Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 10, 2018

EU equity lending revenue improves 19% in first half of 2018

- Germany leads on increasing specials demand

- French equity revenue improves after challenging Q1

- Increasing revenue primarily driven by higher balances

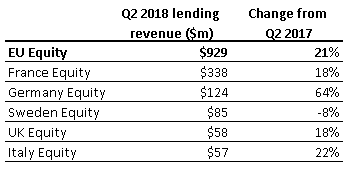

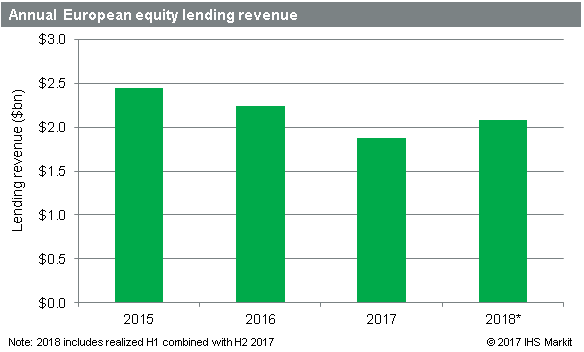

European equity lending revenue was just over $1.3bn in the first half of 2018. That was an improvement of 19% compared with the first half of 2017. After outperforming in Q1, EU equity lending revenues managed a 21% improvement for Q2 relative to 2017. Germany led the way, improving on both balances and fees to deliver $124m in Q2 revenue. Revenues for French equities also improved in Q2, relative to 2017, after lagging in Q1. Revenues in the Nordic countries were up 9%, primarily driven by improvement in Finland, while Sweden posted the only declining revenue in the top five markets.

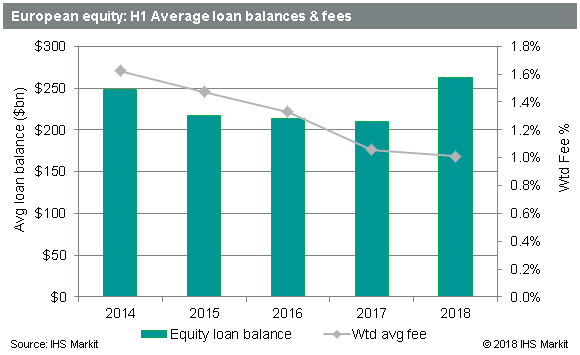

The increasing revenue is primarily the result of increasing loan balances, which registered a Q2 average just below $300bn across the region. The largest contributors to the increase were UK, France, Germany and the Netherlands. Some good news for beneficial owners is that the increase in their loan balances outpaced the 18% increase in lendable inventory, causing EU equity utilization to increase for the 2nd consecutive quarter. The increasing borrow demand pushed the average balances for the first half of 2018 above $250bn, the highest level for the first six months of a year since 2011.

While increasing balances drove the majority of improved revenue, and in fact overall average fees fell slightly for EU equities, there were some notable exceptions. Average fees improved by 35% in Germany and 12% in the Netherlands. Even more impressively, the average lending fee for equities in Greece doubled, to a 10% average annualized fee.

If EU equity lending revenues only match 2017 in the 2nd half of 2018, the overall revenue for the year will only be 7% below 2016, a remarkable comeback after some challenging times at the end of 2016 and early 2017. With increasing borrow balances outstripping lendable supply growth, and the potential for global macro pressures to drive increased hedging activity, the last half of 2018 could make this a very strong year indeed for European equity lending revenues.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feu-equity-lending-revenue-improves-19-in-first-half-of-2018.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feu-equity-lending-revenue-improves-19-in-first-half-of-2018.html&text=EU+equity+lending+revenue+improves+19%25+in+first+half+of+2018+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feu-equity-lending-revenue-improves-19-in-first-half-of-2018.html","enabled":true},{"name":"email","url":"?subject=EU equity lending revenue improves 19% in first half of 2018 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feu-equity-lending-revenue-improves-19-in-first-half-of-2018.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=EU+equity+lending+revenue+improves+19%25+in+first+half+of+2018+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feu-equity-lending-revenue-improves-19-in-first-half-of-2018.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}