Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 02, 2022

Singapore Manufacturing Sector Moderates as Global Headwinds Bite

The Singapore economy has shown continued expansion since the beginning of 2022, helped by significant easing of pandemic-related restrictions. However, Singapore's manufacturing sector is facing increasing headwinds due to the slowdown in the US, EU and China. This has been mitigated by improving conditions in the service sector, notably the rebound in international tourism, business conventions and air travel as border restrictions are easing across much of the Asia-Pacific region.

The upturn in inflation pressures and slowing world growth are expected to create increasing headwinds to growth in the remainder of 2022 and into early 2023.

Singapore economy shows some moderation

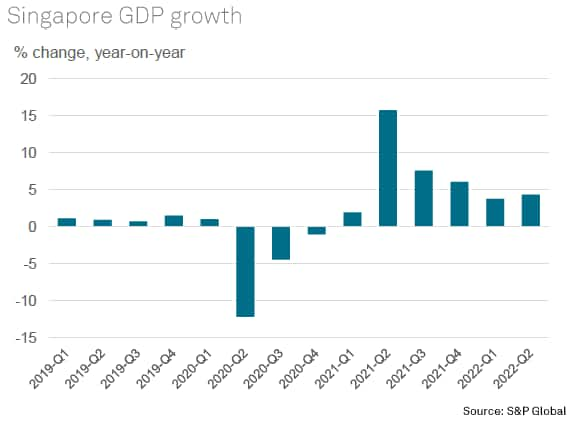

The Singapore economy grew at a pace of 4.4% y/y in the second quarter of 2022, after growth of 3.8% y/y in the first quarter of 2022. This follows a strong economic rebound from the pandemic in 2021, when GDP growth rose by 7.6% y/y.

Helped by improving domestic demand, Singapore's services sector grew at 4.8% y/y and the manufacturing sector grew at a pace of 5.7% y/y in the second quarter of 2022. Service sector output in the second quarter was buoyed by surging output for food and beverage services, as pandemic-related restrictions were eased significantly during the quarter.

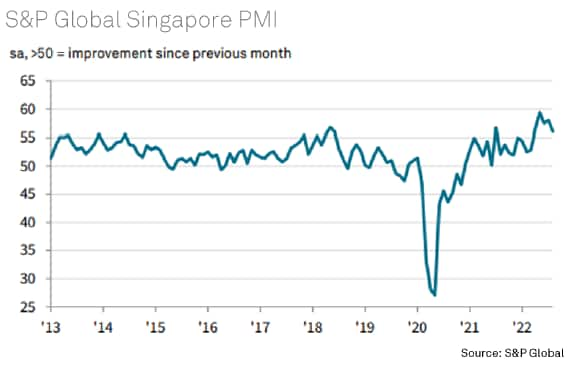

The headline S&P Global Singapore Purchasing Managers' Index™ (PMI™) posted 56.0 in August, down from 58.0 in July. The latest reading remained above the 50.0 no-change mark for a twenty-first successive month to signal continued expansion in overall operating conditions. Despite staying historically high, the rate of improvement eased to a five-month low amid slight softening in both output and demand growth.

Manufacturing sector slowdown

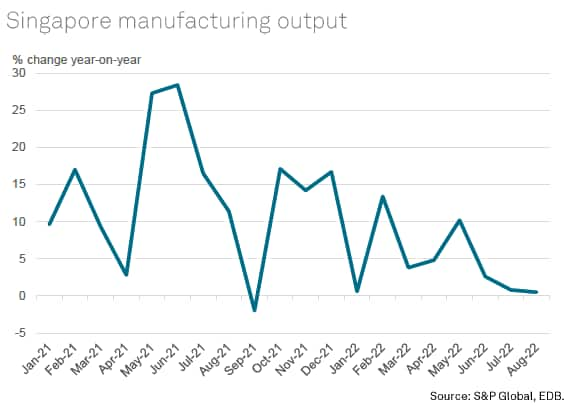

Singapore's manufacturing output growth slowed to just 0.5% year-on-year in August, although production rose by 2.0% month-on-month.

