Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 21, 2023

US flash PMI signals further acceleration of economic growth in April, but resurgent demand also brings higher price pressures

The latest PMI survey data from S&P Global adds to signs that business activity has regained growth momentum after contracting over the seven months to January.

Growth is also reassuringly broad-based, led by services thanks to a post-pandemic shift in spending away from goods, though goods producers are also reporting signs of demand picking up again.

Jobs growth has accelerated alongside the resurgence of demand, aided by reports of vacancies being more easily filled, reflecting improved supply of candidates and higher wages.

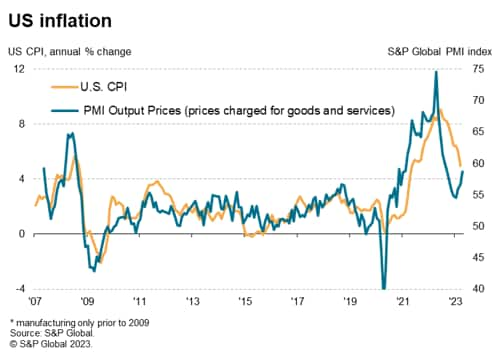

However, the upturn in demand has also been accompanied by a rekindling of price pressures. Average prices charged for goods and services rose in April at the sharpest rate since September of last year, the rate of inflation having now accelerated for three successive months. This increase helps explain why core inflation has proven stubbornly elevated and points to a possible upturn - or at least some stickiness - in consumer price inflation.

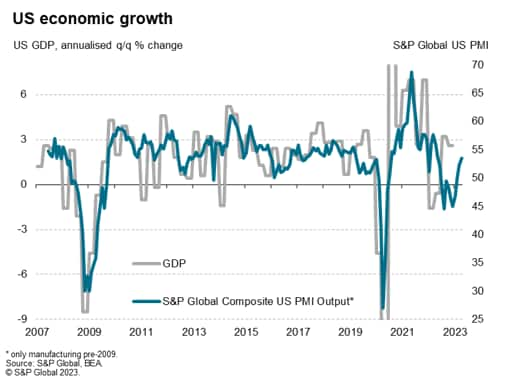

US output growth at 11-month high

The headline S&P Global Flash US PMI Composite Output Index rose to an 11-month high in April, up from 52.3 in March to 53.5. The latest reading adds to signs that business activity has regained robust growth momentum after contracting over the seven months to January. The latest reading is indicative of GDP growing at an annualized quarterly rate of just over 2%.

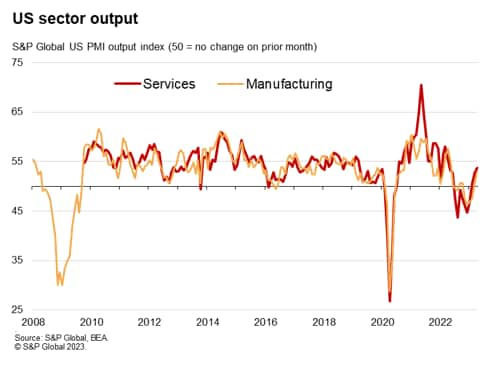

Broad-based expansion

The upturn was led by the service sector, where activity grew for a third successive month and at the fastest rate for a year. Goods producers meanwhile also reported a strengthening of output growth compared to the marginal return to growth seen in March, registering the largest monthly gain in production since May of last year.

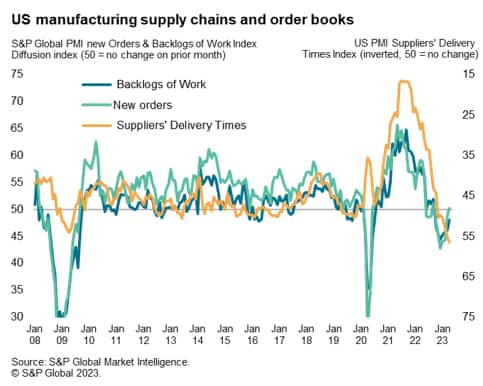

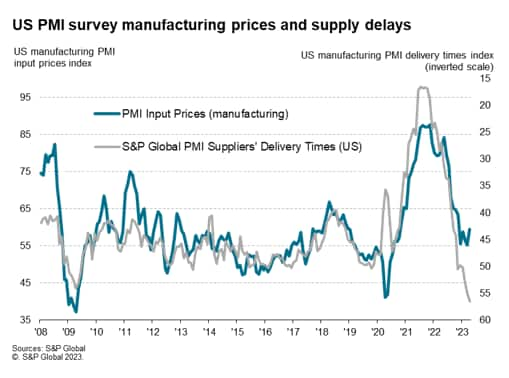

Producers benefit from record supply chain improvement

In manufacturing, the increase in output was again often associated with better supply of raw materials rather than any fundamental improvement in the demand picture, though new orders showed the first rise - albeit only marginal - since last September. Supplier lead times meanwhile quickened to the greatest extent on record (since May 2007), allowing firms to process backlogs of work which had in many cases built up amid the pandemic supply squeeze. Factory order backlogs fell for a seventh straight month as a result.

