Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 04, 2020

UK PMI adds to signs of fourth quarter economic resilience amid second lockdown

- UK all-sector PMI at 49.5 in November, signalling modest downturn

- Service sector downturn offset by faster growth in manufacturing and construction

- Business optimism lifted by vaccine news, but temporary Brexit boost likely to fade next year

UK PMI data showed encouraging resilience amid renewed COVID-19 lockdown measures in November, suggesting the economy is set for a far smaller hit to GDP in the fourth quarter than seen earlier in the year. The lighter nature of the lockdown, supportive external demand, improved confidence and a temporary Brexit boost have all helped alleviate the economic pain of the lockdown.

Economy sees divergent trends

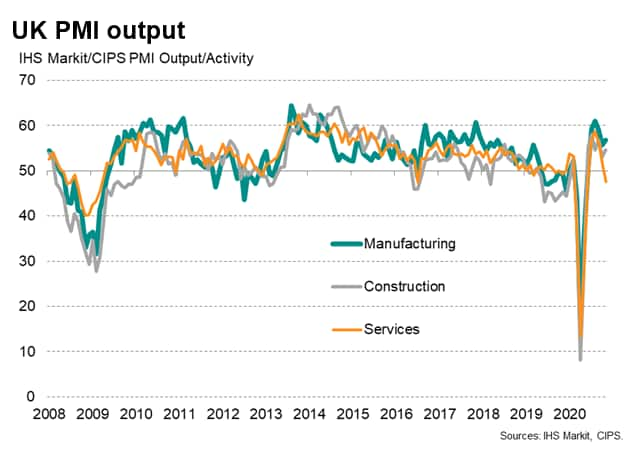

The IHS Markit/CIPS PMI surveys showed service sector activity falling back into decline in November as a second lockdown to fight a resurgent wave of COVID-19 infections hit many businesses, especially consumer-facing firms in areas such as hospitality.

More encouragingly, manufacturing and construction output continued to rise, and growth even accelerated slightly in both cases compared to that seen in October.

Moreover, the decline seen in the service sector was far less severe than suffered earlier in the year, at the height of the lockdowns amid the first virus wave.

The overall situation was therefore one in which the upturns in manufacturing and construction almost entirely offset the downturn recorded in the services sector, resulting in only a modest overall drop in output. The all-sector IHS Markit/CIPS PMI output index, which is a GDP weighted composite of the indices from the three sectors, merely fell from 52.2 in October to 49.5 in November.

With any reading below 50 indicating contraction, the PMI still points to the UK economy having fallen into decline in November, but the impact of the lockdowns appears to have been far less severe than earlier in the year. Note that this index fell to 36.3 in March and slumped as low as 13.4 in April.

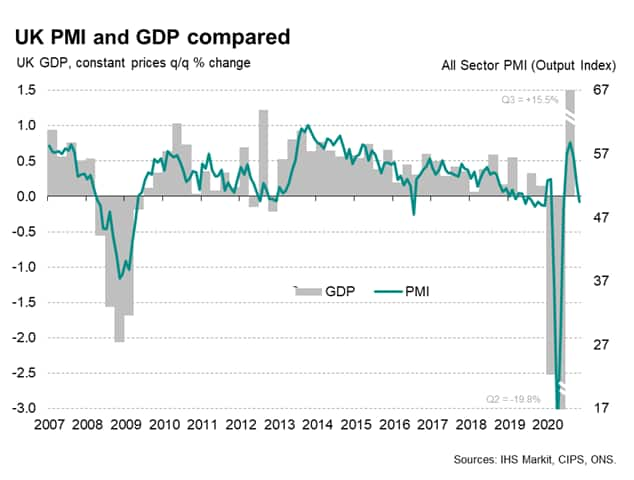

Some caution is warranted in interpreting what the PMI signals for GDP during lockdowns, not least because the PMI coverage excludes retail. GDP fell far more sharply than indicated by the PMI in the second quarter, and also rebounded more markedly than the PMI signalled in the third quarter. The PMI may therefore potentially once again understate the fall in GDP seen during the November lockdown to some degree. However, the relative resilience of the all-sector PMI in November provides a strong signal that GDP will decline by much less than earlier in the year.

There are various factors which have helped alleviate the impact of the pandemic on the UK economy in the fourth quarter.

