Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 23, 2023

US economy close to stalling in August as flash PMI falls to 50.4

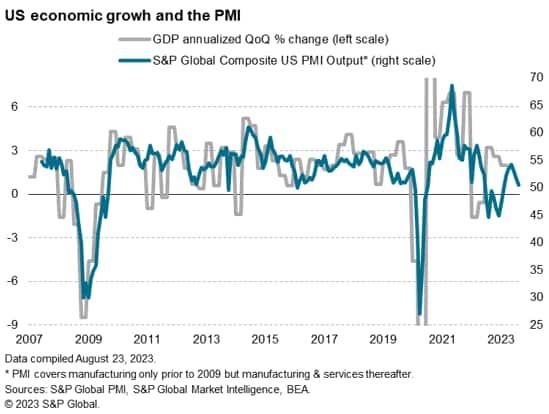

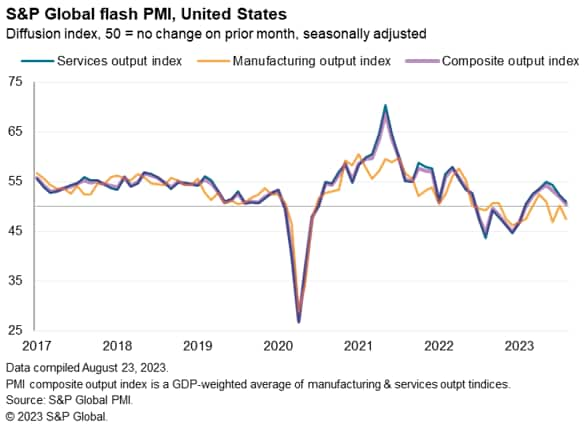

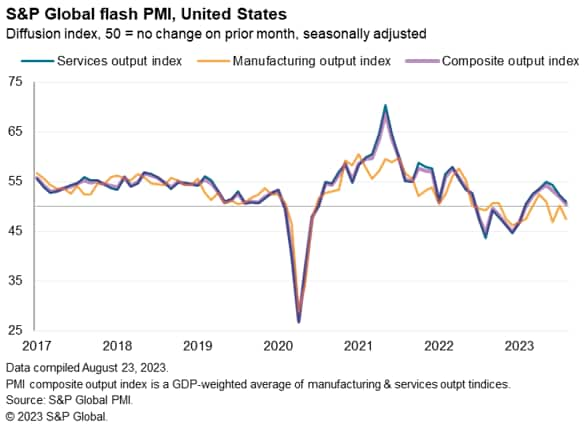

US business activity growth came close to stalling in August, according to flash PMI data compiled by S&P Global. The survey shows that the service sector-led acceleration of growth in the second quarter has faded, accompanied by a further fall in factory output.

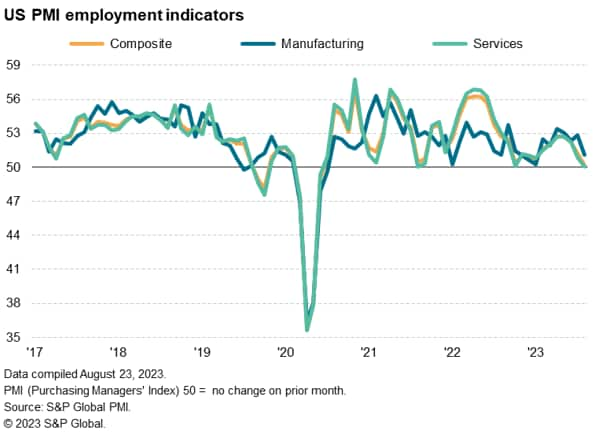

Companies reported that demand is looking increasingly lethargic in the face of high prices and rising interest rates. A resultant fall in new orders received by firms in August could tip output into contraction in September as firms adjust operating capacity in line with the deteriorating demand environment. Hiring could likewise soon turn into job shedding in the coming months after a near-stagnation of employment in August.

