Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 24, 2024

UK economy starts 2024 on stronger footing, but Red Sea shipping delays drive prices higher

UK business activity growth accelerated for a third straight month in January, according to early PMI survey data, marking a promising start to the year. The survey data point to the economy growing at a quarterly rate of 0.2% after a flat fourth quarter, therefore skirting recession and showing signs of renewed momentum.

Businesses have also become more optimistic about the year ahead, with confidence rebounding to its highest since last May. Business activity and confidence are being in part driven by hopes of faster economic growth in 2024, in turn linked to the prospect of falling inflation and commensurately lower interest rates.

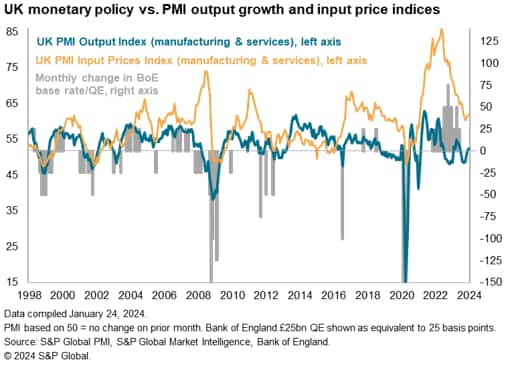

However, the surprising strength of growth in January, which has exceeded forecasts, may deter the Bank of England from cutting interest rates as soon as many are expecting, especially as supply disruptions in the Red Sea are reigniting inflation in the manufacturing sector. Supply delays have spiked higher as shipping is re-routed around the Cape of Good Hope, the longer journey times lifting factory costs at a time of still-elevated price pressures in the service sector. Inflation is therefore indicated to remain stubbornly higher in the 3-4% range in the near future.

Economy starts 2024 on stronger footing

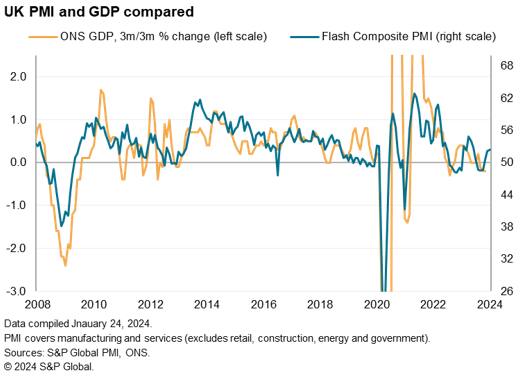

Early survey data point to a stronger than expected start to the year for the UK economy. The headline economic growth indicator from the flash PMI surveys, the seasonally adjusted S&P Global UK Composite Output Index, rose from 52.1 in December to 52.5 in January. Economists had anticipated a reading of 52.2.

The rise signals increased output for a third month running after three months of decline, boding well for the UK to avoid a recession. At its current level, the PMI is broadly indicative of GDP growing at a quarterly rate of 0.2% at the start of the year, according to historical comparisons, having signalled a largely stalled economy over the fourth quarter of 2023 and a 0.1% contraction in the third quarter.

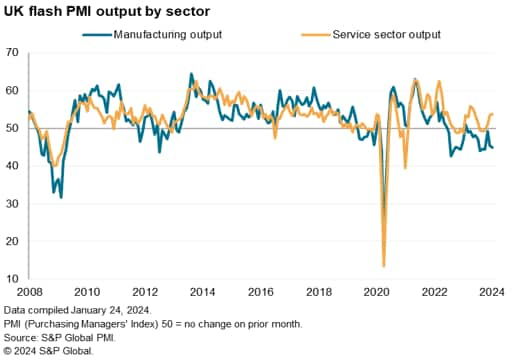

Trends varied markedly by sector, however, with service sector growth accelerating while manufacturing remained a worrying drag on the economy, enduring one of its toughest spells since the global financial crisis in terms of the depth and length of the current downturn.

