Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 17, 2022

Strength in official manufacturing data not set to last

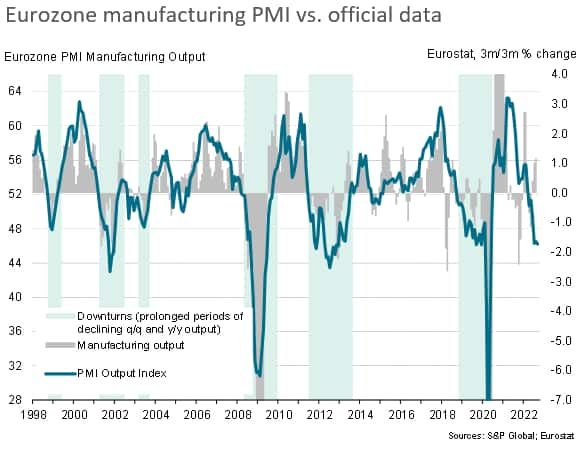

Ahead of next week's flash eurozone PMI release, we review the survey findings and the official data after a marked divergence has become apparent. We find that, based on the reliable signalling power accrued by the PMI over the past 25 years, the recent upturn in official manufacturing data will soon reverse to confirm that the goods-producing sector has entered a steep downturn.

Data divergence

The latest publication of official data from Eurostat showed manufacturing output rising 1.7% in August, almost entirely reversing a 1.8% decline in July. The improvement pushed the three-month-on-three-month growth rate up to 1.2%, its highest since February, and the annual rate of increase jumped to 3.4%, its highest since September of last year.

In contrast, the S&P Global Output Index from the manufacturing PMI survey recorded just 46.5 in August, signalling a steep manufacturing contraction after a similar decline in July. The more recent September index reading of 46.3 points to an even steeper rate of contraction, broadly indicative of output falling at a three-month-on-three-month rate of 1.5%.

The official data are therefore indicating a manufacturing sector that has regained growth momentum whereas the PMI survey points to an increasingly severe looking downturn.

Digging deeper into the official data, there has been a great deal of volatility in the numbers in recent months, and the latest improvement can be at least partly traced to strong variations in growth trends in Ireland, which reported a 16.6% surge in production in August after a 20.6% decline in July.

The PMI has meanwhile been considerably less volatile than the official data, depicting a largely continual slowdown in growth throughout the year to March, after which the PMI has been signalling falling output on a three-month-to-three-month basis according to our regression-based model.

Consistent signalling from the PMI

The upcoming data flow will therefore be important to watch in order to assess the health of the eurozone manufacturing sector. One metric to bear in mind, however, is that - over the 25 years of PMI survey history - whenever the PMI has fallen below 50, the official data have always subsequently signalled a period of sustained manufacturing contraction. On no occasions have the PMI data sent a false signal of impending, prolonged manufacturing decline.

While there have been times when official data have briefly fallen into decline when the PMI has been above 50, on all such occasions the official data have swiftly rebounded into growth territory to correct the downturn signal.

Only in 2021 was there a period when the official data signalled a prolonged manufacturing decline while the PMI was not below 50, but this largely reflected technical factors (base effects) relating to factory lockdowns and the pandemic.

We therefore expect the official data to weaken again in the coming months, in line with the consistent signalling power of the PMI that has been observed over the last quarter century. Further information on the scale and duration of this downturn will be provided by the October flash PMI data, published 24th October.

PMI more accurate than EC survey data

It is worth pointing out that the European Commission survey has also been signalling a stronger manufacturing performance than the PMI survey, though it should also be noted that this survey appears to have been overstating growth for much of the past 4-5 years when historical comparisons are made against official data.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrength-in-official-manufacturing-data-not-set-to-last-October2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrength-in-official-manufacturing-data-not-set-to-last-October2022.html&text=Strength+in+official+manufacturing+data+not+set+to+last+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrength-in-official-manufacturing-data-not-set-to-last-October2022.html","enabled":true},{"name":"email","url":"?subject=Strength in official manufacturing data not set to last | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrength-in-official-manufacturing-data-not-set-to-last-October2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Strength+in+official+manufacturing+data+not+set+to+last+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstrength-in-official-manufacturing-data-not-set-to-last-October2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}