Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 02, 2024

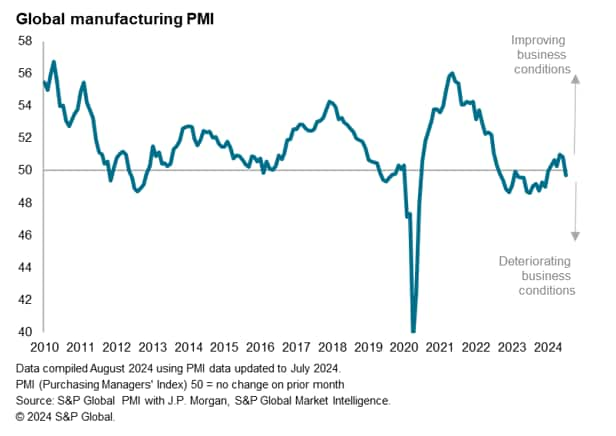

At 49.7, down from 50.8 in June, the Global Manufacturing PMI, sponsored by J.P.Morgan and compiled by S&P Global Market Intelligence, signalled a deterioration of business conditions for the first time in seven months in July.

The deterioration points to a worrying halting of the manufacturing recovery seen in the first half of the year, which had seen the sector's best performance for two years.

The PMI is a composite index derived from five survey 'sub-indices'. Here are our top five takeaways from some of these sub-indices, which provides a deeper insight into the current manufacturing trends relating to output, demand, inventories, supply chains, employment and prices.

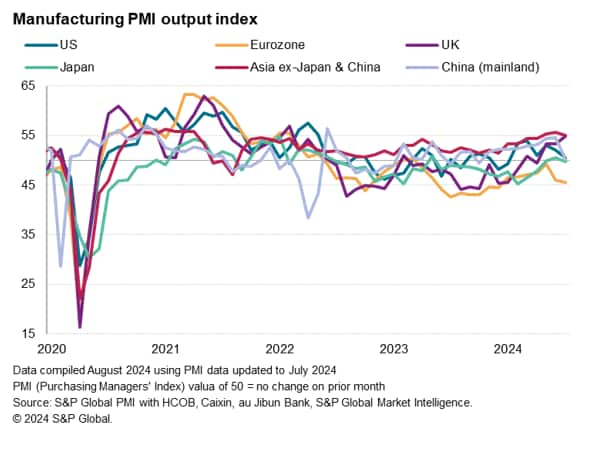

The PMI survey's sub-index of production, which tracks actual month-on-month factory output changes, signaled a near-stalling of production in July. The near-stagnation marks a strong contrast to the robust gains seen in the prior two months, which had been among the strongest performances recorded over the past three years.

The survey data exhibit a correlation of 75% with the official annual rate of change in global production, with the survey data acting with a three-month lead. Using a simple regression-based model, the latest PMI data indicate that manufacturing output has stalled in July after having been growing worldwide at a relatively robust annual rate of approximately 2% during the second quarter.

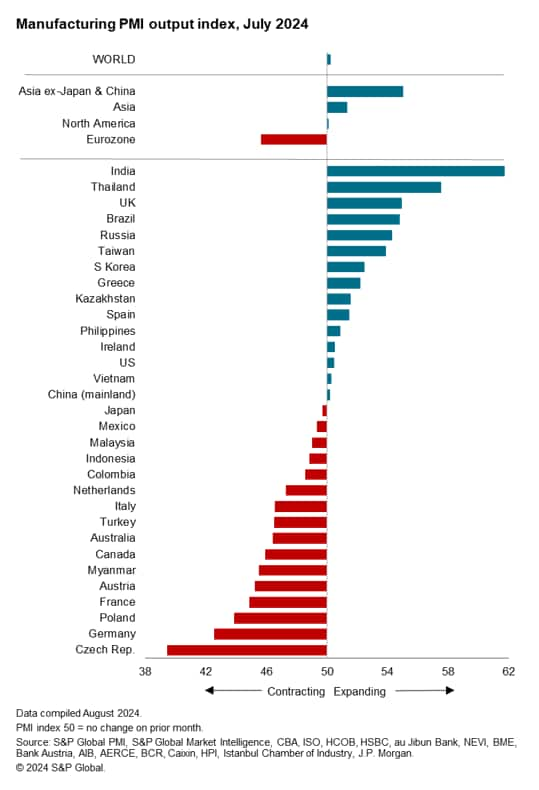

In total, 16 of the 31 economies for which manufacturing S&P Global's PMIs are available reported falling output in July, which is the highest proportion for six months.

