Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 03, 2024

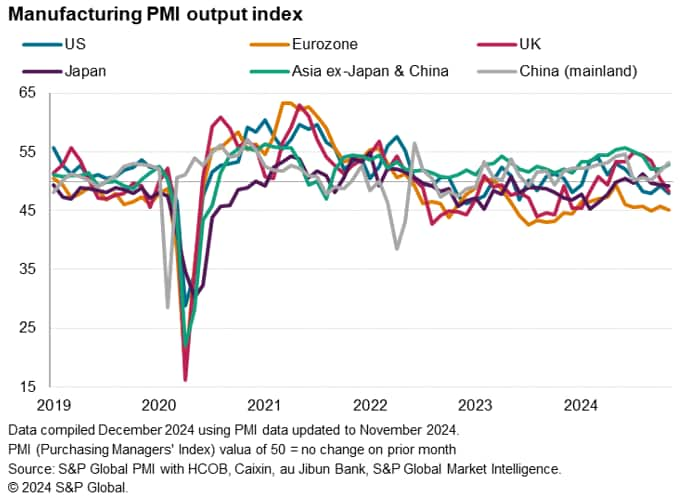

The global manufacturing sector stabilised in November after four months of modest declines. At 50.0, up from 49.4 in October, the Global Manufacturing PMI, sponsored by J.P. Morgan and compiled by S&P Global Market Intelligence, signalled no change in operating conditions, albeit with marked regional variations, in part linked to changing behaviours in response to the threat of US tariffs.

Improved business conditions in mainland China (with a five-month high PMI reading of 51.5) and the rest of Asia (where the PMI rose to 51.1) contrasted with a deepening downturn in the Eurozone (whose PMI sank to 45.2), though conditions came close to stabilising in the United States (PMI at a five-month high of 49.7).

Here are our top five takeaways from November's manufacturing PMI surveys sub-indices, which provide a deeper insight into manufacturing business conditions by analysing varying trends of output, demand, inventories, supply chains, employment and prices.

The PMI survey's sub-index of production, which tracks actual month-on-month changes in factory output, reached a five-month high in November, signaling a second monthly marginal rise in production volumes after output had fallen in September.

The survey data exhibit a correlation of 75% with the official annual rate of change in global production, with the survey data acting with a three-month lead. Using a simple regression-based model, the latest PMI data indicated that worldwide manufacturing output has risen marginally so far in the fourth quarter after a flat picture over the third quarter as a whole.

However, marked variations in production trends around the world persisted into November, characterised by faster output growth in Asia offset by falling production in Europe and North America.

In total, output rose in 16 of the 32 individual economies for which PMI data are available but fell in the remaining 16. India continued to report the strongest expansion of production by a wide margin. However, among the major economies, especially robust expansions were also reported in the Philippines, Spain, mainland China, Brazil, Canada and Taiwan. Of these, growth rates accelerated in all bar Spain and Brazil. Canada's production growth notably hit a two-and-a-half year high while a five-month high was seen in mainland China.

At the other end of the scale, the four steepest rates of decline were all seen among eurozone member states, led by France, Germany, Italy and Austria, with neighboring Czech Republic reporting the fifth-fastest decline. EU-neighboring Turkey reported the sixth-steepest fall, followed by the Netherlands, another eurozone member state.

The eurozone as a whole consequently once again recorded the sharpest contraction of production on a regional basis, followed by North America, where Canada's production gain was offset by declines in the US and Mexico. In contrast, growth in Asia accelerated to a five-month high, albeit curbed by modest falls in output in Japan, South Korea and Malaysia.

One other notable substantial change seen in November was the first fall in output for seven months in the UK, where the production decline was the sharpest since February.

Global manufacturing new orders rose marginally, buoyed by rising domestic demand and a moderating rate of decline in global trade flows. New export orders fell for a sixth straight month in November, but at the slowest rate seen over the past four months.

The PMI data point to global trade volumes falling 2% in year-on-year terms so far in the fourth quarter of 2024.

Among the major economies, an especially marked export decline in the eurozone was accompanied by steepening trade losses in the US but with moderating declines recorded in Japan and the UK. Exports from mainland China meanwhile rose at the fastest rate for seven months, contrasting with declines seen in the prior three months, and the rest of Asia also saw its first export gain since July.

Export gains were in fact limited to just eight countries, led by India with Spain notably following close behind in second place to buck the broader trade malaise reported out of the eurozone. Strong export gains were also seen in Taiwan and South Korea, as well as Russia. Mainland China's export improvement lifted it to sixth place in the rankings.

The bottom of the export rankings was dominated by European economies, with France reporting the sharpest decline.

Global goods exports have now fallen almost continually since early 2022 amid the post-pandemic shift in demand from goods to services and a sustained trend toward inventory reduction. The amount of inputs purchased by manufacturers has likewise fallen almost continually since mid-2022, but rose marginally for the first time in five months.

Two key developments in purchasing behaviour were evident in November. First, factories in mainland China reported the largest rise in purchases for four years. Only India and Kazakhstan reported a greater rise in purchases than China in November. However, among the major economies, the biggest positive change in purchasing activity was seen in the US, where the rate of decline moderated sharply.

These changes in purchasing behaviour could be in part linked to the threat of US tariffs, notably in relation to exports from China. One-in-four US manufacturers reporting higher purchases attributed this buying to front-running tariffs on imported inputs.

Higher purchases in mainland China were meanwhile likewise often linked to the ramping up of production and exports amid customer stockpiling in advance of tariffs, though increased domestic stimulus measures form the authorities in China were also seen as having boosted near-term production.

The ratio of US input buying to current production rose to the highest seen since the 2018 tariffs barring pandemic-related stockpiling.

However, while in part due to the front-running of tariffs, this increase in buying also reflected growing optimism about US production in the year ahead, for which expectations rose in November to the highest for over two and a half years, pushing US manufacturing optimism above that of all other major economies.

However, future expectations also improved in most other major economies bar the UK, the latter having seen sentiment subdued by tax-hiking budgetary changes, often attributed to the prospects of lower interest rates and a moderation of the cost of living crisis that has affected many economies. In mainland China, sentiment hit an eight-month high buoyed also by domestic stimulus. Measured globally, future optimism hit a six-month high in December.

Access the latest release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings