Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 14, 2018

South Korean exporters face headwinds amid slowing global growth

- Global manufacturing growth down to 21-month low in August

- Export climate holding up well but risks skewed to the downside

- Weaker expansion in global goods-producing sector has strong implications for South Korean exporters

August PMI data signalled the weakest rate of improvement in global manufacturing business conditions for almost two years. The headline J.P. Morgan Global Manufacturing PMI fell to 52.5 from 52.8 in July, indicating only a moderate rate of growth. Notably, the survey highlighted a softening of global demand pressures, with exporters continuing to report anaemic growth in their sales.

With global output increasing at a slower pace, countries with a heavy reliance on foreign demand - such as South Korea - look particularly vulnerable if this trend persists.

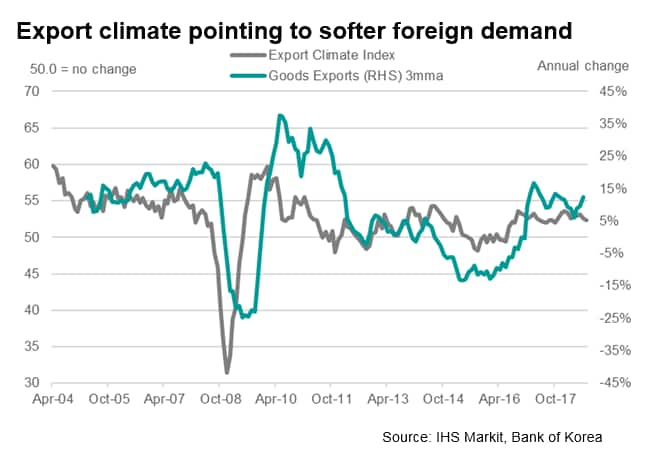

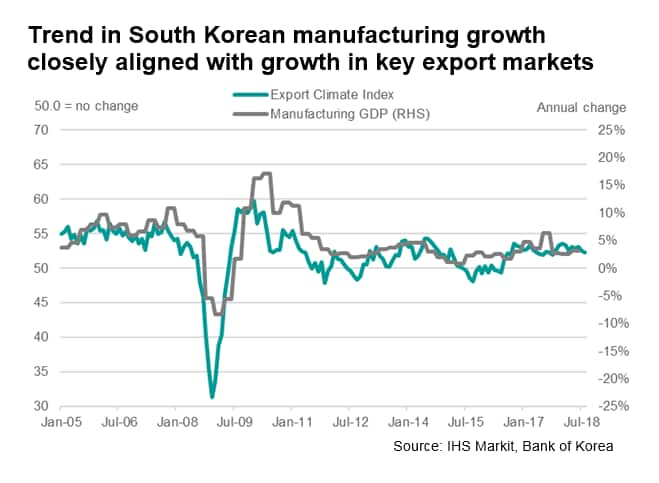

The South Korean PMI Export Climate Index - calculated by aggregating trade-weighted output PMI data for countries which buy South Korean goods - declined for a second successive month in August, dropping to its lowest since last October. This indicates that output growth among South Korea's key manufacturing export markets has weakened, in turn hinting that weaker economic growth will translate into softer demand for South Korean exports.

On one hand, despite easing in August, the Export Climate Index remains relatively elevated, suggesting near-term prospects for exporters are positive. On the other hand, with the South Korea Export Climate Index and Global PMI New Orders Index exhibiting a strong positive correlation (see first chart), South Korean exporters will likely face increasing headwinds if global demand pressures ease further, with export growth likely to deteriorate.

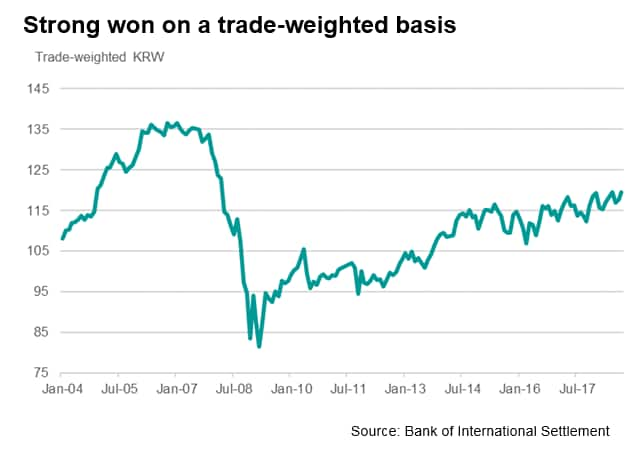

Exchange rate risk has meanwhile been fairly balanced. Broad US dollar strength has seen the Korean won become cheaper for US buyers of Korean products, who account for roughly 12% of all exported goods. Meanwhile, depreciation of the Chinese yuan has impacted competitiveness in Korea's largest international market (China accounts for around 25% of exports). Nonetheless, the trade-weighted won has been on an upward trajectory since the financial crisis, suggesting that exporters are more sensitive to changes in output and demand than the exchange rate. As such, monitoring monthly changes in global business conditions will be key to gauging the potential direction that South Korea's manufacturing sector could be heading.

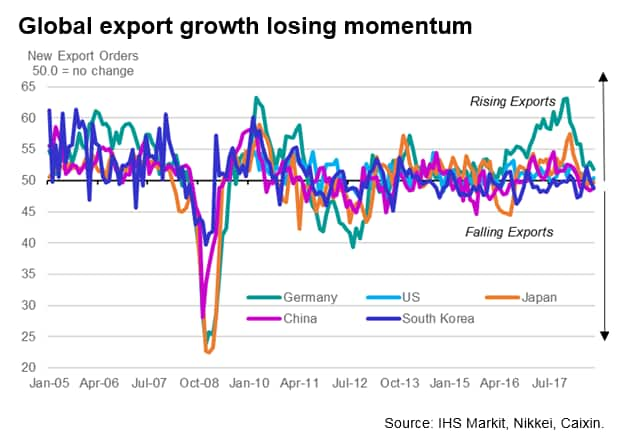

Relative to other large global exporters, PMI data have yet to signal any notable shift in momentum for South Korea, in contrast to China, Germany, Japan and the US. That said, some surveyed companies highlighted during the August survey period that the current US-China trade conflict, the country's two largest trading partners, provided a reason to be pessimistic towards future output prospects.

Encouragingly, for the past year, South Korea's exports have increased by around 10% annually on average, according to official data, and the South Korea Export Climate Index is indicating that global production levels should continue to support further expansion in the manufacturing sector for the time being. But with global demand pressures easing and output growth among the country's key trading partners also slowing amid intensifying global trade tensions, the risks appear to be tilted towards the downside.

Joseph Hayes, Economist, IHS Markit

Tel: 01491 461 006

Email: joseph.hayes@ihsmarkit.com

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsouth-korean-exporters-face-headwinds-140918.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsouth-korean-exporters-face-headwinds-140918.html&text=South+Korean+exporters+face+headwinds+amid+slowing+global+growth+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsouth-korean-exporters-face-headwinds-140918.html","enabled":true},{"name":"email","url":"?subject=South Korean exporters face headwinds amid slowing global growth | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsouth-korean-exporters-face-headwinds-140918.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=South+Korean+exporters+face+headwinds+amid+slowing+global+growth+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsouth-korean-exporters-face-headwinds-140918.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}