Lighter lockdown

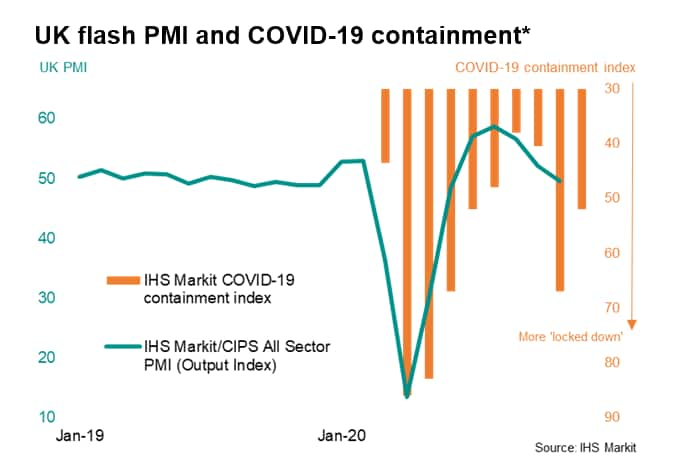

First, the lockdown measures in the UK have been less severe than earlier in the year. IHS Markit's COVID-19 Containment Index rose from 41 in October to 67 in November, indicating a severe tightening of restrictions, but this compares with readings of 86 and 83 in April and May respectively during the first lockdown.

*COVID-19 containment index is based on information relating to issues such as closures of schools, non-essential shops and restaurants, as well as restrictions on public gatherings, internal mobility and external borders. We also forecast how these are expected to change in coming months, based primarily on government announcements. A reading of 100 means severe restrictions while a reading of zero indicate no restrictions.

Supportive external demand

Second, the UK's external environment has been stronger than earlier in the year. Economies such as the US and China have seen sustained strong - and even accelerating - growth in November.

The JPMorgan Global PMI, compiled by IHS Markit, consequently remained in robust expansion territory in November, suggesting that the external demand environment remained supportive to UK businesses. In contrast, synchronised lockdowns around the world earlier the year meant the external environment acted as a major drag, exacerbating weakened domestic demand.

