Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 21, 2022

UK flash PMI signals economic resurgence as Omicron wave ebbs, but price pressures intensify

The latest PMI surveys indicate a resurgent economy in February, with business activity leaping higher as COVID-19 containment measures were relaxed. Growth accelerated in both services and manufacturing, the former seeing especially strong growth as consumer-facing and hospitality business enjoyed reviving demand. Producers also benefitted from reduced supply chain bottlenecks, though failed to see an upturn in demand growth, linked in turn to slumping exports. Consequently, while service providers reported a rising backlog of work to sustain activity in coming months, goods producers reported a steep fall in backlogs.

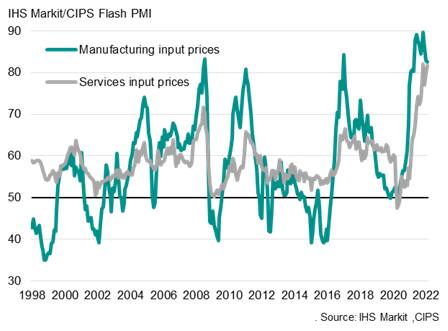

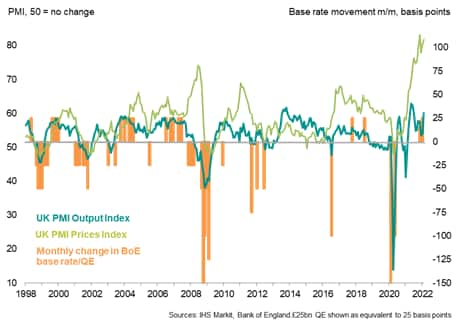

The PMI's overall gauge of input costs meanwhile rose to its second highest ever level, signalling persistent inflation pressures. Although manufacturing raw material prices grew at a slower rate, rising staff costs and higher energy prices meant service sector cost inflation hit a near-record high.

The combination of accelerating growth and persistent elevated inflationary pressures will add to the likelihood of a further, imminent, rate hike at the Bank of England.

Economy rebounds as Omicron fades

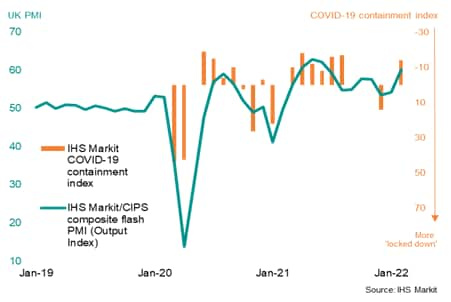

UK economic growth accelerated sharply in February as COVID-19 containment measures were relaxed and virus-related supply disruptions eased. The IHS Markit/CIPS composite PMI output index, covering both services and manufacturing, rose from 54.2 in January to 60.2 in February, according to the early 'flash' reading, indicating the fastest rate of expansion since June of last year.

The improvement follows a sharp slowdown during December and January, when growth had sunk to the weakest since the lockdowns of early 2021. Whereas December had seen COVID-19 containment measures tightened to the strictest since last July amid the surging Omicron wave. February saw these measures withdrawn to leave the overall level of containment at its lowest since the pandemic began, according to IHS Markit calculations.

UK PMI and COVID-19 Containment

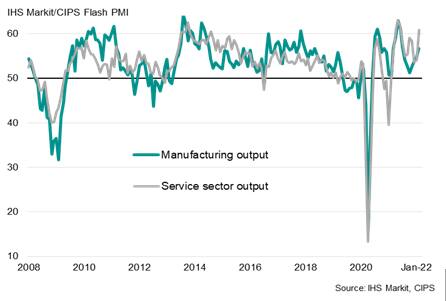

Service sector leads the upturn

The service sector was the largest beneficiary of the relaxation of virus containment measures, with output growth soaring to the highest since last June. The survey has only recorded faster growth in eight months over its prior 25 year history.

The service sector growth spurt was led by hotels, restaurants and other consumer-facing businesses, as virus-fighting restrictions were lifted. Transport services also stabilised after heavy declines in the prior two months. Business services likewise reported a markedly improved performance, reflecting reviving demand and fewer staff absences, though financial services reported a slowdown.

UK PMI output indices

Manufacturers enjoy reduced bottlenecks

Manufacturing output growth also accelerated in February, reaching its fastest since July of last year to signal a revival of good production after the bout of weakness associated with the Delta and Omicron waves. The autos and other transport sector led the manufacturing upturn as supply bottlenecks eased.

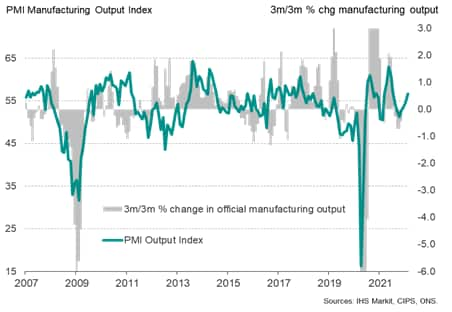

UK manufacturing output

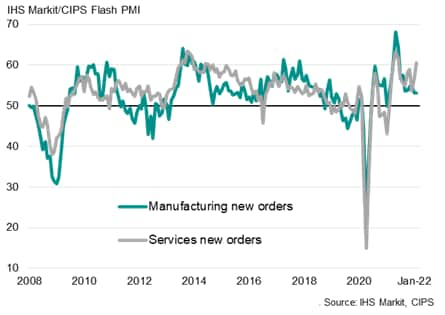

Demand conditions diverge

However, while both services and manufacturing saw faster output growth in February, demand conditions varied between the two sectors.

