Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 22, 2018

Taiwan’s strong export orders point to further upturn in trade

- Export orders rise 17.5% in December, strongest since February 2017

- Faster growth confirms earlier PMI survey data

- Persistent supply bottlenecks could weigh on future production

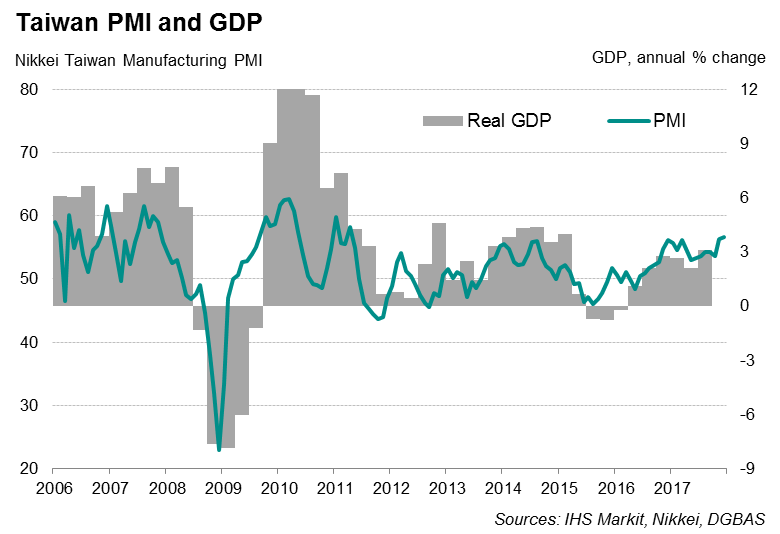

There was plenty of year-end cheer for Taiwanese exporters as foreign orders surged in December, according to the latest official data. For 2017 as a whole, exports rose 13.2% year-on-year, which marked the strongest growth rate since 2010.

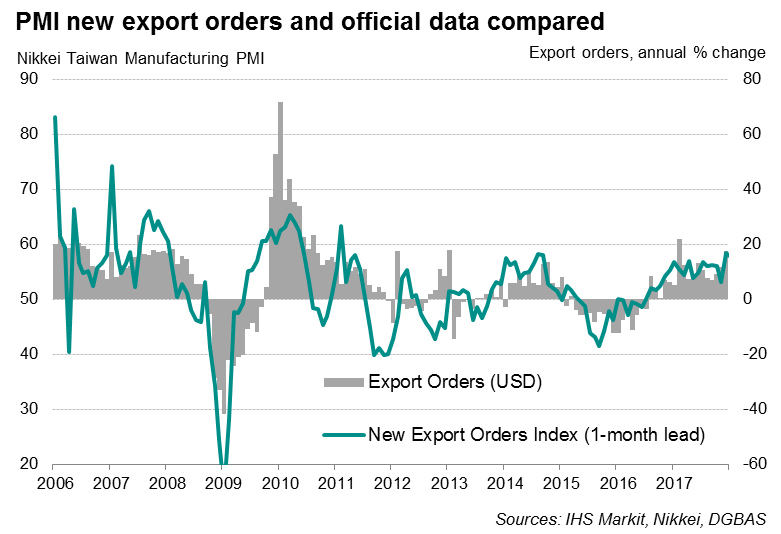

While the headline number exceeded analysts’ expectations, the sharper acceleration had been signalled ahead by the Nikkei Taiwan Manufacturing PMI survey.

EU recovery drives manufacturing

Data from the Ministry of Economic Affairs showed export orders rising 17.5% in December, up from 11.6% in November, representing the strongest annual rate of increase since February. For the year as a whole, export orders were up 13.2% in 2017, to indicate the quickest pace of expansion for seven years.

The latest export orders data reflected stronger external demand, especially from the US, Europe and Japan, which have been seeing robust economic growth rates in recent months. Sales to the US, Europe and Japan rose at double-digit rates, with the rate of increase from Europe accelerating to the highest since the summer of 2010. PMI surveys for the eurozone and Japan suggest that growth momentum will have remained strong at the start of the year, which bodes well for demand of Taiwanese exports.

Booming electronics demand

The main driver of the manufacturing upturn remained the buoyant demand for electronics, which would be welcome news for regional countries such as Korea, Singapore and Malaysia where electronics are a dominant export sector.

IHS Markit's detailed sector PMI data showed tech manufacturing being the fastest growing sector globally in 2017.

Supply shortages could bite

The official data add to the positive outlook for Taiwan’s trade at the start of 2018, as indicated by the December PMI surveys. Total new orders placed with Taiwanese manufacturers, including new export sales, continued to rise at a solid pace in December. At the same time, output expanded at the fastest pace in nine months as a result of the improvement in demand.

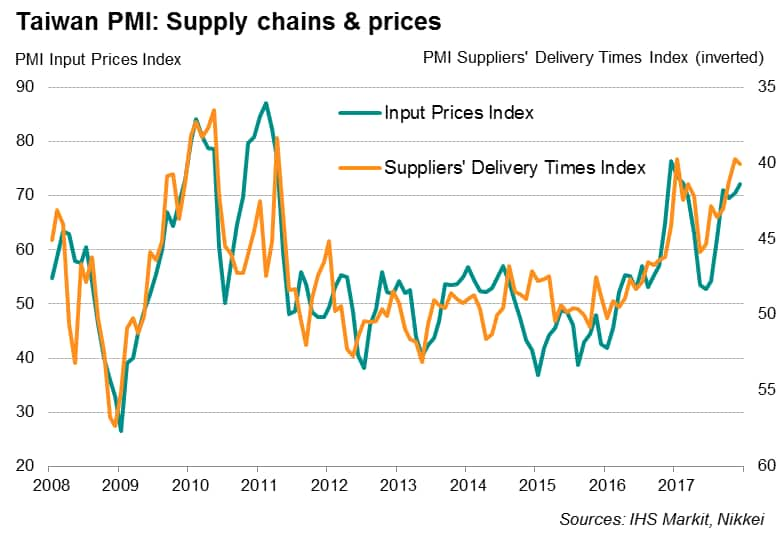

Anticipating greater production requirements, Taiwanese manufacturers continued to build-up inventories of inputs, which ought to keep production humming at current high levels in January. However, stretched supply chains could see firms finding it increasingly difficult to source inputs. There was survey evidence of stock shortages at vendors resulting in delivery delays, which could weigh on production in the future.

Moreover, vendors were increasingly granted greater pricing power as demand continued to exceed supply at the end of 2017. Input price inflation remained elevated, with December’s rate of increase the highest since February. With the rise in selling prices considerably lower than costs, factories are facing downward pressure on profit margins.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftaiwans-strong-export-orders-point-to-further-upturn-in-trade.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftaiwans-strong-export-orders-point-to-further-upturn-in-trade.html&text=Taiwan%e2%80%99s+strong+export+orders+point+to+further+upturn+in+trade","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftaiwans-strong-export-orders-point-to-further-upturn-in-trade.html","enabled":true},{"name":"email","url":"?subject=Taiwan’s strong export orders point to further upturn in trade&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftaiwans-strong-export-orders-point-to-further-upturn-in-trade.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Taiwan%e2%80%99s+strong+export+orders+point+to+further+upturn+in+trade http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftaiwans-strong-export-orders-point-to-further-upturn-in-trade.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}