Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 01, 2018

UK Manufacturing PMI stages unconvincing rebound in May

- Manufacturing PMI rises in May but fails to recoup April's decline

- Weak new order inflows mean backlogs of work drop to the greatest extent since August 2016

- Record rise in inventories of finished items

- Smallest jobs gain since February 2017

- Selling prices rise at joint-slowest rate in 20 months

UK manufacturers reported an increased rate of production in May, but forward-looking indicators suggest growth will weaken in coming months unless demand revives.

The IHS Markit/CIPS Manufacturing PMI rose from 53.9 in April to 54.4 in May. Although up on the near one-and-a-half year low seen at the start of the second quarter, the latest reading was the second-lowest since March of last year. At 54.2, the average PMI reading so far in the second quarter is down from 54.9 in the first quarter and puts manufacturing on course for its weakest quarterly performance since the end of 2016.

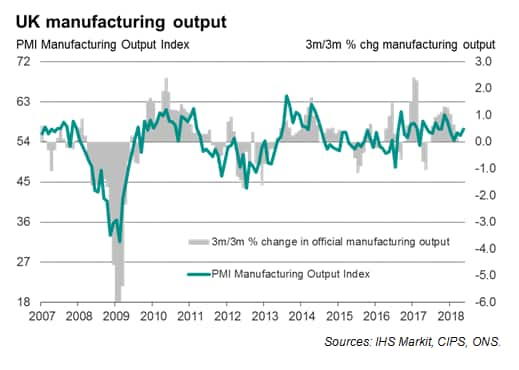

Encouragingly, the output index component of the PMI showed production growth accelerating to the highest since December, running at a level broadly consistent with factory output growing at a quarterly rate approaching 0.5%.

Weak new orders growth darkens outlook

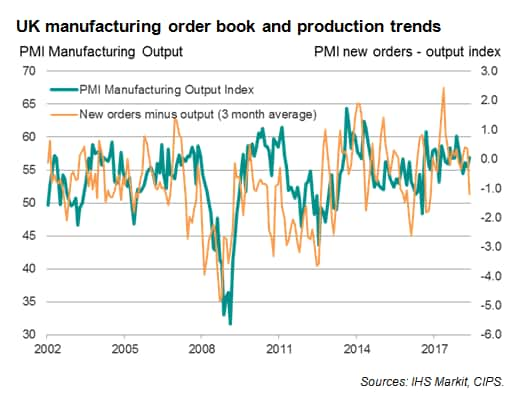

Less encouraging was the news from the survey's gauge of new orders, which indicated the weakest rise since June of last year. The divergence between output and new orders growth bodes ill for future production. In May, the rate of growth of new orders in fact outpaced that of production to the greatest extent since September 2016, and has now outpaced output in five of the past six months.

Backlogs of work consequently fell sharply in May, down for the fifth successive month and dropping to the greatest extent since August 2016. Stocks of finished goods meanwhile rose to the greatest extent in the survey history, often attributed to weaker than expected sales.

The weakness of order book growth relative to output suggests production will rise to a softer extent in coming months to move closer in line with the reduced rate of order inflows, unless of course demand picks up again.

Firms' expectations about future output meanwhile slipped to a six-month low in May, further highlighting the risk that the production trend will weaken in coming months.

Deteriorating employment trend

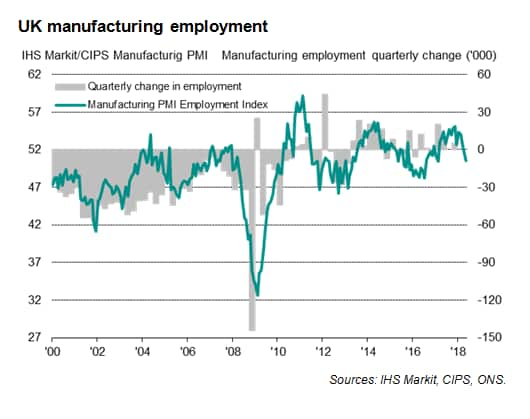

Manufacturers cut back on their hiring in response to the slower growth of demand and to reduce costs in the face of an uncertain outlook. Employment rose to the smallest extent since February 2017.

Comparisons of the survey's employment index with official employment numbers suggest the PMI is indicative of manufacturing headcounts falling in May.

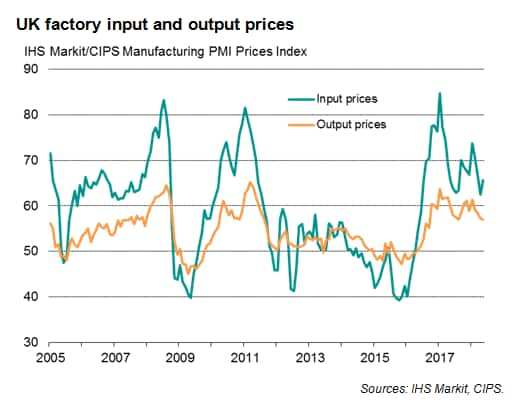

Output price inflation at 20-month low

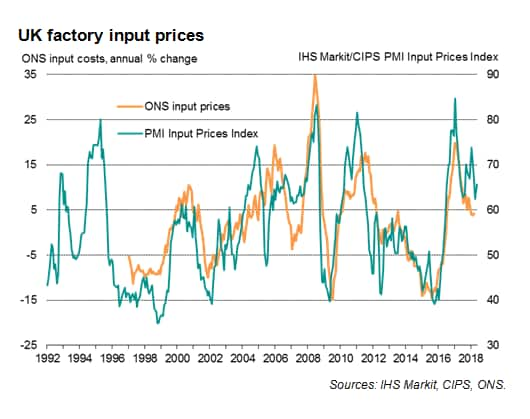

The news on prices was mixed. Higher oil prices contributed to a re-acceleration in the rate of input cost inflation, albeit with the rate of increase remaining below recent peaks. In contrast, average output prices rose at the joint-slowest rate since September 2016, suggesting producers struggled to pass higher costs on to customers. Many firms linked an inability to raise prices, or the need to cut prices, to strong competition.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturing-pmi-stages-unconvincing-rebound-in-may.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturing-pmi-stages-unconvincing-rebound-in-may.html&text=UK+Manufacturing+PMI+stages+unconvincing+rebound+in+May+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturing-pmi-stages-unconvincing-rebound-in-may.html","enabled":true},{"name":"email","url":"?subject=UK Manufacturing PMI stages unconvincing rebound in May | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturing-pmi-stages-unconvincing-rebound-in-may.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+Manufacturing+PMI+stages+unconvincing+rebound+in+May+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturing-pmi-stages-unconvincing-rebound-in-may.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}