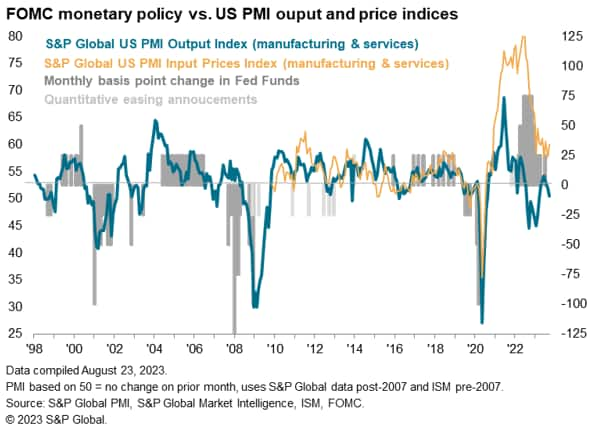

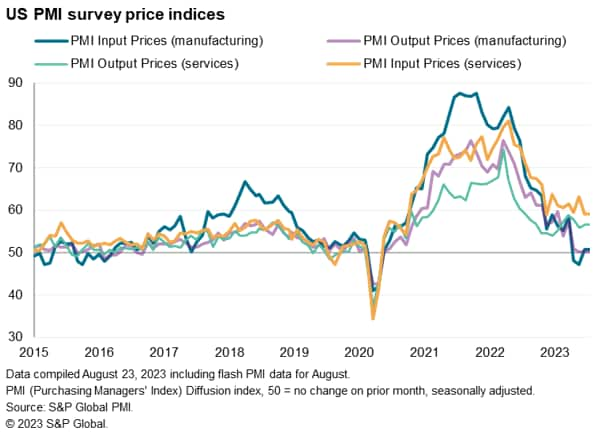

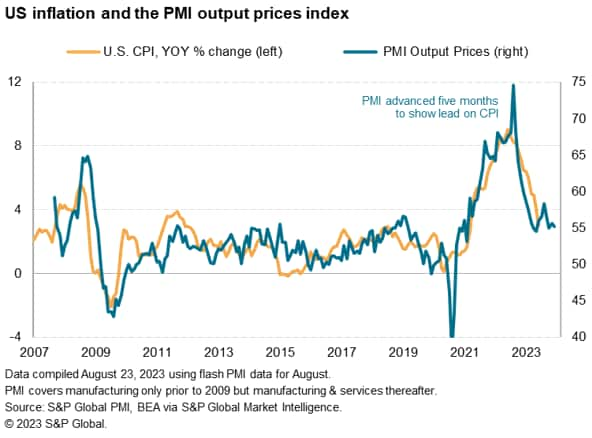

Meanwhile, cost pressures have regained some momentum as the rate of input price inflation quickened on the back of greater fuel, wage and raw material costs. Efforts to remain competitive and drive sales stifled the pace of selling price inflation, leaving the survey price data indicating some stickiness of inflation around the 3% level.

Stagnation warning

A near-stalling of business activity in August raises doubts over the strength of US economic growth in the third quarter. The headline S&P Global Flash US PMI Composite Output Index indicated only a fractional increase in output across the private sector midway through the third quarter. At 50.4 in August, down from 52.0 in July, the latest reading signaled the weakest upturn in activity since February.

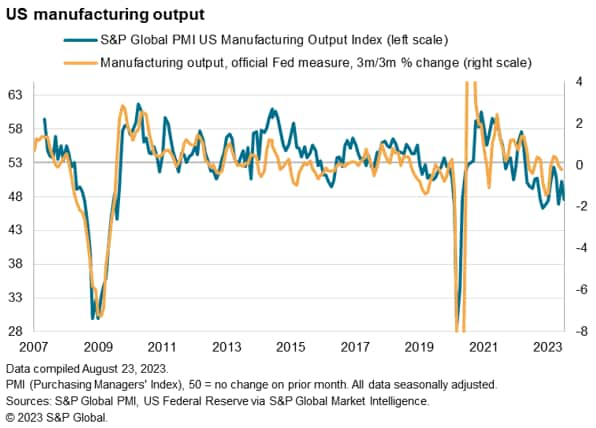

Following broadly unchanged levels of production in July, goods producers returned to contraction territory in August. The latest drop in output was the second in the last three months and indicative of the official (Fed) measure of US manufacturing production showing an increased rate of decline midway through the third quarter.

