Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 17, 2023

UK wage growth cools amid uncertain economic outlook

The latest official labour market data showed signs of cooling pay growth, confirming earlier signals from survey data of a softening jobs market. It is anticipated that sluggish economic growth, linked to higher interest rates, will continue to restrain the labour market and pull wage and price pressures lower in the coming months, though restrictions to the supply of labour are likely to persist and have the potential to be on ongoing source of inflation concern.

Signs of slower pay growth

Data from the Office for National Statistics (ONS) showed average employee earnings (excluding bonuses) growing at an annual rate of 6.5% in the three months to January. That represented a cooling from the 6.7% rate seen in the three months to December, albeit still running higher than anything seen since comparable data were first available over 20 years ago, barring an initial blip during the early months of the pandemic.

The big question is whether this represents a turning point, after which pay growth will weaken sharply, or whether pay growth will remain stubbornly high. The latter is naturally a concern to policymakers, boding ill for inflation to be pushed higher by rising pay deals.

Looking in more detail at recent pay growth, single-month data showed regular pay rising at an annual rate of 6.1% in January, which is the slowest rate since last September and represented a second month of moderation. On the same basis, private sector pay growth has fallen to 6.2% in January, down sharply from 7.1% in January and 7.6% in December, so likewise cooling for a second successive month.

More timely survey data meanwhile suggest that overall pay growth will continue to moderate in the near term. The monthly survey of around 400 recruitment consultancies conducted by S&P Global on behalf of KPMG and the REC. showed average pay awarded to people taking up new permanent jobs grew at a slightly accelerated rate in February, but this rate is still far lower than seen throughout much of 2022 and in fact lies only slightly above the five-year average seen prior to the pandemic. This is broadly consistent with annual wage growth in the region of 3%, which would not be a concern to the Bank of England.

Similarly, the survey showed pay for temporary and contract workers grew in February at one of the slowest rates seen over the past two years.

Public sector pay growth accelerates

One area of concern is the public sector, where pay growth accelerated to 4.8% in the latest three months according to official statistics, and to 5.4% in January alone. This in part reflects the impact of industrial action, as public sector workers seek to restore lost real pay amid the cost of living crisis. However, with inflation running at double digits in recent months, it's clear that real pay continues to fall at an historically high rate, providing a likely driver of ongoing industrial action and a pay bargaining chip that favors employees.

Key to future pay growth will naturally therefore be the degree to which headline inflation cools in the UK, as this will affect pay bargaining. But pay bargaining power will also depend on the extent to which economic growth - and hence demand for staff - slows, as well as the supply of labour.

Weakened demand for staff and fewer shortages

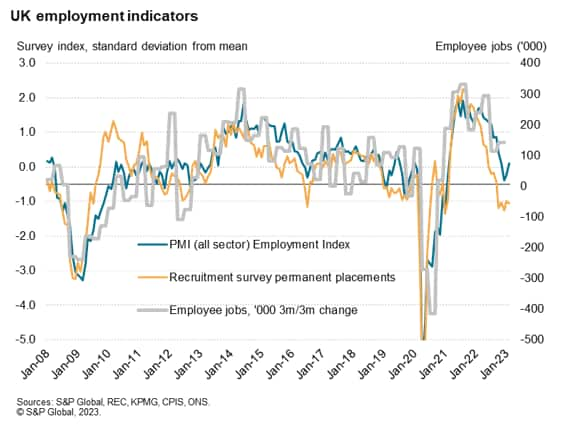

Although the PMI survey showed jobs growth picking up in February after falling slightly in the prior two months, the recruitment industry survey showed the number of people placed in permanent jobs still falling at one of the steepest rates seen since the global financial crisis. Growth of agency billings from temp/contract workers also remained largely becalmed, contrasting markedly with the near-record increases seen this time last year. This relatively subdued employment picture suggest that we could see some downward pressures to pay growth in the coming months.