By region, the greatest resilient was seen in Asia excluding mainland China and Japan, with China reporting only a marginal expansion of output and Japan reporting a marginal decline. The fastest factory expansion globally was again recorded in India, followed by Thailand.

Barely any growth was meanwhile recorded in North America, signalling the weakest performance for six months, as a modest expansion of output in the US (a six-month low) was offset by falling production in Mexico and Canada.

However, the worst performing region was again Europe, and specifically the eurozone. Manufacturing output falls in Germany, France and Italy dragged output in the eurozone lower at a rate not seen for seven months, meaning the single currency area has now reported falling output continually over the past 16 months. Weakness in the eurozone also spread to neighbouring countries such as Poland the Czech Republic, the latter reporting the steepest decline of all 31 economies monitored by the PMIs.

However, not all of European manufacturing is struggling: the UK reported its strongest expansion for 29 months in July to sit third place in the global output rankings. It has also seen the strongest improvement in performance of all countries so far this year. Spain, Greece and Ireland also reported higher output in July.

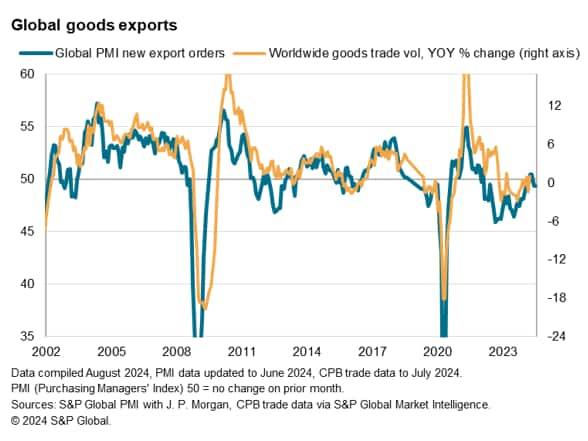

Global output growth was subdued by new orders for goods falling in July for the first time since January. The reduced inflow of new work was in part fueled by the second successive monthly decline in worldwide new export orders.

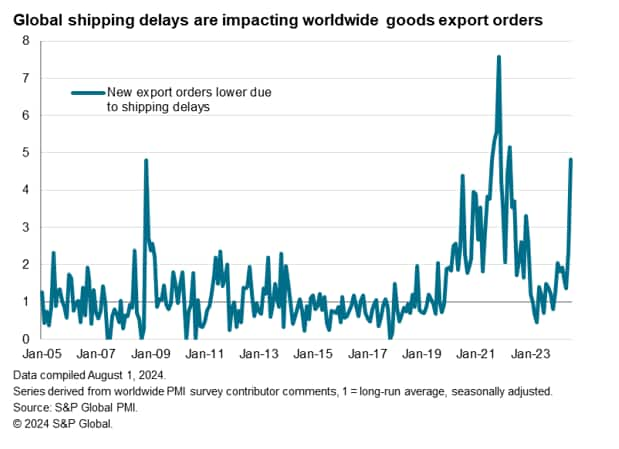

Exports were hit in part by trade disruptions emanating from shipping delays, often linked to the diversion of ships from the Red Sea. The number of manufacturers reporting that new export orders fell in July due to shipping delays has risen to nearly five times the long-run average. This is below the brief peak of just over 7.5 times the long run average seen at the height of the pandemic, but is clearly very elevated by historical standards to indicate that shipping delays are having had an increasingly detrimental impact on global trade and economic growth at the start of the third quarter. Click here for more detailed analysis on shipping.

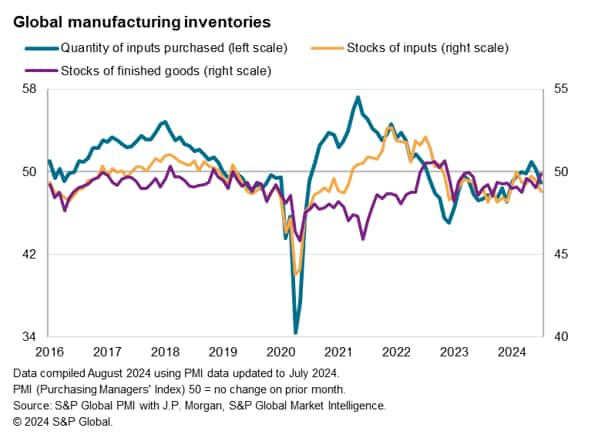

The PMI surveys track two measures of inventories, both of which added to the gloomier picture for the goods-producing sector in July.

First, inventories of purchased inputs fell at the fastest rate for seven months linked to reduced buying of inputs, in turn due to a combination of falling demand and shipping constraints.