A key factor driving the slowdown of manufacturing output growth has been weakening growth momentum in the electronics sector, which accounts for 40% of total manufacturing sector output. Electronics output in August contracted by 7.8% y/y, with semiconductors output down by 6.6% y/y. The downturn in electronics reflects a broader global weakening in electronics new orders, as economic growth momentum has slowed in the US, EU and China in recent months. Declining chemicals output, which fell by 11.2% y/y, also contributed to the weak outturn.

Declining output in electronics and chemicals was mitigated by strong growth in biomedical manufacturing, which rose by 11.1% y/y, as well as buoyant growth in transport engineering, which rose by 32.8% y/y. This reflected strong growth in both the aerospace engineering segment, which rose by 42.3% y/y, as well as 42.8% y/y growth in the marine and offshore engineering segment.

Overall, total manufacturing output growth during the first eight months of 2022 was up 4.4% y/y, with the electronics sector still recording positive growth of 4.9% y/y. However, the electronics sector will face growing headwinds in the near term due to continued weakening growth momentum expected for the US and EU in the remainder of 2022 and into 2023.

Inflation pressures

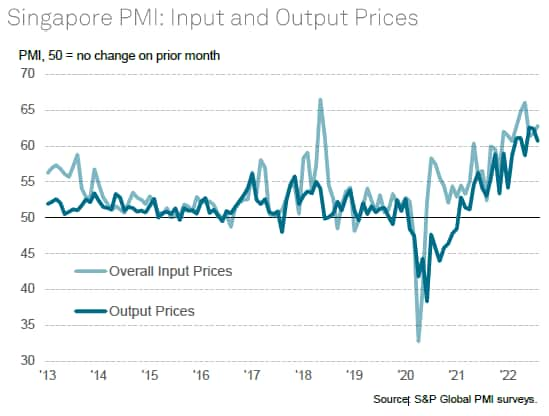

According to the August S&P Global Singapore PMI survey, input and output price inflation remained historically sharp and among the highest on record. The rate of input cost inflation accelerated from August, driven by rises in both purchase costs and average staff expenditure. Higher fuel, energy and raw materials costs were all reported. Moreover, staff costs increased, and at a rate which was the second-sharpest on record. Anecdotal evidence suggested that commission and overtime pay-outs, higher headcounts, and salary adjustments all contributed to sharp wage growth.

Singapore's CPI inflation rate has risen significantly since the beginning of 2022. CPI-All Items inflation came in at 7.5% y/y in August, up from 7.0% y/y in July and 4.0% in January 2022. The Monetary Authority of Singapore's (MAS) measure of Core Inflation rose to 5.1% y/y in August, from 4.8% in July.

For calendar 2022, the MAS and Ministry of Trade and Industry estimate that CPI-All Items inflation is expected to come in at 5.0-6.0%, while MAS Core Inflation is projected to average 3.0-4.0%.