Resurgent service sector

Service sector growth accelerated slightly in January to reach the fastest since last May. The index of business activity in the services sector in fact rose from 53.4 in December to 53.8, indicating a third month of accelerating growth. New business growth also picked up, rising for a third straight month and also posting the largest rise since last May. Exports of services also improved, rising at a rate not seen since last July, albeit expanding at a slower pace than domestic demand.

Within the service sector, the strongest gains were seen in the hospitality, transport, tech and financial services sectors, the latter buoyed by market pricing of lower interest rates in 2024. Business services growth also picked up, albeit remaining relatively subdued.

Manufacturing downturn deepens

Manufacturing output meanwhile contracted for the eighteenth time in the past 19 months, the rate of decline hitting the fastest since October and broadly consistent with factory production falling at a steep quarterly rate in excess of 2%. New orders for goods likewise declined at an increased (and marked) rate, partly due to falling exports. Manufacturers commonly cited weak demand both at home and abroad, linked in part to a broad-based focus on cost reduction and inventory readjustment, as well as the ongoing squeeze on households from the increased cost of living.

Supply delays - and prices - spike higher amid Red Sea shipping delays

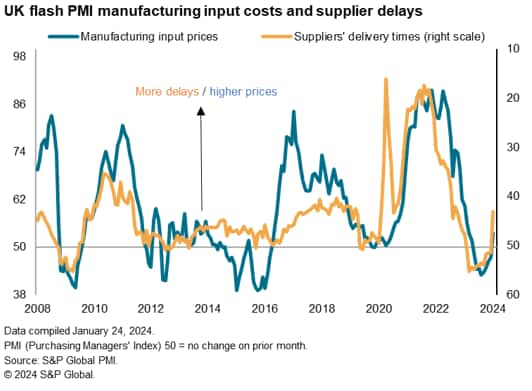

Manufacturing also reported growing issues with supply chains, amid intensifying disruptions to shipping in the Red Sea. Average supplier delivery times lengthened in January to the greatest extent seen since the pandemic-related supply issues of September 2022.

Some 80% of firms reporting slower deliveries explicitly linked the delays to events in the Red Sea, where attacks by Houthi rebels have led increasing numbers of shipping companies to transport goods from Asia to Europe via the Cape of Good Hope rather than the Suez Canal. This extended journey typically lengthens the delivery route by at least 10 days. Delays were most widely reported for textiles and vehicle manufacturing.

Following the adage that "time is money", the lengthening of supplier lead times was accompanied by a rise in manufacturers' input costs for the first time in nine months. January's input price rise was the largest since March of last year. These higher costs were passed on to customers, resulting in the joint-quickest rise in prices charged for goods since last May.

Stubborn inflation persists

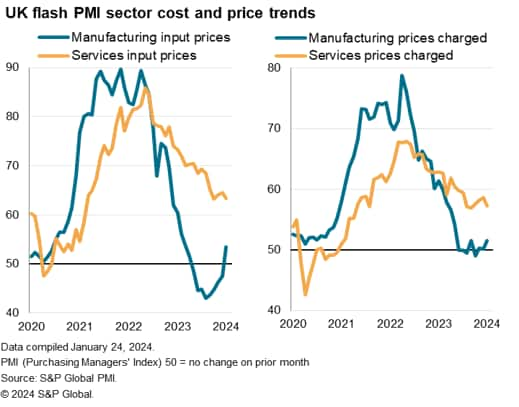

Although the extents to which supplies were delayed and costs rose in January remain far below the peaks seen during the pandemic, the re-acceleration of manufacturing input cost and selling price inflation comes at a time of still-elevated service sector inflation.

Although service sector cost growth eased slightly in January, down to the second-lowest in almost three years, the rate of increase remained well above the pre-pandemic average. Average selling prices for services likewise remained well above the pre-pandemic average as a result.

