Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 22, 2021

UK Flash PMI signals economy lifted by service sector, but manufacturing falters and prices rise at record rate

The flash PMI data show the UK economy picking up speed again in October. However, the expansion is looking increasingly dependent on the service sector, which in turn looks prone to a slowdown amid the recent rise in COVID-19 cases, and was accompanied by an unprecedented rise in firms' costs, which led to a record rise in selling prices.

Economy picks up speed thanks to service sector rebound

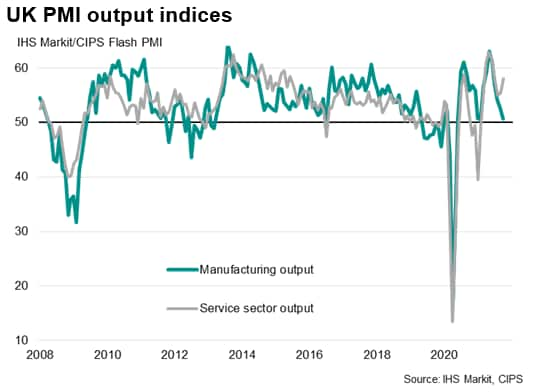

The IHS Markit/CIPS flash composite PMI output index, covering both services and manufacturing, rose from 54.9 in September to 56.8 in October, indicating the fastest expansion of the economy since July.

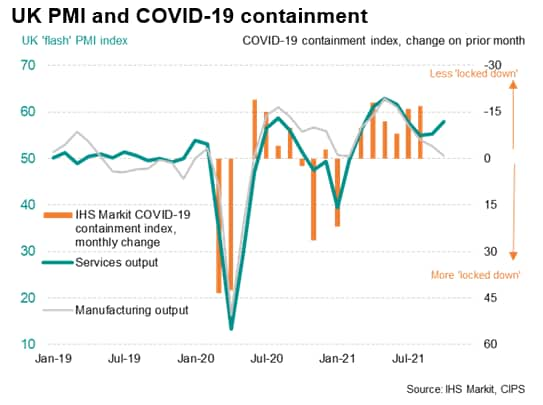

Growth is looking increasingly lop-sided, however, with the upturn led by the services sector, and consumer-facing and hospitality firms in particular driving the expansion for a third month running. In contrast, manufacturing saw production growth almost evaporate, sliding to a pace of near-stagnation which - barring lockdown months - was the weakest performance since the start of 2020. The resulting gap between the strongly-growing service sector and the weakening expansion of the manufacturing economy was the largest since early-2009.

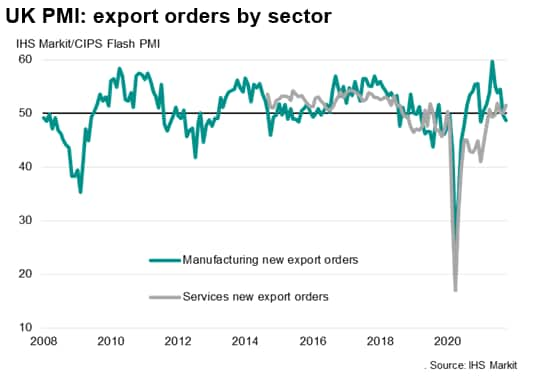

While the service sector continued to benefit from the opening up of the economy, with the enforcement of COVID-19 restrictions having been largely removed, increasing numbers of employees returning to city centres and more travel permitted, factories have been besieged by a further worsening of supply chain delays and ongoing staffing issues, as well as falling exports and what appears to have been diversion of spend toward services.