Moderating global electronics demand adds to headwinds

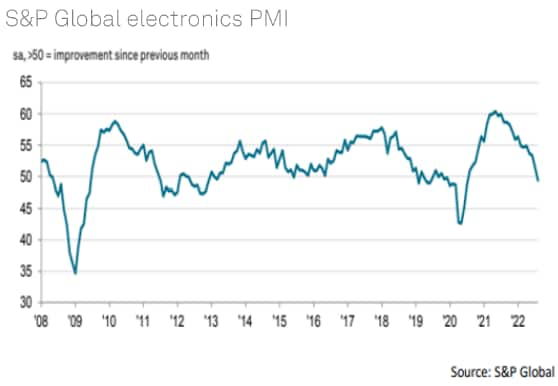

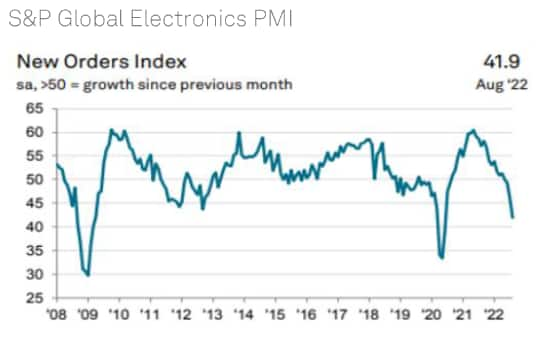

The electronics manufacturing industry is a key segment of Singapore's manufacturing sector, accounting for 40% of the total weight of manufacturing output, dominated by semiconductors-related production. The latest S&P Global survey data indicates that the global electronics manufacturing industry is facing headwinds from the weakening pace of global economic growth.

According to the headline S&P Global Electronics PMI, the global electronics composite index fell to 49.4 in August. The latest survey results indicate that the global electronics industry is now experiencing contractionary conditions for the first time in 26 months.

The two principal sub-components of the Global Electronics PMI - new orders and output - both slipped deeper into contraction territory during August, while inventory levels increased due to sluggish sales and falling production requirements. Weakening economic growth momentum in the US and EU has impacted on consumer demand for electronics, with the economic slowdown in mainland China also contributing to the downturn in new orders.

Singapore's economic outlook

There are a number of significant downside risks to Singapore's near-term growth outlook. Notably, Singapore's export sector is vulnerable to weakening global economic growth momentum, notably in the key export markets of the US, EU and China. Rising inflation pressures are also an important risk to the near-term outlook, particularly as there are signs that wages growth is rising.

However, the medium-term outlook for Singapore's manufacturing sector is supported by a number of positive factors.

In particular, the medium-term global demand outlook for Singapore's electronics industry remains favorable. The outlook for electronics demand is underpinned by major technological developments, including 5G rollout over the next five years, which will drive demand for 5G mobile phones. Demand for industrial electronics is also expected to grow rapidly over the medium term, helped by Industry 4.0, as industrial automation and the Internet of Things boosts rapidly growth in demand for industrial electronics.

In the biomedical manufacturing sector, significant new manufacturing facilities are being built by pharmaceuticals multinationals. This includes a new vaccine manufacturing facility being built by Sanofi Pasteur and a new mRNA vaccine manufacturing plant being built by BioNTech.

The aerospace engineering sector is currently experiencing rapid growth as the reopening of international borders in APAC is boosting commercial air travel across the region. Singapore's role as a leading international aviation hub is likely to continue to strengthen over the medium-term, helped by strong growth in APAC air travel and its role as a key Maintenance, Repair and Overhaul (MRO) hub in APAC.

In the service sector, Singapore is expected to continue to be a leading global international financial centre for investment banking, wealth management and asset management. Singapore will also continue to be a key APAC hub for shipping, aviation and logistics, as well as an important APAC hub for regional headquartering.

However, an important long-term challenge for the Singapore economy will be from ageing demographics, which will result in rising social welfare costs and could gradually reduce Singapore's long-term potential GDP growth rate.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-manufacturing-sector-moderates-as-global-headwinds-bite-Oct22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-manufacturing-sector-moderates-as-global-headwinds-bite-Oct22.html&text=Singapore+Manufacturing+Sector+Moderates+as+Global+Headwinds+Bite+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-manufacturing-sector-moderates-as-global-headwinds-bite-Oct22.html","enabled":true},{"name":"email","url":"?subject=Singapore Manufacturing Sector Moderates as Global Headwinds Bite | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-manufacturing-sector-moderates-as-global-headwinds-bite-Oct22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Singapore+Manufacturing+Sector+Moderates+as+Global+Headwinds+Bite+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-manufacturing-sector-moderates-as-global-headwinds-bite-Oct22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}