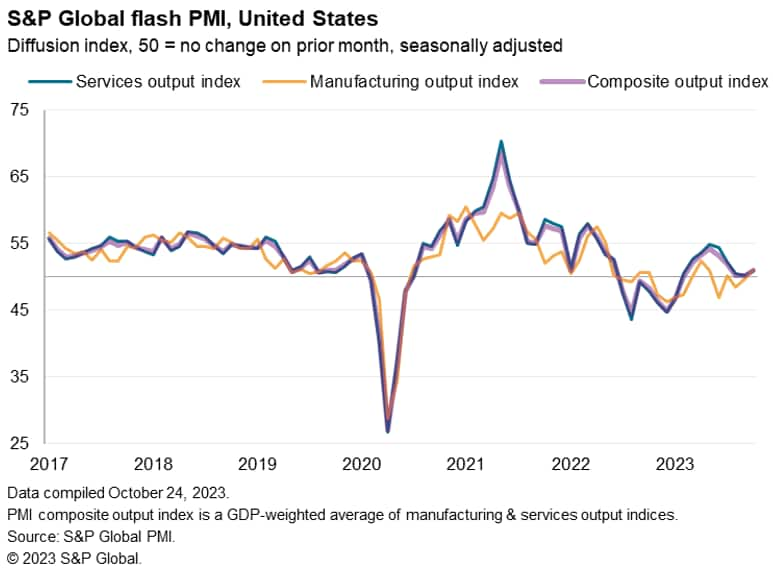

At 51.0 in October, the headline S&P Global Flash US PMI Composite Output Index rose from 50.2 at the end of the third quarter to signal a modest uptick in business activity. Growth in output was the strongest since July, albeit remaining only modest overall.

Given the S&P Global PMI survey has been among the most downbeat economic indicators in recent months, the upturn in US output growth recorded at the start of the fourth quarter is encouraging news. Future output expectations also turned up in October, despite rising geopolitical concerns and domestic political tensions, climbing to the joint-highest for nearly one-and-a-half years.

The sustained growth recorded by the US PMI, albeit only modest, contrasts with downturns signaled by PMI surveys in the Eurozone and United Kingdom in October, to hint at an ongoing US economic outperformance.

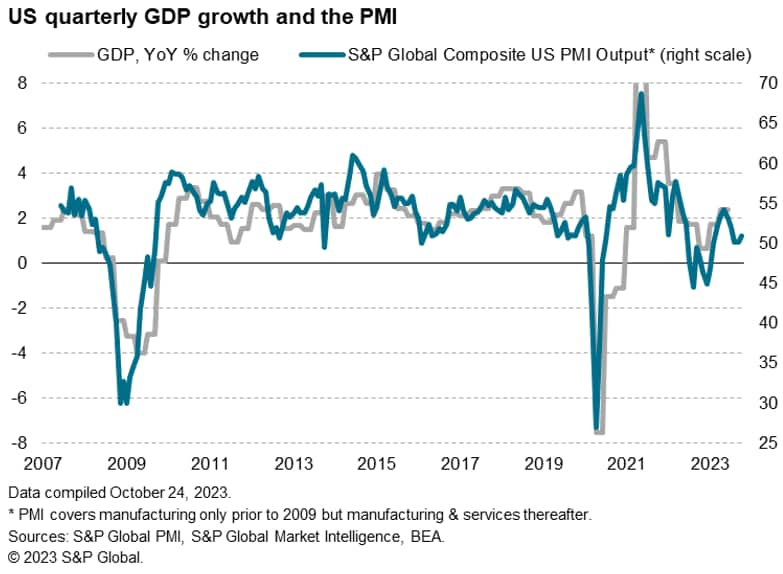

However, the low PMI readings in recent months point to a more subdued picture of the US economy than the robust expansion seen in the second quarter, running at a level broadly consistent with annual growth in the region of 1.5% over the third quarter and into the start of the fourth quarter, which is also well below the likely GDP expansion anticipated in upcoming GDP data. The consensus is looking for 4% annualized GDP growth in the third quarter.

