Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 06, 2018

Tariff threats weigh on sentiment

Research Signals - June 2018

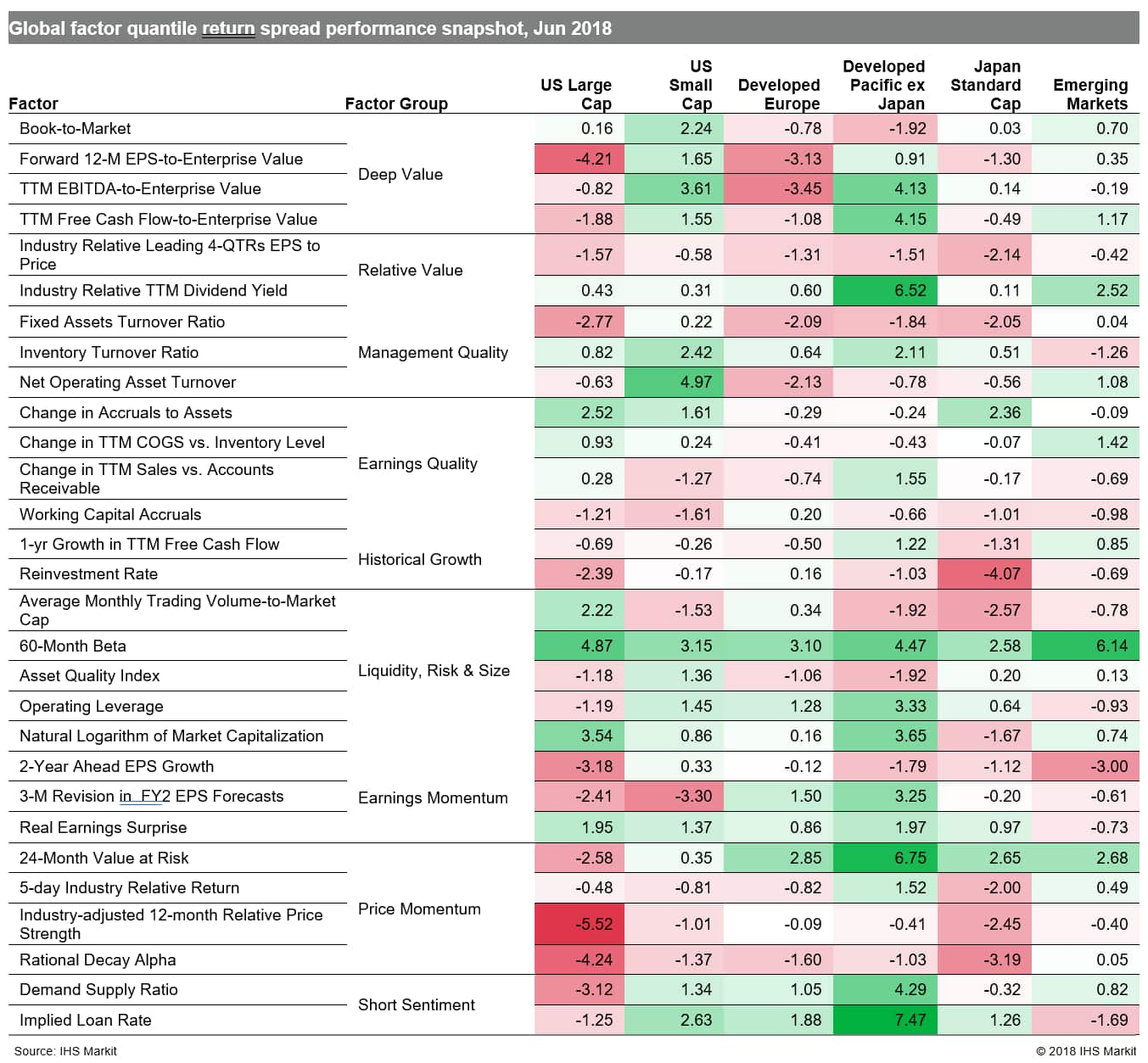

Relative to most global equity markets, US investors maintained a more positive outlook as earnings have held up amid trade tensions. However, US stocks have not been able to support sentiment globally, confirmed by the key role of low risk strategies across markets (Table 1). Volatile markets in the second quarter reflected investors' concerns of whether trade wars will weigh on growth, at the same time as global manufacturing slipped to an 11-month low in June according to the J.P. Morgan Global Manufacturing PMI™.

- US: Price Momentum measures such as Industry-adjusted 12-month Relative Price Strength suffered, along with Demand Supply Ratio particularly among large caps, as the most shorted names outperformed for a third consecutive month

- Developed Europe: While investors punished high risk names for a second month, they did not turn to the safe haven of undervalued names as the most attractively valued name ranked by TTM EBITDA-to-Enterprise Value underperformed by an increasing margin over the period

- Developed Pacific: High risk names captured by 24-Month Value at Risk were a weak performing group, as were the most expensive to borrow names in the securities lending market as gauged by Implied Loan Rate, especially in markets outside of Japan

- Emerging markets: Low beta names outperformed high beta across the full spectrum of 60-Month Beta quintile groups, suggesting a systematic trade across this factor

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftariff-threats-weigh-on-sentiment.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftariff-threats-weigh-on-sentiment.html&text=Tariff+threats+weigh+on+sentiment+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftariff-threats-weigh-on-sentiment.html","enabled":true},{"name":"email","url":"?subject=Tariff threats weigh on sentiment | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftariff-threats-weigh-on-sentiment.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Tariff+threats+weigh+on+sentiment+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftariff-threats-weigh-on-sentiment.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}