Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 16, 2025

Singapore economic activity expands at softest pace for 17 months into end 2024

The S&P Global Singapore PMI - covering the whole economy, including manufacturing, services and construction sectors - indicated that private sector output growth slowed markedly into the end of 2024. This was as incoming new orders rose at a softer pace, with demand observed to have softened among the construction and manufacturing firms in particular according to sub-sector data.

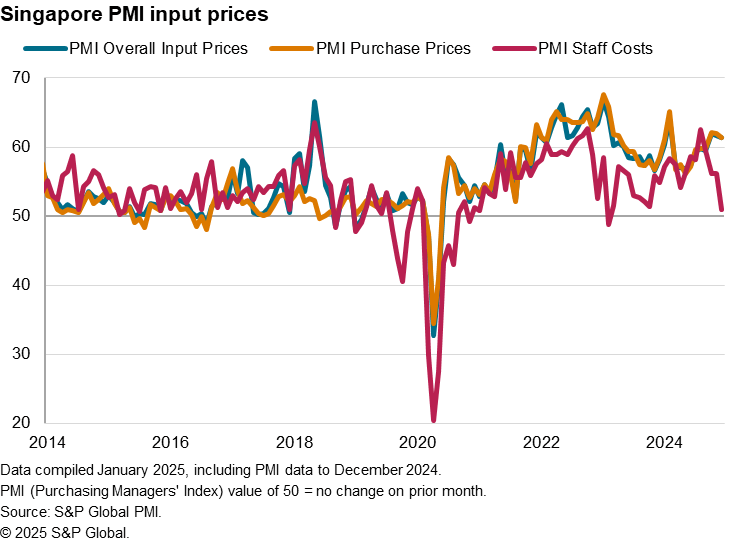

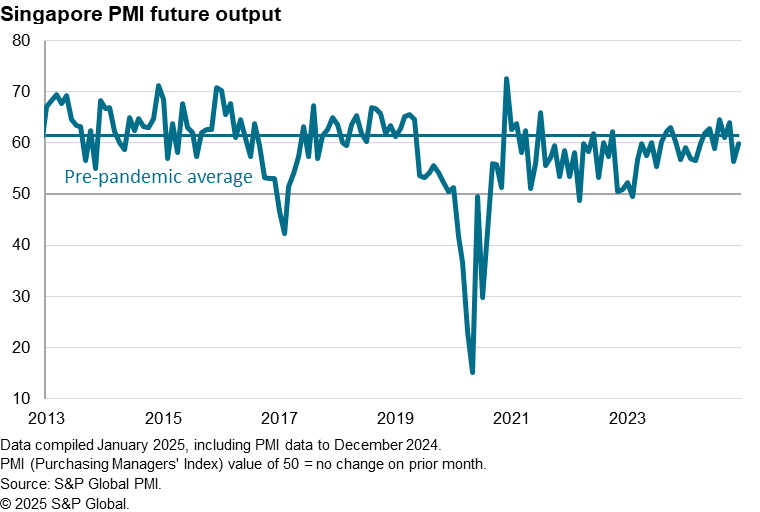

Price pressures meanwhile remained elevated by historical standards as businesses continued to face rising costs, stemming mainly from increased purchase prices while wage inflation softened. Firms also concluded 2024 with optimism levels that were below the pre-pandemic average, reflecting expectations of a more muted outlook for growth at the start of the new year.

Singapore private sector output growth soften in December

The S&P Global Singapore PMI, compiled on a monthly basis, is based on survey responses to questionnaire sent to purchasing managers in a panel of 400 private sector companies across the whole economy, including the manufacturing, services and construction sectors. The latest headline seasonally adjusted PMI posted 51.5 in December, down from 53.9 in November. The headline PMI is a weighted average of the following five indices: New Orders (30%), Output (25%), Employment (20%), Suppliers' Delivery Times (15% and Stocks of Purchases (10%), and the latest fall in the headline PMI was attributed to declines in all components bar the delivery times index (note that the latter is inversely calculated in order to allow it to move in a comparable direction to the other indices).

By posting above the 50.0 neutral mark for the twenty-second successive month, the latest headline PMI reading indicated that Singapore's private sector conditions continued to improve at the end of 2024, but that the rate of improvement was the slowest recorded for 17 months.

