Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 04, 2018

Signs of manufacturing cycle having peaked as PMI slips to five-month low

- Global PMI slips further from near seven-year high

- Eurozone economies see strongest expansion, though North

America closes the gap. Growth remains lacklustre in Asia

- Inflationary pressures remain elevated, and intensify in North

America

Global manufacturing growth slowed to a five-month low in March, though remained robust by recent standards. Regional trends varied markedly, however, with faster growth in the US helping North America to close the gap with the slowing eurozone economy. Asia remained on a sluggish growth path. Capacity constraints meanwhile led to sellers regaining pricing power, notably in the US and Europe.

Growth cools from recent highs

The headline JPMorgan Manufacturing PMI, compiled by IHS Markit, fell for a third successive month, down from 54.1 in February to 53.4 in March. However, while the decline in the PMI so far this year has indicated slowing growth of business activity, December's reading had been the highest for nearly seven years, and the March index remains above the average recorded in 2017, underscoring the resilient steady pace of expansion being signalled by the surveys.

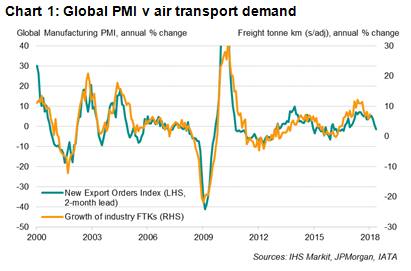

Historical comparisons with official data suggest that the latest PMI is consistent with worldwide factory output growing at an annual rate of approximately 4% (over the past two decades, the PMI has exhibited an 86% correlation with the official manufacturing output data, with the PMI acting with a four-month lead).

Moreover, of the 30 countries for which survey data were available, only three recorded PMI readings below 50, signalling contraction, and even in these cases (Thailand, South Korea and Malaysia) the deteriorations signalled were only modest. The fastest rates of expansion were again seen in the eurozone and its neighbouring countries. The Netherlands headed up the global rankings, followed by Germany and Austria.

Download full article

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsigns-of-manufacturing-cycle-having-peaked-as-pmi-slips-to-fivemonth-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsigns-of-manufacturing-cycle-having-peaked-as-pmi-slips-to-fivemonth-low.html&text=Signs+of+manufacturing+cycle+having+peaked+as+PMI+slips+to+five-month+low+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsigns-of-manufacturing-cycle-having-peaked-as-pmi-slips-to-fivemonth-low.html","enabled":true},{"name":"email","url":"?subject=Signs of manufacturing cycle having peaked as PMI slips to five-month low | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsigns-of-manufacturing-cycle-having-peaked-as-pmi-slips-to-fivemonth-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Signs+of+manufacturing+cycle+having+peaked+as+PMI+slips+to+five-month+low+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsigns-of-manufacturing-cycle-having-peaked-as-pmi-slips-to-fivemonth-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}