More encouragingly, input buying by manufacturers edged back into growth territory for the first time since last July and job gains hit the highest since last September, hinting at expectations of improving production in coming months. Business expectations in the manufacturing sector also ticked up to a three-month high.

Resurgent demand for services

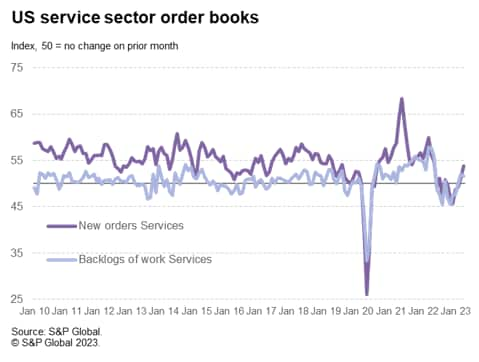

While demand for goods merely stabilised in April, inflows of new orders for services surged higher, growing at the sharpest rate since May of last year. Companies reported reviving consumer and travel-related demand for services in particular, suggesting a further diversion of spend from goods to services thanks to the pandemic-related tailwind for the latter.

In contrast to manufacturing, where current production volumes were only achieved by firms eating into their backlogs of work, the opposite was evident in services, where an inability to fulfil new business led to a second successive monthly rise in backlogs of work, despite April seeing the largest gain in service sector payroll numbers since last July.

Selling price inflation accelerates for third straight month

A downside of the recent resurgence of demand was an accompanying increase in price pressures. Average prices charged for goods and services rose in April at the sharpest rate since September of last year, the rate of inflation having now accelerated for three successive months. This increase helps explain why core inflation has proven stubbornly elevated at 5.6% and points to a possible upturn - or at least some stickiness - in consumer price inflation, which has recently cooled to 5%, as these higher charges are passed down to retail markets.

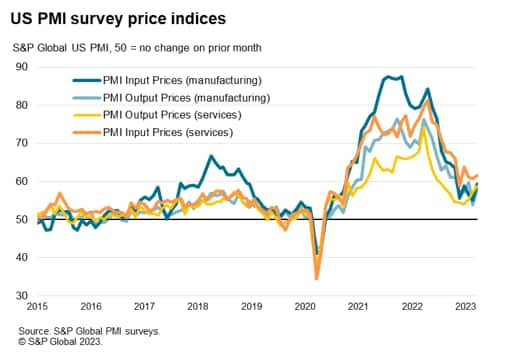

Rates of inflation increased across the board in April, with costs and selling prices rising at faster rates in both manufacturing ands services, albeit in all cases remaining well below rates seen this time last year.

The increase in manufacturing input costs was especially interesting, given the improvement in supplier delivery times seen during the month. Easing supply constraints are usually accompanied by falling price pressures.

Outlook

April's flash PMI data suggest that there are currently few indications of an imminent downturn, and if anything the underlying pace of economic growth has regained some momentum this year. This contrasts with the minutes from the last FOMC meeting, which revealed how policymakers were penciling in mild recession starting later in 2023, in turn encouraging some rate setters to consider treading a more cautious path, especially given recent banking sector stress and tightening credit conditions.

The Fed Funds rate now sits at 4.75-5.0%, having been hiked aggressively to cool inflation. The strength of the PMI data suggest there may be more hikes to come, barring any imminent impact from tighter credit conditions in the coming months.

View the latest press release.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-signals-further-acceleration-of-economic-growth-in-april-but-resurgent-demand-also-brings-higher-price-pressures-Apr23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-signals-further-acceleration-of-economic-growth-in-april-but-resurgent-demand-also-brings-higher-price-pressures-Apr23.html&text=US+flash+PMI+signals+further+acceleration+of+economic+growth+in+April%2c+but+resurgent+demand+also+brings+higher+price+pressures+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-signals-further-acceleration-of-economic-growth-in-april-but-resurgent-demand-also-brings-higher-price-pressures-Apr23.html","enabled":true},{"name":"email","url":"?subject=US flash PMI signals further acceleration of economic growth in April, but resurgent demand also brings higher price pressures | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-signals-further-acceleration-of-economic-growth-in-april-but-resurgent-demand-also-brings-higher-price-pressures-Apr23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+PMI+signals+further+acceleration+of+economic+growth+in+April%2c+but+resurgent+demand+also+brings+higher+price+pressures+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-signals-further-acceleration-of-economic-growth-in-april-but-resurgent-demand-also-brings-higher-price-pressures-Apr23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}