Looking at new orders, which represent the influx of new demand, service sector work inflows hit an eight-month high while manufacturing new orders continued to grow at the slowest rate for a year.

New orders by sector

These divergent new orders trends were even more apparent when looking at the export component. While relaxed travel restrictions both at home and abroad meant service sector exports rose at a rate exceeded only once over the past four years (beaten only slightly by the gain seen last November), manufacturing exports fell at the steepest rate seen since the initial pandemic global lockdowns of early-2020. Goods exporters blamed Brexit as having exacerbated pandemic related headwinds to trading

New export orders by sector

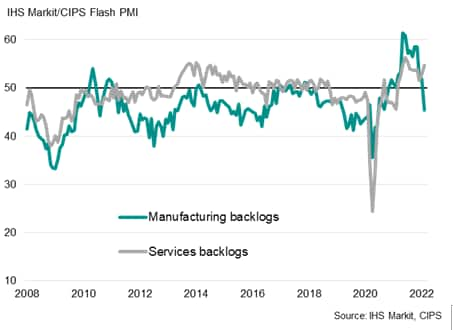

However, the clearest indications of changing - and diverging - demand conditions were seen in the survey's backlogs of work indices. These indices measure the amount of orders that companies have yet to start work on or complete. As such, they represent the 'pipeline' of work to sustain output in coming months. Whereas service sector backlogs of work rose in February to the greatest extent since last July, manufacturing backlogs fell at a rate not witnessed since June 2020.

These indices therefore hint at service sector growth accelerating in March, as companies seek to deal with rising backlogs of work, whereas manufacturers are more likely to scale back their production due to a lack of work unless new orders growth revives.

Backlogs of work by sector

Supply constraints ease to 15-month low

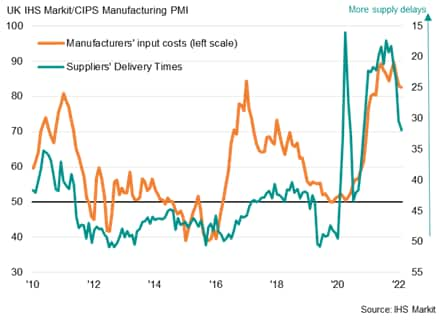

The decline in backlogs of work in manufacturing also explains why factory output growth accelerated without any commensurate increase in new orders. In many cases, the increase in factory production in fact reflected improved availability of inputs rather than an upturn in demand. Suppliers' delivery times lengthened in February to the smallest extent for 15 months, signalling a further moderation of the supply squeeze.

Encouragingly, this supply chain easing led to a reduction in material price inflation, which dipped in February to the lowest since last April, albeit remaining elevated by historical standards.

UK PMI producer input prices and supply delays

Unfortunately, other price pressures intensified during the month, notably in terms of rising staff costs and higher energy prices. Service sector cost inflation consequently hit a near-record high, offsetting the cooling of manufacturing input price pressures to leave the PMI's overall gauge of input costs at its second-highest ever level.

Input prices by sector

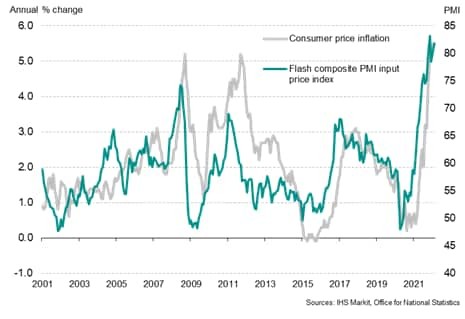

Persistent inflation

Such strong input price growth suggests no imminent cooling of consumer price inflation pressures, which are currently running at the highest for three decades.

UK inflation

Higher interest rates

With the PMI's gauge of output growth accelerating markedly in February and costs pressures intensifying to the second-highest on record, the odds of an increasingly aggressive policy tightening have shortened, with a third back-to-back rate rise looking increasingly inevitable in March. However, the indications of a growing plight for manufacturers will need to be watched, as will the service sector's new business index need to be monitored for signs of the demand revival losing steam. Given the rising cost of living, higher energy prices and increased uncertainty caused by the escalating crisis in Ukraine, downside risks to the demand outlook have risen.

Bank of England policy and the PMI

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-economic-resurgence-as-omicron-wave-ebbs-feb22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-economic-resurgence-as-omicron-wave-ebbs-feb22.html&text=UK+flash+PMI+signals+economic+resurgence+as+Omicron+wave+ebbs%2c+but+price+pressures+intensify+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-economic-resurgence-as-omicron-wave-ebbs-feb22.html","enabled":true},{"name":"email","url":"?subject=UK flash PMI signals economic resurgence as Omicron wave ebbs, but price pressures intensify | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-economic-resurgence-as-omicron-wave-ebbs-feb22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+flash+PMI+signals+economic+resurgence+as+Omicron+wave+ebbs%2c+but+price+pressures+intensify+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-economic-resurgence-as-omicron-wave-ebbs-feb22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}