Second, inventories of finished goods fell at the slowest rate for 15 months in part due to weaker than anticipated sales causing inventories to rise in some companies.

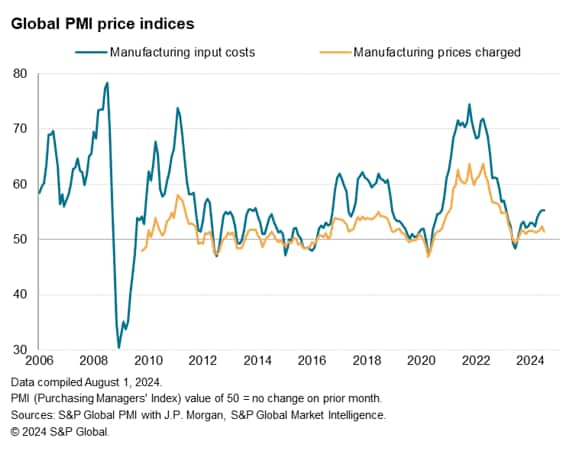

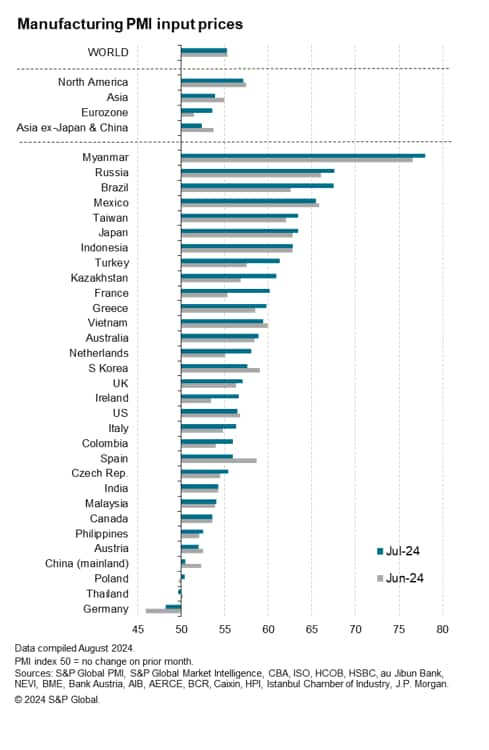

While higher shipping rates contributed to higher production costs in July, the downturn in demand and accompanying pull-back in input buying took some pressure off supply chain prices. Measured overall, worldwide factory input cost inflation consequently slowed only marginally from June' s 16-month high, though remained slightly below the pre-pandemic decade average.

In the case of selling prices, manufacturing selling price inflation fell back to a four-month low in July, having risen to a 15-month high in June.

The drop in selling price inflation largely reflecting reduced pricing power amid weakened demand, limiting scope for factories to pass higher costs on to customers. However, the evolution of manufacturing costs will need to be monitored carefully over the coming months in relation to the longer-term inflation outlook.

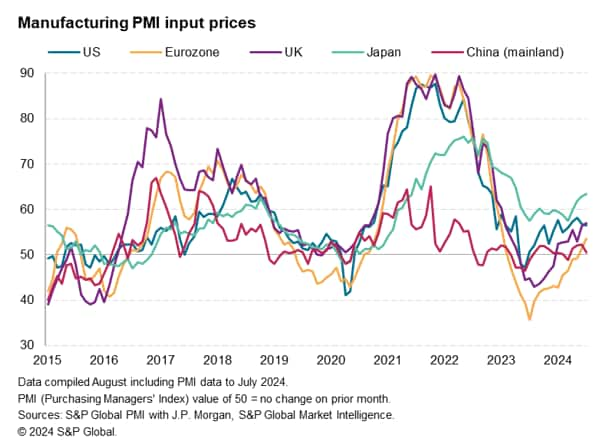

Of the major developed economies, the steepest rate of input cost inflation was again seen in Japan during July, where upward pressure on prices hit a 15-month high (exacerbated by the impact of the yen's weakness via higher import costs), followed by France, where the rate of increase was the highest since January 2023. The rate of increase across the eurozone as a whole also reached the highest since January 2023, as did the rate of inflation in the UK. In contrast, prices fell in Germany.

Input cost inflation in the US meanwhile remained close to its pre-pandemic 10-year average but moderated slightly, notably allowing selling price inflation to ease to register barley any increase.

Looking at the emerging markets, prices barely rose in mainland China (a four-month low), with only Thailand ranking lower as its costs fell slightly. Especially steep rises were meanwhile seen in Myanmar, Russia, Brazil (a two-year high), Mexico and Taiwan (a 25-month high).

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.