Looking into the detail, production at manufacturing firms rose in October at the quickest pace since April, while output growth at service sector firms was the fastest in three months. The latter nevertheless continues to lag substantially behind the robust expansion seen earlier in the year, and is therefore a key element of the more subdued growth picture witnessed by the survey in recent months compared to that seen in the second quarter.

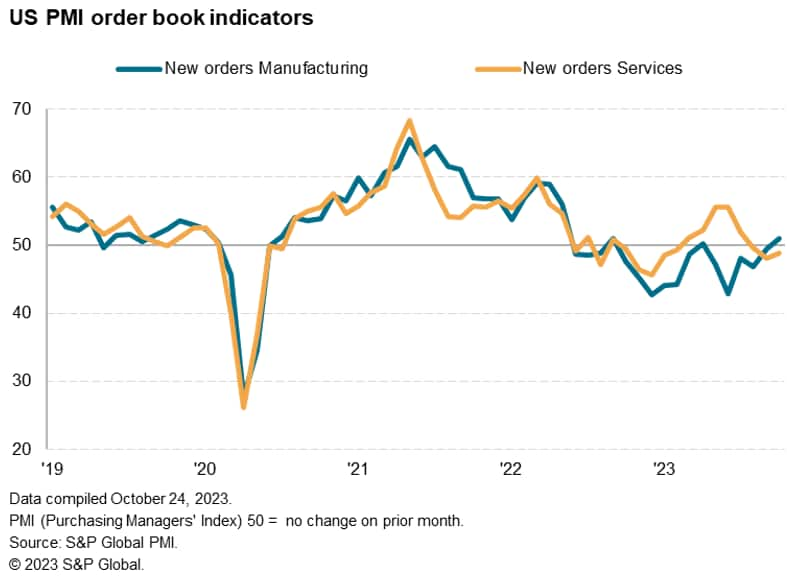

Although some service providers highlighted a pick-up in domestic customer sales (overall exports continued to fall in October), many firms continued to note that high interest rates and challenging economic conditions weighed on client demand. Some mentioned smaller and less frequent orders being placed by customers.

As such, service sector new business fell for a third month running, albeit at a softer pace than seen in September.

In contrast, manufacturers reported the first rise in new orders since April. Some factories attributed this to the diversification of products and sales strategies, as well as some alleviation of the recent cost of living squeeze amid higher wage growth. The data therefore hint at a switch in spending and demand back towards goods and away from services.