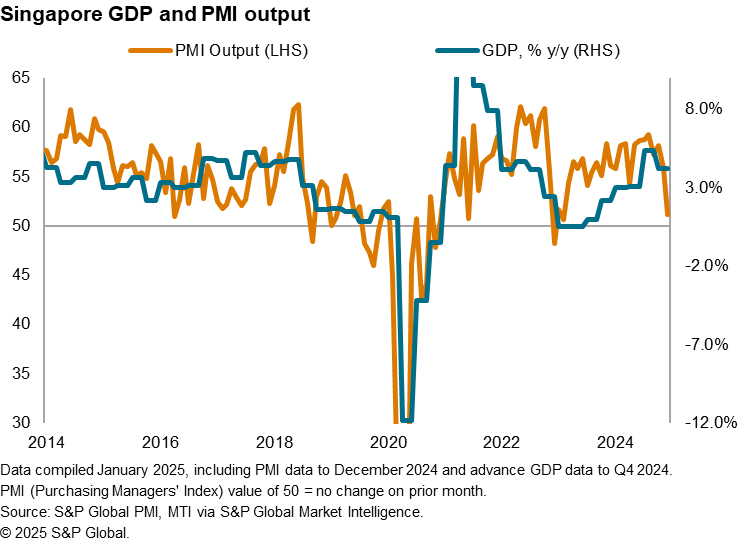

While the headline PMI serves as a bellwether for overall economic conditions, the seasonally adjusted Output Index component of the PMI is best used in forecasting GDP growth, and the manufacturing output PMI sub-index serves best for predicting the industrial production trend.

The latest Singapore PMI Output Index posted 51.1 in December, which was the lowest recorded since February 2023. Substantial expansions in private sector output earlier in the fourth quarter nevertheless meant only a modest softening of growth over the whole of Q4 on average, rather than a steep slowing compared to Q3. As it stands, the advance official Q4 GDP estimate arrived at 4.3% year-over-year (y/y), down from a final reading of 5.4% in Q3. However, the dynamic of the PMI Output Index through the fourth quarter hints at growth momentum being lost as we head into the first quarter of 2025.

Manufacturing output growth eases as electronics growth peaks in the short-term

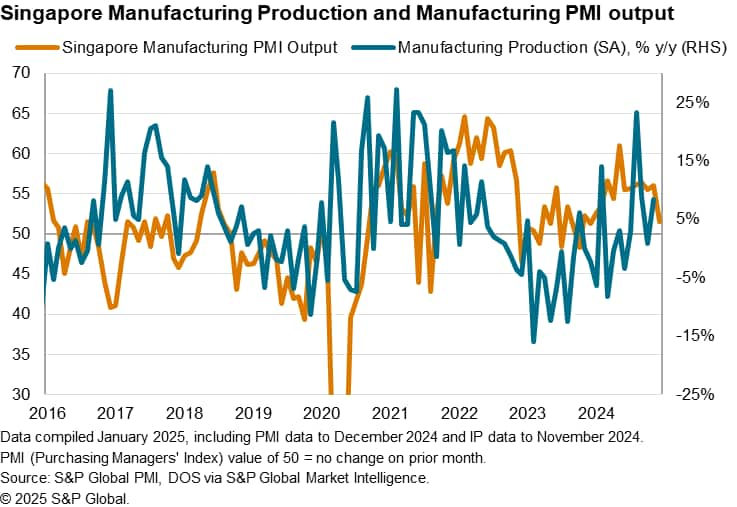

Details from the PMI Output Index showed that particular pockets of weakness were observed in the construction, consumer services, and finance & insurance sectors at the end of the year. The key manufacturing sector meanwhile also saw the rate of output growth ease noticeably from the mid-2024 peak. Comparing the Singapore Manufacturing PMI Output Index (a dataset that is not released as part of the Singapore PMI but is published as part of the ASEAN Manufacturing PMI) with Singapore's manufacturing production, the latest PMI data has confirmed the trend of a further lowering of manufacturing output growth into the end of the year. Additionally, manufacturing demand had also deteriorated at the end of the year according to the PMI New Orders Index, softening as part of the worsening global manufacturing picture in December.

