Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 26, 2018

UK economy enjoys robust end to an otherwise weak 2017, in line with PMI

- GDP rises 0.5% in fourth quarter

- 2017 growth comes in at 1.8%, weakest since 2012

- Services and manufacturing growth contrast with construction downturn

- PMI hints at weaker start to 2018

The UK economy enjoyed further resilient growth in the closing quarter of 2017, though the upturn failed to prevent the country avoiding the worst annual performance for five years.

Solid end to a weak 2017

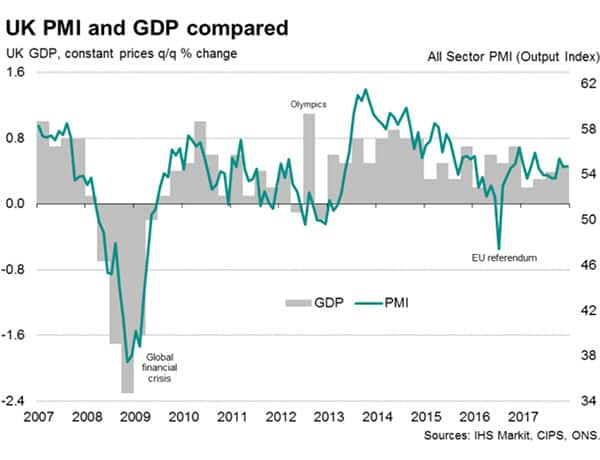

Gross domestic product rose 0.5% in the three months to December, up from 0.4% in the third quarter, according to the Office for National Statistics. The upturn means the economy grew 1.8% in 2017 as a whole, down from 1.9% in 2016. That was the weakest expansion since 2012 and contrasted with faster growth in many of the world’s other economies, notably the eurozone and the United States.

Global GDP is likely to have grown 3.1% in 2017, up from 2.4% in 2016, with the rate of expansion in advanced economies accelerating from 1.6% to 2.3%.

Compared to a year ago, UK GDP was up just 1.5% in the fourth quarter, which was the smallest annual increase since the start of 2013.

The fourth quarter rate of expansion was consistent with recent PMI survey evidence, which had signalled growth of 0.4-0.5% (a regression-based PMI model in fact pointed to 0.45%). While the GDP data at this stage are only based on a small amount of information from December, the surveys suggest solid growth momentum was sustained through to the end, with the December PMI registering similar growth to November.

Mixed sector trends

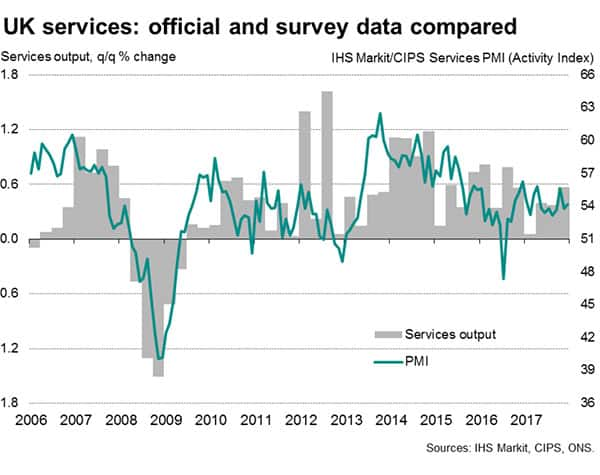

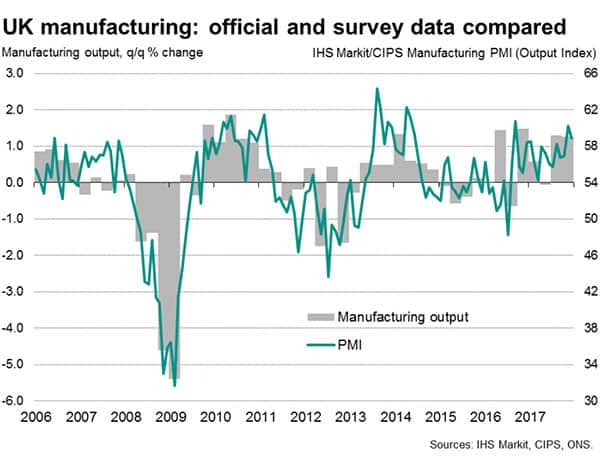

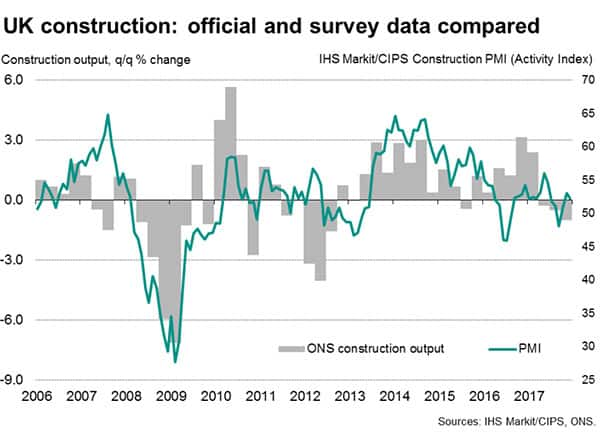

The official data also confirmed the survey signals of growth being driven by manufacturing and services, while the construction sector struggled.

The service sector grew by 0.6% in the three months to December, up from 0.4% in the third quarter. But industrial production growth slowed from 1.3% to 0.6% and the construction sector contracted by 1.0%, the latter representing a deepening of the building sector’s current recession. The industrial slowdown was due to a production fall in the energy sector; manufacturing output rose 1.3%, unchanged on the third quarter’s expansion.

Outlook risks

However, weaker growth of order books, decade high price pressures, subdued future optimism and a slowdown in hiring all underscored downside risks to the near-term outlook, according to the PMI surveys.

Looking ahead, the twin concerns are the degree to which higher prices and falling real pay will continue to erode consumer spending power, and the extent to which Brexit uncertainty is holding back business investment (and potentially hiring too). The recent strengthening of the pound could also start to have an adverse effect on exports, which had been a main driver of a revived manufacturing sector in 2017.

The economy is therefore likely to lose a little pace in 2018, with the consensus for growth running at 1.4%. In contrast, global economic growth is widely expected to accelerate slightly in 2018, suggesting the UK will once again underperform.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-enjoys-robust-end-to-otherwise-weak-2017-in-line-with-pmi.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-enjoys-robust-end-to-otherwise-weak-2017-in-line-with-pmi.html&text=UK+economy+enjoys+robust+end+to+an+otherwise+weak+2017%2c+in+line+with+PMI","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-enjoys-robust-end-to-otherwise-weak-2017-in-line-with-pmi.html","enabled":true},{"name":"email","url":"?subject=UK economy enjoys robust end to an otherwise weak 2017, in line with PMI&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-enjoys-robust-end-to-otherwise-weak-2017-in-line-with-pmi.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+economy+enjoys+robust+end+to+an+otherwise+weak+2017%2c+in+line+with+PMI http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-enjoys-robust-end-to-otherwise-weak-2017-in-line-with-pmi.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}