Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 22, 2024

US flash PMI indicates steady growth in February as price pressures cool further

The early PMI data for February indicate that the US economy continued to expand midway through the first quarter, pointing to annualized GDP growth in the region of 2%. Although service sector growth cooled slightly, manufacturing staged a welcome return to growth, with factory output growing at the fastest rate for ten months.

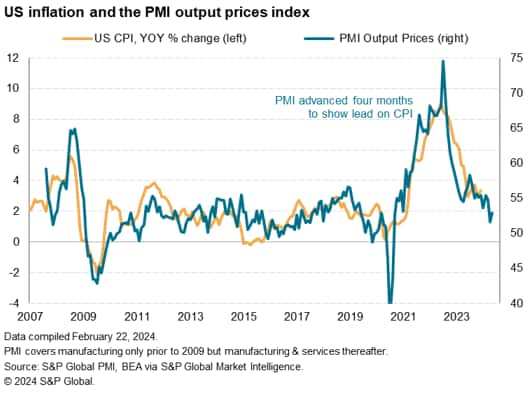

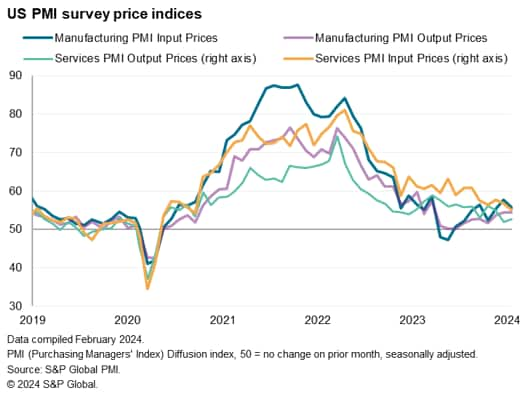

Importantly price pressures moderated further, hinting at inflation running at the Fed's 2% target.

Growth sustained into February as manufacturing sector revives

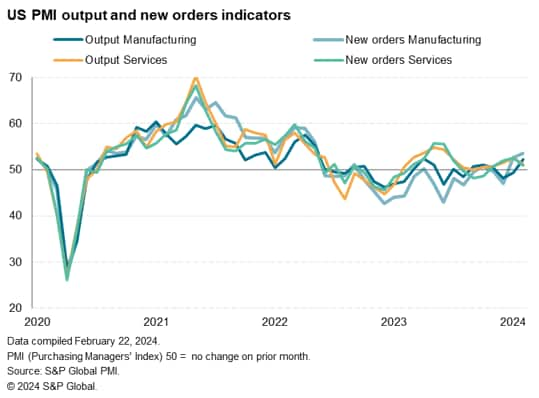

At 51.4, the headline S&P Global Flash US PMI Composite Output Index fell from 52.0 in January and signaled a marginal expansion in business activity midway through the first quarter of 2024. Nonetheless, the pace of expansion was the second-fastest since July 2023 as manufacturers and service providers recorded growth in output.

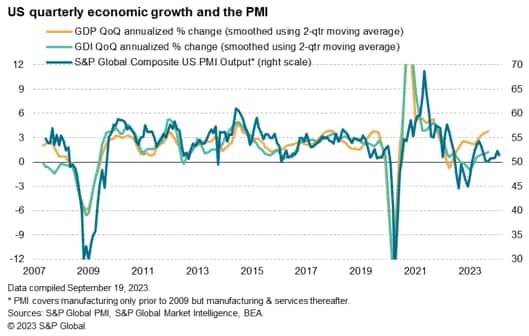

While the recent PMI data have signaled weaker economic growth than the official GDP numbers over the past year, both are now indicating an expanding economy. However, the rate of expansion signaled by the PMI has been more closely aligned with the GDI data than the GDP numbers over the past two years, pointing to around 2% annualized growth in both the fourth quarter of 2023 and in the first quarter of 2024 so far.

Although service sector output rose for a thirteenth straight month in February, the sector lost growth momentum. Service sector confidence in the year-ahead outlook has also dipped, in part reflecting some pullback in the extent to which interest rates are expected to fall in 2024.

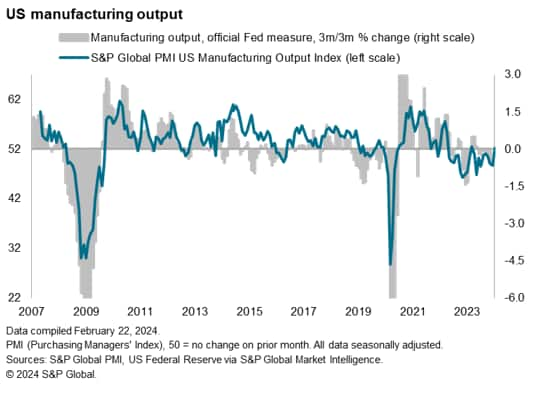

It was nevertheless welcome news that both manufacturing and services are expanding again for the first time in three months, as manufacturing firms registered a renewed rise in production in February.

Better weather conditions compared to January trumped shipping concerns, helping drive an overall improvement in supplier delivery times, which in turn facilitated higher factory production. Signs of inventory reduction policies becoming less widespread also helped boost output and sustain high levels of business confidence in the outlook for the year ahead among manufacturers.

US inflation set to fall further

Encouragingly from a policymaking perspective, the sustained expansion is being accompanied by subdued price pressures. Although up slightly in February, the survey's gauge of selling prices for goods and services continues to run at a level consistent with the Fed hitting its 2% inflation target, and a further slowdown in input cost growth to the lowest since October 2020 hints at price pressures remaining subdued in the coming months.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-indicates-steady-growth-in-february-as-price-pressures-cool-further-Feb24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-indicates-steady-growth-in-february-as-price-pressures-cool-further-Feb24.html&text=US+flash+PMI+indicates+steady+growth+in+February+as+price+pressures+cool+further+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-indicates-steady-growth-in-february-as-price-pressures-cool-further-Feb24.html","enabled":true},{"name":"email","url":"?subject=US flash PMI indicates steady growth in February as price pressures cool further | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-indicates-steady-growth-in-february-as-price-pressures-cool-further-Feb24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+PMI+indicates+steady+growth+in+February+as+price+pressures+cool+further+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-indicates-steady-growth-in-february-as-price-pressures-cool-further-Feb24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}