Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 07, 2018

South Korea PMI signals manufacturing slowdown

- Manufacturing PMI suggests a slowdown in Q2

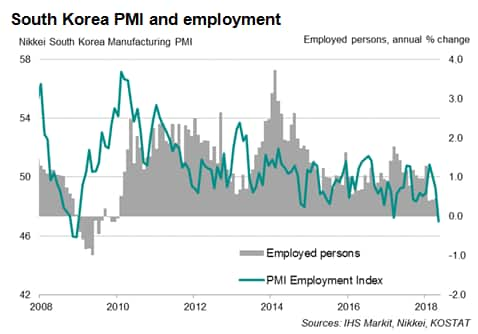

- Deepest fall in employment since 2008 global crisis

- Firms raise prices at faster rate despite easing cost inflation

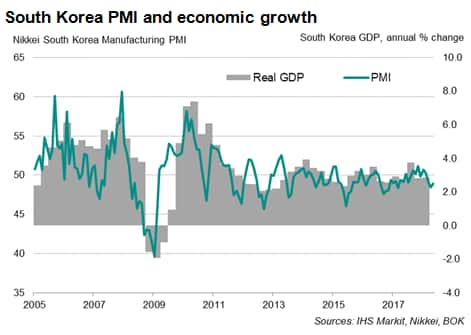

Business conditions in South Korea's manufacturing sector deteriorated further in May, according to the Nikkei PMI surveys, setting the scene for its weakest quarterly performance since late-2016.

Second quarter downturn

The headline Nikkei South Korea Manufacturing PMI™ rose from 48.4 in April to 48.9 in May, indicating a third successive monthly deterioration of the health of the sector. The average PMI reading so far for the second quarter is the lowest for six quarters, suggesting the sector has slipped into a marked slowdown compared to earlier in the year.

Steepest job losses since 2008 crisis

The slowdown has been accompanied by a concerning decline in net employment in the manufacturing sector, foretelling softer growth in the wider labour market. New job additions have been slightly above 100,000 in recent months, sharply lower than the 2017 average of 316,000.

May survey data showed the pace of factory job losses quickening to a rate not seen since the height of the global financial crisis in late-2008. Anecdotal evidence suggested that layoffs linked to weaker-than-expected inflows of work, exacerbated by the rising cost of labour due to the recent minimum wage hike. There were also reports of corporate restructuring weighing on hiring.

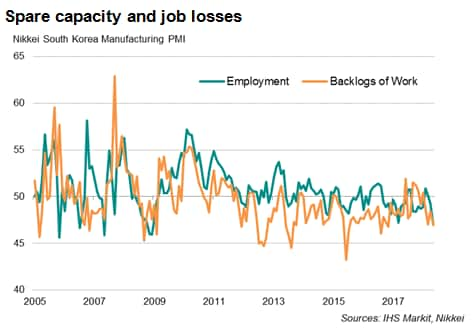

Furthermore, on-going spare capacity in the sector, as indicated by falling backlogs of work, likewise discouraged firms from boosting hiring.

Easing inflation

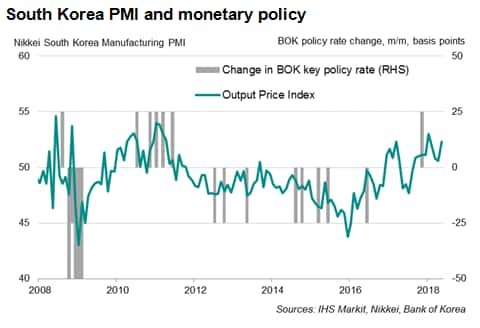

The latest surveys meanwhile brought mixed news on prices.

Supply shortages and greater raw material prices (often linked to oil) were key drivers of input cost inflation in May, according to survey evidence. There were also some reports of increased salaries (connected to minimum wage hikes) adding to overall cost burdens. However, the overall rise in factory input costs was the smallest in ten months

By contrast, the rate of inflation of selling prices for manufactured goods picked up to a four-month high. However, the higher rate of charge inflation is unlikely to be sustainable, assuming cost pressures continue to abate. Signs of easing cost inflation amid weaker demand growth offer fewer opportunities for future hikes in selling prices.

Gloomier outlook

The recent trend of lower new business inflows also points to a further output decline in coming months. The survey data highlight how there is little impetus for factories to scale up production as current demand can be easily met by their stores of finished goods, which have accumulated on average, albeit marginally, in recent months.

Weak sales also dented optimism. While still positive, the PMI's gauge of business confidence - the Future Output Index - slipped to a seven-month low.

Monetary policy

The survey data hint at a continued dovish bias to policymaking. The Bank of Korea held monetary policy unchanged last month, with Governor Lee highlighting strong headwinds for the South Korean economy in coming months. He also noted weak job creation, particularly in the manufacturing sector amid restructuring in shipping and auto industries.

May PMI added to the dimmer outlook, supporting the view of the central bank having to keep its policy rate steady for the time being.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fkorea-pmi-signals-manufacturing-slowdown.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fkorea-pmi-signals-manufacturing-slowdown.html&text=South+Korea+PMI+signals+manufacturing+slowdown+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fkorea-pmi-signals-manufacturing-slowdown.html","enabled":true},{"name":"email","url":"?subject=South Korea PMI signals manufacturing slowdown | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fkorea-pmi-signals-manufacturing-slowdown.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=South+Korea+PMI+signals+manufacturing+slowdown+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fkorea-pmi-signals-manufacturing-slowdown.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}