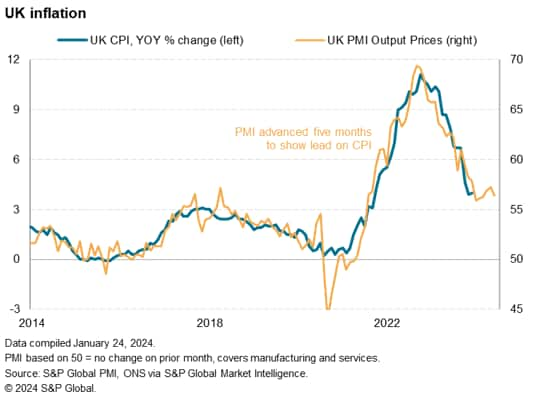

While the cooling of service sector inflation helped offset the renewed acceleration of manufacturing cost inflation, the weighted average price increase of the two sectors remained well above pre-pandemic levels in January, broadly indicative of consumer price inflation running at an annual rate of 3-4%.

There is also scope for the manufacturing supply chain situation to worsen further in the near term. S&P Global Market Intelligence risk experts cite how "The scale of the ongoing military response … is unlikely to deter the Houthi, or remove their capability to mount further attacks against international shipping and naval forces in the Red Sea". Furthermore, resultant changes to shipping schedules due to the longer route around the Cape are also expected to cause port congestion and issues with container availability.

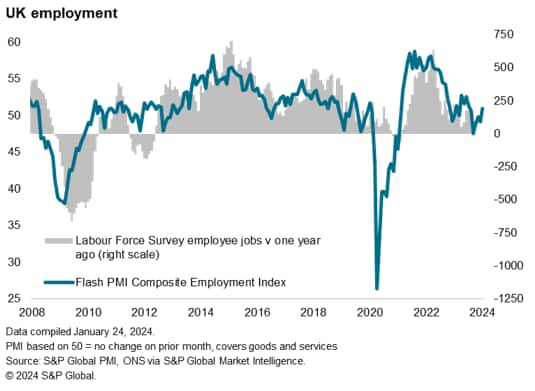

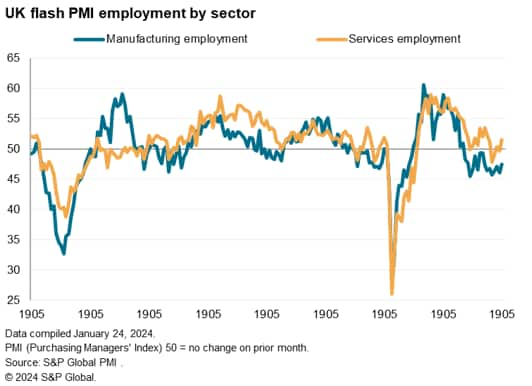

With the Bank of England citing elevated service sector price inflation as a key concern in relation to the stubbornness of consumer price inflation above its 2% target, the cooling of service sector inflation will provide some welcome news to policymakers. However, improved employment growth in January, with the flash PMI signalling the largest jobs gain for six months, will fuel worries that the tight labour market remains a source of elevated price pressures.

Improved outlook

Hiring picked up in January, notably in the service sector, amid improved growth expectations for the year ahead. Business confidence about the 12-month outlook rose to the highest since last May, also rising above the pre-pandemic average for the first time since May.

A concern is that this improved confidence is in part a reflection of companies anticipating lower inflation in the coming months, allowing looser monetary policy and faster economic growth. Any set back to this conjecture could of course puncture this mood.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-starts-2024-on-stronger-footing-but-red-sea-shipping-delays-drive-prices-higher-Jan24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-starts-2024-on-stronger-footing-but-red-sea-shipping-delays-drive-prices-higher-Jan24.html&text=UK+economy+starts+2024+on+stronger+footing%2c+but+Red+Sea+shipping+delays+drive+prices+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-starts-2024-on-stronger-footing-but-red-sea-shipping-delays-drive-prices-higher-Jan24.html","enabled":true},{"name":"email","url":"?subject=UK economy starts 2024 on stronger footing, but Red Sea shipping delays drive prices higher | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-starts-2024-on-stronger-footing-but-red-sea-shipping-delays-drive-prices-higher-Jan24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+economy+starts+2024+on+stronger+footing%2c+but+Red+Sea+shipping+delays+drive+prices+higher+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-starts-2024-on-stronger-footing-but-red-sea-shipping-delays-drive-prices-higher-Jan24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}