Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 01, 2023

US PMI data highlight ongoing plight of manufacturing amid falling demand and inventory reduction

S&P Global's PMI surveys showed the US manufacturing sector remaining in steep decline in February. A lack of new orders suggest that production could deteriorate further in the coming months as factories deplete their pipelines of previously placed orders, backlogs of which accumulated during the pandemic amid supply shortages, which are now easing. A further shift toward inventory reduction is meanwhile adding to the industrial sector's drag on the wider economy.

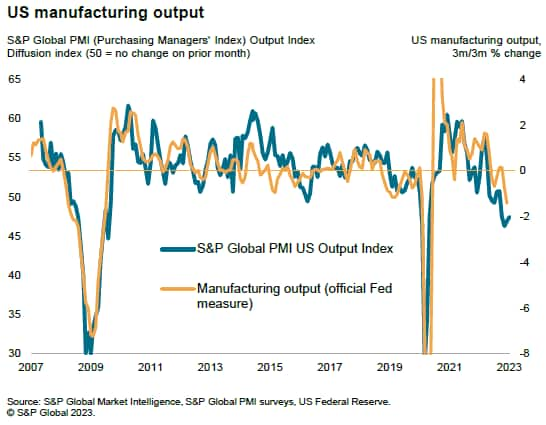

Manufacturing output in steep decline

US manufacturing remained under intense pressure in February. Although the S&P Global Manufacturing PMI rose slightly, up from 46.9 in January to a three-month high of 47.3, it continues to signal one of the steepest downturns outside of pandemic lockdown months since 2009. Importantly, the output sub index - which correlates closely with changes in the official measure of manufacturing production (yet is published several weeks ahead of the official gauge), also remained well below the 50.0 no change level at 47.4; a reading which is consistent with the manufacturing sector contracting at a quarterly rate of approximately 2%.

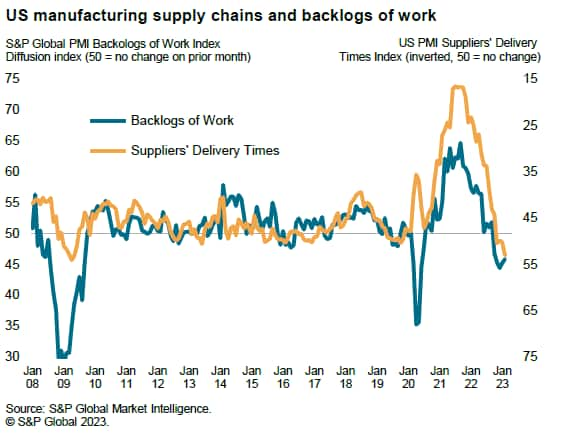

Moreover, some of the improvement could merely be attributed to faster supplier delivery times, which quickened to the greatest extent since 2009 to facilitate higher production and enabled factories to work through previously placed orders. Many of these backlogged orders were accumulated during the pandemic amid shortages of components. Auto makers being constrained by a lack of semiconductors was the most widely cited example of this.

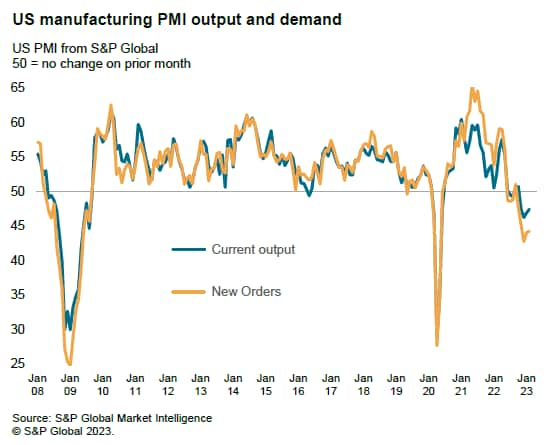

Dearth of demand

The worry is that new order inflows continue to fall sharply as many companies report disappointing sales, linked in part to a sustained trend towards cost-saving inventory reduction and low levels of confidence at their customers, both at home and abroad.

Importantly, the spread between the survey's output and new orders gauges remains one of the highest on record, indicating that output is not being cut commensurately relative to the recent decline in new orders. This reflects the fact that output is currently being supported by the backlogs of previously placed orders.

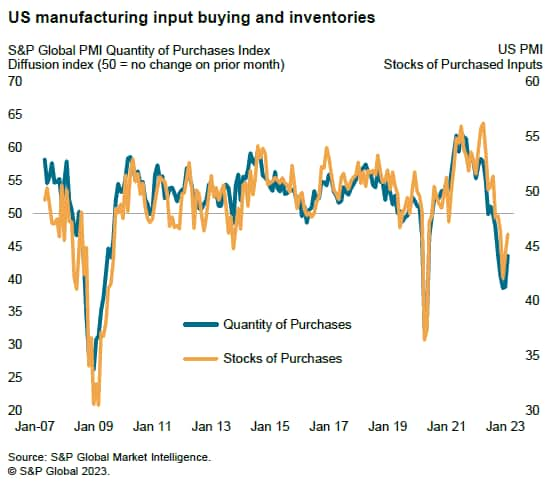

Inventory reduction

This all helps explain why manufacturers continued to reduce their input buying at an historically elevated rate in February. With concerns over supply scarcities easing and lower production volumes necessitating fewer inputs, the amount of goods bought by factories fell for a seventh successive month. Although the rate of decline moderated, it was still among the steepest seen since the global financial crisis in 2009.

Economic drag

None of this points to a healthy economic situation. The clear message is that, unless demand growth accelerates, firms will eventually run out of previously placed orders and have to cut production and inventories further, adding to the industrial sector's drag on the economy.

Access the press release here

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-pmi-data-highlight-ongoing-plight-of-manufacturing-amid-falling-demand-and-inventory-reduction-Mar23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-pmi-data-highlight-ongoing-plight-of-manufacturing-amid-falling-demand-and-inventory-reduction-Mar23.html&text=US+PMI+data+highlight+ongoing+plight+of+manufacturing+amid+falling+demand+and+inventory+reduction+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-pmi-data-highlight-ongoing-plight-of-manufacturing-amid-falling-demand-and-inventory-reduction-Mar23.html","enabled":true},{"name":"email","url":"?subject=US PMI data highlight ongoing plight of manufacturing amid falling demand and inventory reduction | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-pmi-data-highlight-ongoing-plight-of-manufacturing-amid-falling-demand-and-inventory-reduction-Mar23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+PMI+data+highlight+ongoing+plight+of+manufacturing+amid+falling+demand+and+inventory+reduction+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-pmi-data-highlight-ongoing-plight-of-manufacturing-amid-falling-demand-and-inventory-reduction-Mar23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}