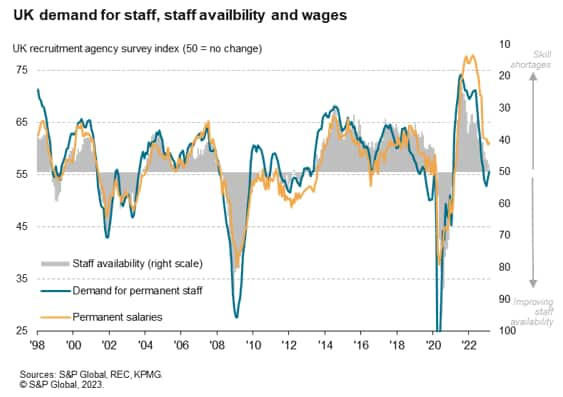

At the same time, the sharp deterioration in staff availability seen during the pandemic, which contributed to higher pay growth, has also faded. While overall staff availability as reported by recruitment agencies continued to deteriorate in February, the incidence of shortages has fallen to a near two-year low.

This combination of weakened demand for additional staff and fewer incidences of skill shortages should combine to help restrain pay growth in the months ahead.

How solid is business confidence?

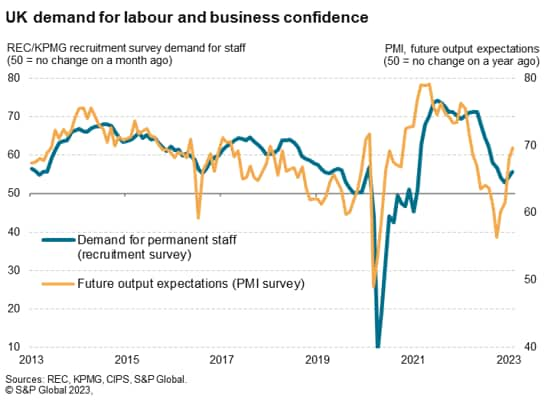

An important metric to watch will be the degree to which a recent upturn in business confidence will be sustained. The PMI surveys found business expectations regarding output in the 12 months ahead to have revived further in February from the low -point seen in the immediate aftermath of last autumn's mini budget. With the hiring trend closely correlated with business confidence, near-term prospects for the employment trend are positive, though we remain skeptical of this improvement.

Sentiment has been buoyed by a combination of greater political stability with the Sunak administration, signs of inflation peaking and reduced recession risks. A concern is that these reduced recession risks could now prompt further, more aggressive, monetary policy tightening should inflation worries persist, which seems likely in the very near term at least. Such a renewed hawkish stance could set the recovery back. Thus, even in the case of economic growth proving stronger than anticipated, tighter policy will likely curb that expansion, maintaining a distinct possibility of the UK seeing a mild recession in 2023.

The immediate outlook therefore appears to be one where wage growth is pulled in differing directions by various forces. On one hand, a diminished pool of available labour and stubbornly elevated inflation in the first half of 2023 have the potential to exert ongoing upward pressure on wage growth in the coming months. On the other hand, while economic growth and business confidence has picked up since late last year, the foundations of this improvement look unconvincing to date, hence economic growth - and employment growth - are likely to remain sluggish at best in 2023. This will act as a dampener on any wage growth.

Much therefore remains uncertain in terms of the labour market. Budget measures are likely to help boost growth, via improving the supply of labour and encouraging investment, but these measures are likely to have only a modest impact on a bigger picture which sees the UK continuing to struggle against low productivity growth, low investment and various negative consequences of Brexit, as well as the ongoing damage to households from a severe drop in real wages.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-wage-growth-cools-amid-uncertain-economic-outlook-Mar23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-wage-growth-cools-amid-uncertain-economic-outlook-Mar23.html&text=UK+wage+growth+cools+amid+uncertain+economic+outlook+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-wage-growth-cools-amid-uncertain-economic-outlook-Mar23.html","enabled":true},{"name":"email","url":"?subject=UK wage growth cools amid uncertain economic outlook | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-wage-growth-cools-amid-uncertain-economic-outlook-Mar23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+wage+growth+cools+amid+uncertain+economic+outlook+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-wage-growth-cools-amid-uncertain-economic-outlook-Mar23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}