Improved optimism

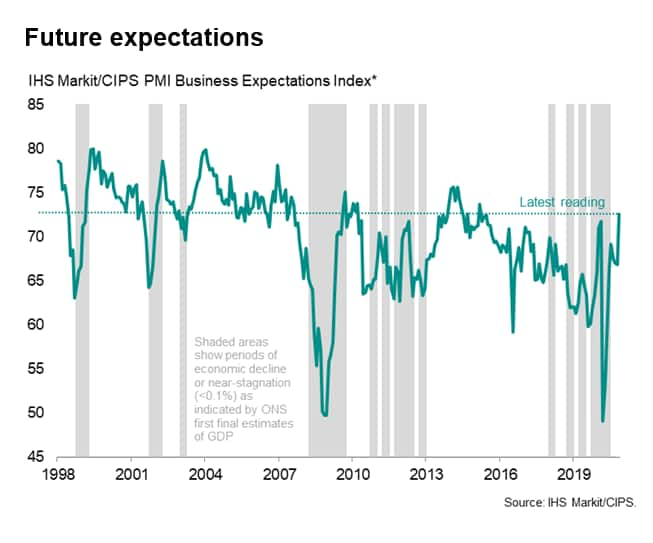

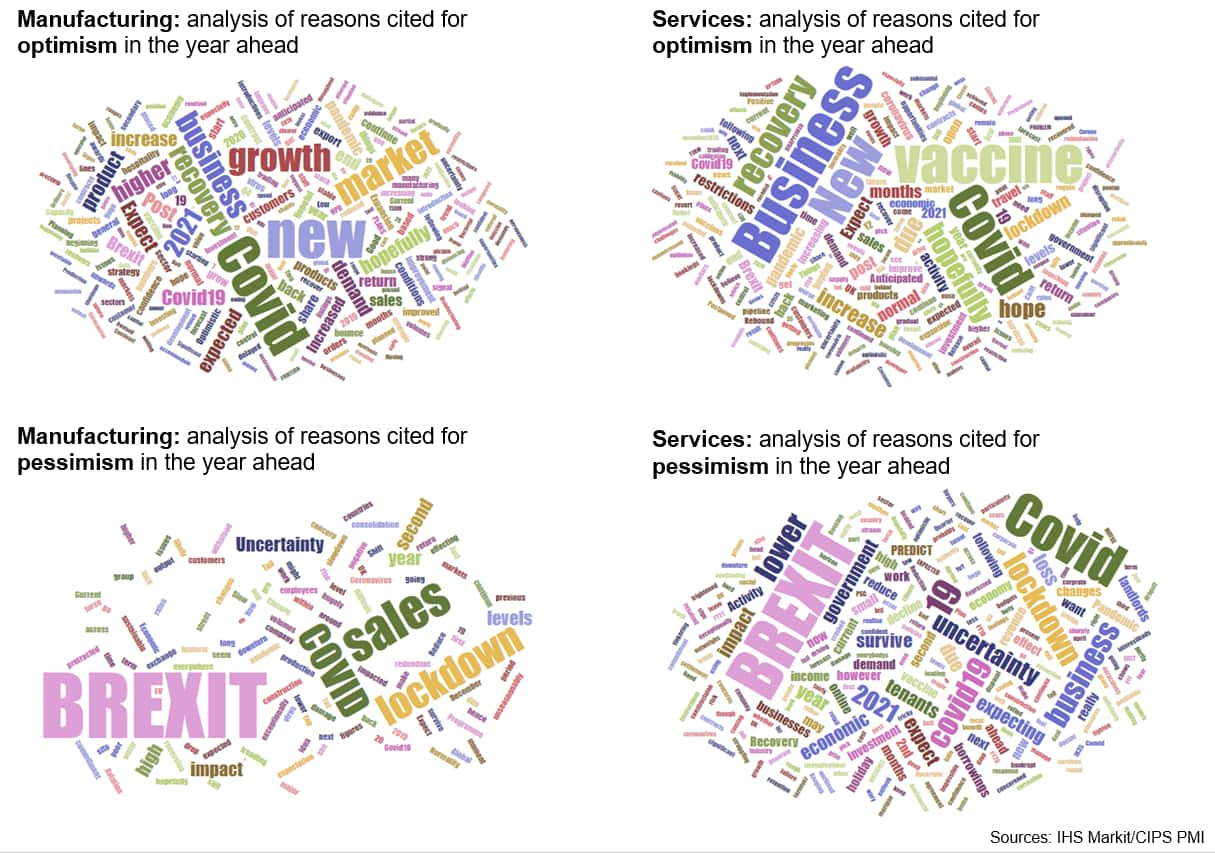

Third, business conditions were supported in December by improved sentiment about the year ahead. Earlier in the year, at the start of the pandemic, the lack of a light at the end of the tunnel meant companies focused on belt tightening amid widespread risk aversion. Business confidence about prospects for the year ahead slumped in March to the lowest in the PMI survey's history. In November, in contrast, encouraging news on vaccine developments in particular helped propel sentiment to its highest since March 2015, signalling a shift to greater risk appetite.

Brexit boost

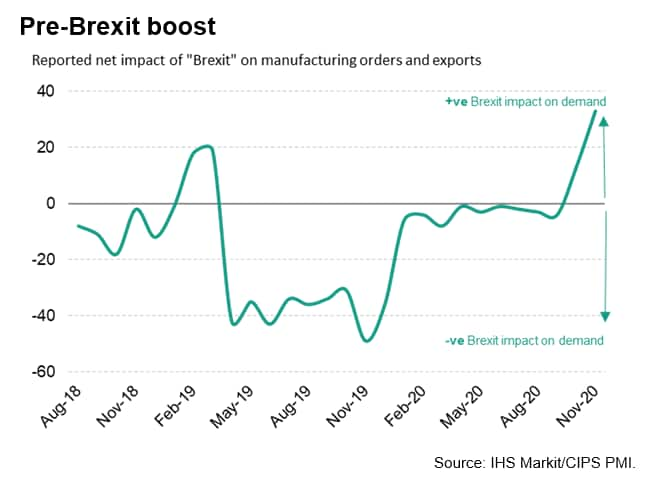

A fourth factor is likely to be more temporary. With the UK's departure from the EU at the end of the transition period on 31st December, companies reported a surge in demand from foreign customers - especially in the EU - ahead of Brexit.

The reported net boost to manufacturing orders and exports (as measured by the reasons cited by companies for rising demand) exceeded that seen ahead of prior Brexit 'deadlines' by a substantial margin. This positive boost to orders will fade, and in fact likely reverse, in the New Year, based on what we have seen during previous bouts of such pre-Brexit ordering.

Analysis of reasons cited for either optimism or pessimism in the coming year clearly shows that 'Brexit' is widely cited as the key threat to businesses, especially in the manufacturing sector. Hopes of a successful vaccine form the principal basis for optimism.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pmi-adds-to-signs-of-fourth-quarter-economic-resilience-amid-second-lockdown-dec20.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pmi-adds-to-signs-of-fourth-quarter-economic-resilience-amid-second-lockdown-dec20.html&text=UK+PMI+adds+to+signs+of+fourth+quarter+economic+resilience+amid+second+lockdown+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pmi-adds-to-signs-of-fourth-quarter-economic-resilience-amid-second-lockdown-dec20.html","enabled":true},{"name":"email","url":"?subject=UK PMI adds to signs of fourth quarter economic resilience amid second lockdown | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pmi-adds-to-signs-of-fourth-quarter-economic-resilience-amid-second-lockdown-dec20.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+adds+to+signs+of+fourth+quarter+economic+resilience+amid+second+lockdown+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pmi-adds-to-signs-of-fourth-quarter-economic-resilience-amid-second-lockdown-dec20.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}