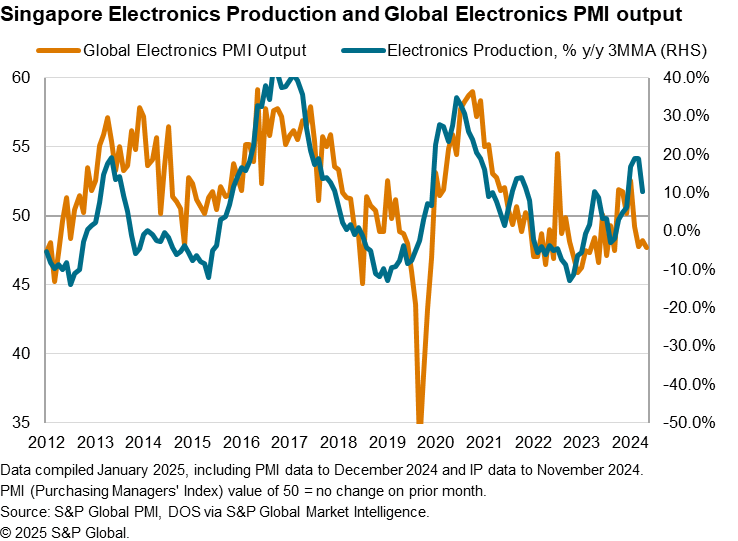

Singapore's all-important electronics sector meanwhile remained in expansion in November according to official data, but comparisons with the Global Electronics PMI Output Index, which appears to have peaked for the near-term earlier in August 2024, has hinted at some softening of growth ahead.

Private sector selling price inflation remains stubborn amid elevated purchase prices

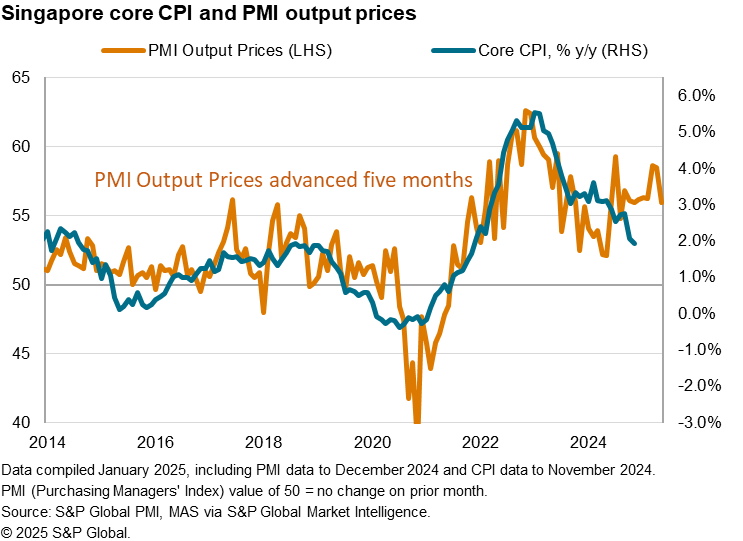

Focusing on inflation, despite slowing business activity growth, selling price inflation across the Singaporean private sector remained elevated above the long-run average at the end of 2024. With PMI output prices providing guidance on the trend for core inflation, the latest data therefore suggested that we may see prices remaining relatively stubborn at around the 2-3% level at the start of 2025.

Underpinning the elevated selling price inflation has been rising input prices. Overall input price inflation continued to rise at a steep pace in December, buoyed by sharp increases in purchases prices while staff costs rose only marginally into the end of the year.

Confidence subdued at year-end

Finally, the survey's only sentiment indicator - the Future Output Index, which asks panellists regarding their expected growth in the next 12 months - showed that business optimism improved slightly from November at the end of 2024. However, the level of confidence remained below the pre-pandemic average with anecdotal evidence outlining concerns regarding the outlook for sales, particularly due to elevated prices.

Access the Singapore PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economic-activity-expands-at-softest-pace-Jan25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economic-activity-expands-at-softest-pace-Jan25.html&text=Singapore+economic+activity+expands+at+softest+pace+for+17+months+into+end+2024++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economic-activity-expands-at-softest-pace-Jan25.html","enabled":true},{"name":"email","url":"?subject=Singapore economic activity expands at softest pace for 17 months into end 2024 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economic-activity-expands-at-softest-pace-Jan25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Singapore+economic+activity+expands+at+softest+pace+for+17+months+into+end+2024++%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economic-activity-expands-at-softest-pace-Jan25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}