Although still registering an expansion, services firms meanwhile reported the slowest increase in activity for six months as high interest rates and inflationary pressures were reportedly seen to have increasingly weighed on customer spending.

Demand rises only for services exports

Softer demand conditions were evidenced by the first decrease in new orders since February. Manufacturers saw new orders fall at a quicker pace, while service providers saw the fastest drop in new business since the start of the year. Sustained pressure from inflation and high interest rates were often linked to the decline.

Muted demand from key export markets, especially Europe, meanwhile led to a renewed decrease in new export orders for goods in August. Service providers registered a slower expansion in new export sales, but services exports - which includes those services purchased by foreigners in the US - are now notable in being the only source of growing demand in the US economy.

Employment under pressure

August data indicated only a fractional rise in employment. Although extending the current sequence of job creation that started just over three years ago, the pace of increase was the slowest over this period. Weak demand and lower new orders resulted in job shedding at some firms, with mounting wage costs compounding decisions to cut staff.

Service providers reined in hiring activity as employment in the sector was broadly unchanged on the month. A lack of new business and some instances of difficulties retaining staff dragged on jobs growth. Meanwhile, manufacturers continued to see a rise in employment. The rate of job creation was the slowest since January, however, as voluntary leavers were often not replaced.

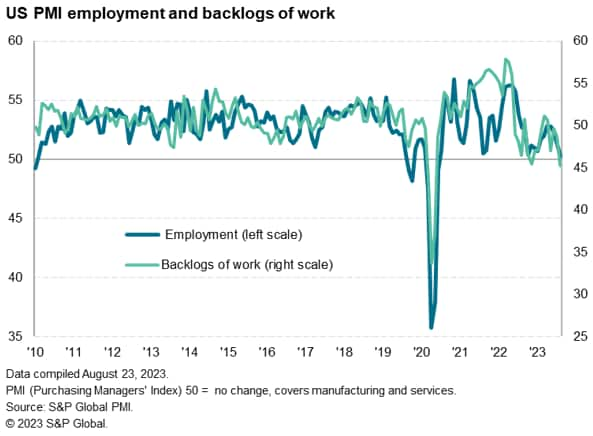

Strain on capacity dissipated further, as backlogs of work contracted at the sharpest rate since May 2020. Decreases in incomplete work at both manufacturers and service providers quickened from July.

The deteriorating picture presented by the survey's backlogs of work data hint at further pressure to reduce headcounts in the near future.

CPI, sticking at 3%?

Upward pressure on operating expenses from greater wage bills, increased raw material prices and higher fuel costs meanwhile led to a reacceleration in the pace of input price inflation in August. The rate of increase in costs was sharper than the long-run series average, as manufacturers and service providers recorded faster upticks. Although much slower than those seen through the last two years, the pace of increase in cost burdens at goods producers was the steepest since April.

In contrast, the rate of output charge inflation slowed during August amid efforts to boost sales. The pace of increase was historically elevated as firms continued to pass through higher costs to clients, but reports of customer requests for discounts and competitive pricing stymied upticks in selling prices. The overall increase was led by service providers, however, as manufacturers left output charges unchanged from July.

The upshot from the survey's price data is that inflation appears to be sticking around the 3% mark, as manufacturing price falls have given way to some stability and even some price rises in the case of energy, while service sector inflation remains stubbornly elevated by historical standards.

To watch in the coming months will be whether the cooling of the labour market evidenced by the August survey will help alleviate wage pressures, notably in the service sector.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economy-close-to-stalling-in-august-as-flash-pmi-falls-to-50.4-Aug2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economy-close-to-stalling-in-august-as-flash-pmi-falls-to-50.4-Aug2023.html&text=US+economy+close+to+stalling+in+August+as+flash+PMI+falls+to+50.4+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economy-close-to-stalling-in-august-as-flash-pmi-falls-to-50.4-Aug2023.html","enabled":true},{"name":"email","url":"?subject=US economy close to stalling in August as flash PMI falls to 50.4 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economy-close-to-stalling-in-august-as-flash-pmi-falls-to-50.4-Aug2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+economy+close+to+stalling+in+August+as+flash+PMI+falls+to+50.4+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economy-close-to-stalling-in-august-as-flash-pmi-falls-to-50.4-Aug2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}