Prices rise at record pace

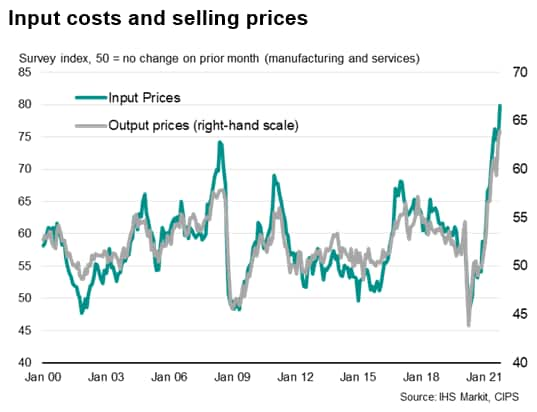

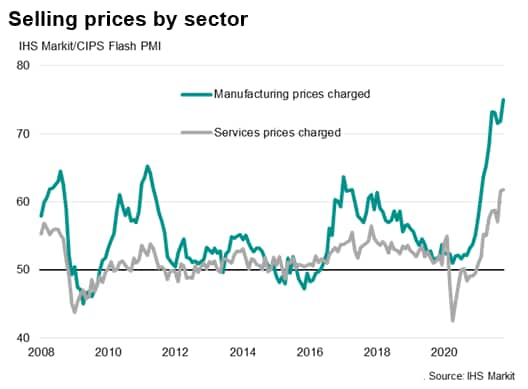

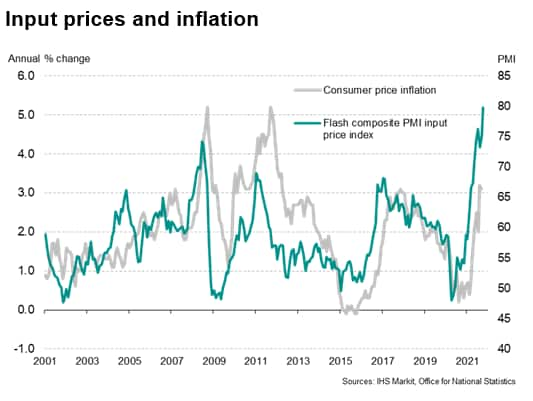

The expansion was accompanied by an unprecedented rise in price pressures. The latest increase in average cost burdens was the largest since comparable data were first available in January 1998. Survey respondents often cited rising fuel, transport and energy bills, alongside steep price increases for items in short supply.

Output charges at UK private sector firms increased at the steepest rate since the index began more than two decades ago in response to the escalating input costs, with record and accelerating rates of increase seen in both manufacturing and services.

These higher price pressures will inevitably feed through into higher consumer prices in coming months. Have moderated to 3.1% in September, consumer price inflation looks set to rise markedly further as we head towards the end of the year, given that the PMI price gauges tend to lead the official inflation data.

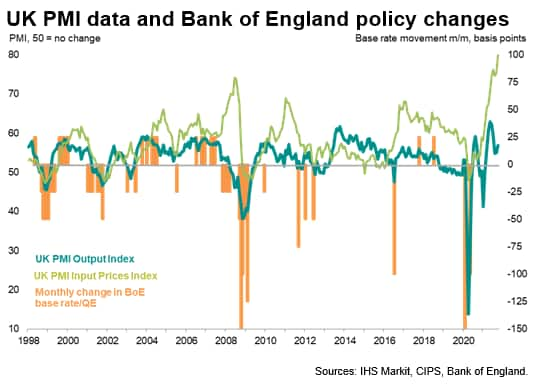

Policy tightening at the Bank of England

The flash PMI data come at a time when the Bank of England is leaning towards hiking interest rates to safeguard against inflationary expectations becoming entrenched. The record readings of the PMI survey's price gauges will inevitably pour further fuel on these inflation worries and add to the case for higher interest rates.

However, the economic growth signals from the PMI remain less convincing from a policy standpoint. The service sector is clearly in something of a sweet spot as the UK has seen more people's lives and livelihoods return closer to normal. Some of the growth momentum will therefore fade as this rebound passes. Moreover, rising COVID-19 case numbers pose a downside risk to growth in the coming months, potentially deterring some services-oriented activity among consumers in particular and potentially leading to the renewed enforcement of health restrictions as winter draws in.

The recovery meanwhile faces headwinds from numerous other angles. It's becoming increasingly evident that businesses will have to contend with disrupted supply chains and higher logistics costs for some time to come, as well as acute labour shortages and rising wage pressures. UK households are meanwhile facing rising prices, including elevated energy and fuel costs, as well as impending tax increases and the end of several COVID-19 support measures.

It's therefore clear that the resilience of the economy will be tested severely in the coming months, which suggests a strong risk that any imminent tightening of policy could quickly need to be reversed.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-economy-lifted-by-service-sector-but-manufacturing-falters-and-prices-rise-at-record-rate-Oct21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-economy-lifted-by-service-sector-but-manufacturing-falters-and-prices-rise-at-record-rate-Oct21.html&text=UK+Flash+PMI+signals+economy+lifted+by+service+sector%2c+but+manufacturing+falters+and+prices+rise+at+record+rate+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-economy-lifted-by-service-sector-but-manufacturing-falters-and-prices-rise-at-record-rate-Oct21.html","enabled":true},{"name":"email","url":"?subject=UK Flash PMI signals economy lifted by service sector, but manufacturing falters and prices rise at record rate | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-economy-lifted-by-service-sector-but-manufacturing-falters-and-prices-rise-at-record-rate-Oct21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+Flash+PMI+signals+economy+lifted+by+service+sector%2c+but+manufacturing+falters+and+prices+rise+at+record+rate+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-economy-lifted-by-service-sector-but-manufacturing-falters-and-prices-rise-at-record-rate-Oct21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}