Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 08, 2018

UK pay growth hits three-year high as employers fight to fill vacancies

- Recruitment agencies report fastest employee pay growth for three years

- Demand for staff revives to show largest gain for six months

- Staff availability continues to deteriorate

Average salaries awarded to candidates taking up new jobs rose at the fastest rate for three years in May in a further sign that the tightening labour market is pushing up UK wage growth. The findings, from the latest REC recruitment industry survey compiled by IHS Markit, will further fuel expectations that the Bank of England will hike interest rates again in coming months.

Accelerating pay growth

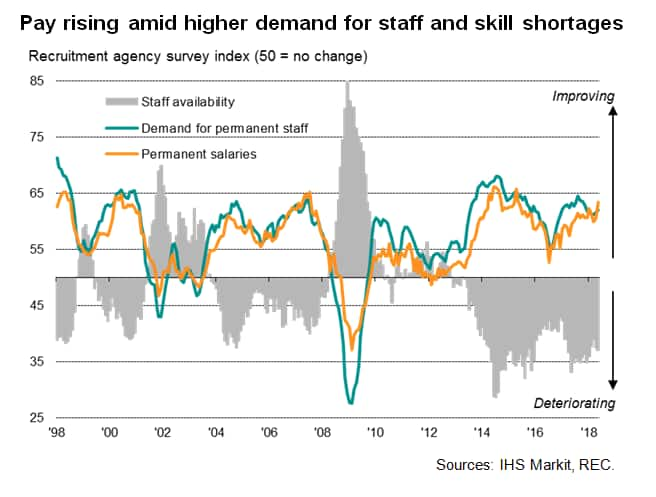

After slowing in the two months to March, growth of salaries awarded to people placed in new permanent jobs re-accelerated for a second month running in May, registering the highest rate of increase since May 2015.

The survey, based on a panel of 400 recruitment and employment agencies, also showed average hourly pay for temporary and contract workers rising sharply. Although down slightly on April, the marked rate of increase in May means the past two months have also seen the steepest jump in temp pay for two years.

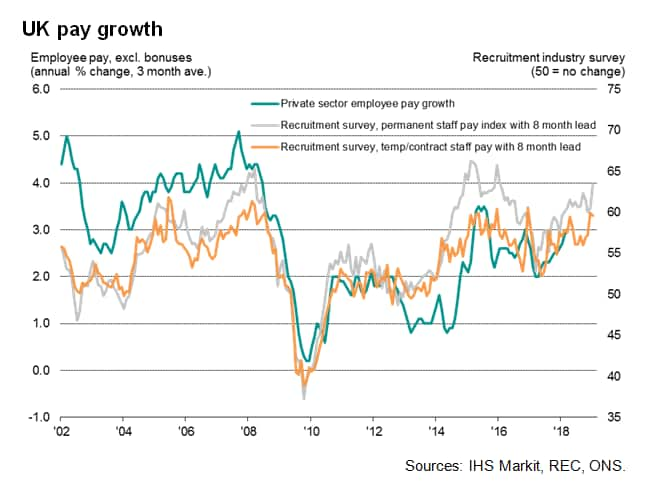

The data suggest that the rate of wage growth will continue to accelerate in coming months. The REC survey pay indices have strong correlation with changes in wages; though tend to move well in advance of the official data. The latest official numbers showed underlying pay growth (excluding bonuses) accelerated to 2.9% in the three months to March, reaching 3.0% in the private sector. A rise above 3% for both measures therefore seems likely as the summer proceeds.

Rising demand for staff

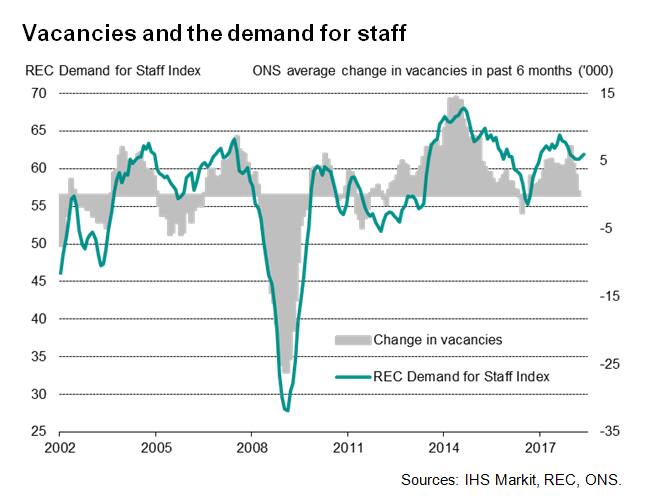

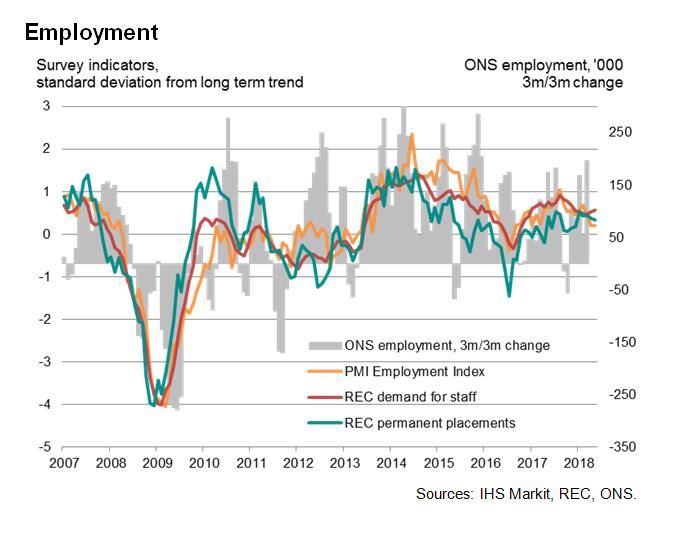

Recruitment agencies also reported that demand for staff from employers rose at the steepest rate for six months in May, the rate of increase accelerating after having slowed earlier in the year, likely as a result of snow-related disruptions to business in March.

However, while demand for staff rose at an increased rate, the number of people placed in new jobs showed the smallest - albeit still strong - gain so far this year, in part due to increased difficulties finding suitable candidates to fill vacant positions. Staff availability was reported to have deteriorated at the steepest rate since January, continuing a remarkable and sustained trend of declining staff availability that has been evident since 2013.

The continual drop in staff availability signalled by the survey over the past five years has been the most significant period of labour market tightening recorded over the survey's 20-year history, and highlights the extent of the resulting upward pressure on employee pay growth.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pay-growth-hits-threeyear-high-as-employers-fight-to-fill-vacancies.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pay-growth-hits-threeyear-high-as-employers-fight-to-fill-vacancies.html&text=UK+pay+growth+hits+three-year+high+as+employers+fight+to+fill+vacancies+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pay-growth-hits-threeyear-high-as-employers-fight-to-fill-vacancies.html","enabled":true},{"name":"email","url":"?subject=UK pay growth hits three-year high as employers fight to fill vacancies | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pay-growth-hits-threeyear-high-as-employers-fight-to-fill-vacancies.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+pay+growth+hits+three-year+high+as+employers+fight+to+fill+vacancies+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-pay-growth-hits-threeyear-high-as-employers-fight-to-fill-vacancies.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}