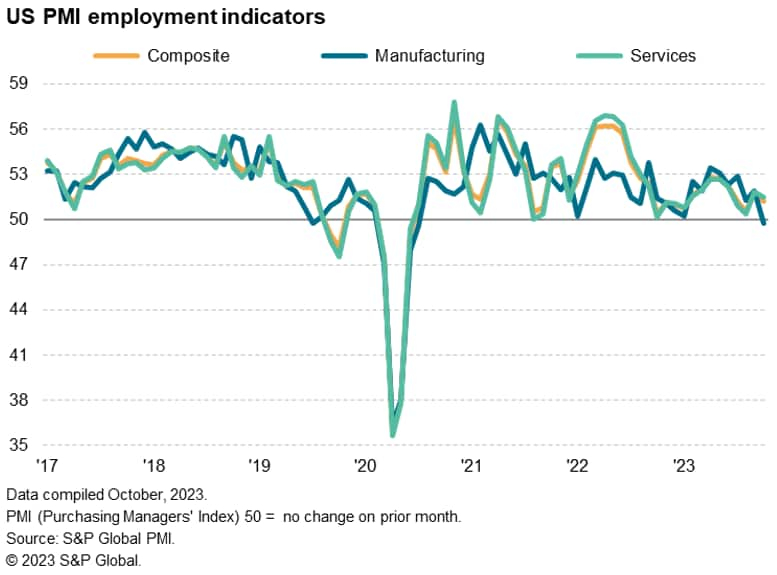

Employment

While the flash PMI showed US businesses continuing to hire additional workers during October, the job gains slowed compared to September. The rate of employment growth was only marginal overall as many firms noted that voluntary leavers were not replaced due to uncertainty surrounding future demand conditions and efforts to make cost savings. Manufacturing firms even reported a fractional drop in staffing numbers on the month, despite the uptick in orders. This signaled the first decline in manufacturing jobs seen since July 2020.

CPI on the wane

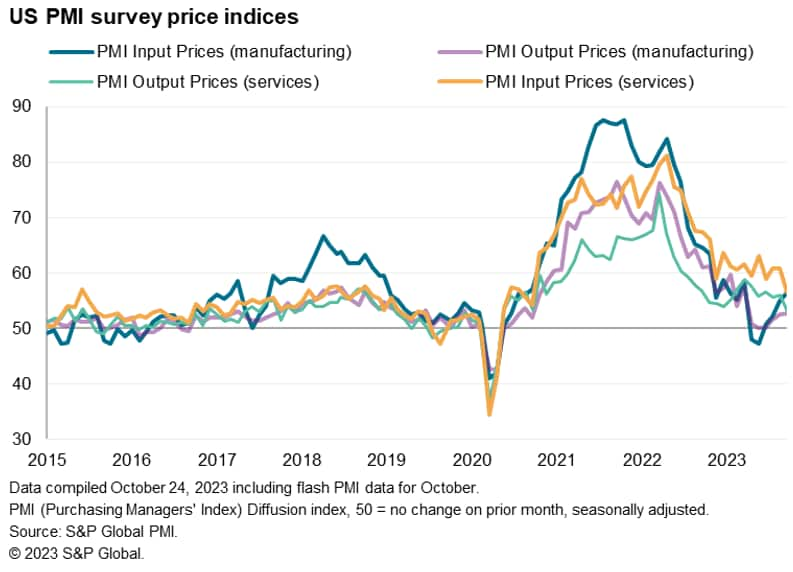

Firms' input cost inflation meanwhile fell sharply, dropping to the lowest since October 2020. Average selling prices for goods and services also rose at a reduced rate, posting the smallest monthly rise since June 2020. The latter hints at CPI inflation cooling further, with the Fed's 2% target coming into focus for the first time since the pandemic began.

Weaker demand for inputs reportedly led suppliers to reduce material prices, therefore relieving some pressure on industrial cost burdens. The softer rise in costs was led by service providers, however, as hikes in oil and oil-derived material prices pushed up cost burdens in the manufacturing sector.

In terms of selling (output) prices, manufacturers continued to increase output prices at only a modest pace, while service providers reported a notable slowdown in charge inflation amid intense competitive pressures and growing customer requests for concessions.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-soft-landing-hopes-boosted-as-flash-pmi-lifts-higher-and-price-pressures-abate-Oct2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-soft-landing-hopes-boosted-as-flash-pmi-lifts-higher-and-price-pressures-abate-Oct2023.html&text=US+soft+landing+hopes+boosted+as+flash+PMI+lifts+higher+and+price+pressures+abate+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-soft-landing-hopes-boosted-as-flash-pmi-lifts-higher-and-price-pressures-abate-Oct2023.html","enabled":true},{"name":"email","url":"?subject=US soft landing hopes boosted as flash PMI lifts higher and price pressures abate | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-soft-landing-hopes-boosted-as-flash-pmi-lifts-higher-and-price-pressures-abate-Oct2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+soft+landing+hopes+boosted+as+flash+PMI+lifts+higher+and+price+pressures+abate+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-soft-landing-hopes-boosted-as-flash-pmi-lifts-higher-and-price-pressures-abate-Oct2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}