Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 19, 2023

Service sector drives growth in Spain as divergence with manufacturing widens

With Spain continuing to spearhead the wider Eurozone recovery, we take a deeper dive into the country's latest HCOB PMI data, which is compiled by S&P Global. By its own historical standards, growth in the Spanish private sector over the past three months has been marked and a stark contrast to the weakness seen in the final quarter of 2022. However, similar to trends seen in many other economies across the globe, the recent upturn has almost entirely been driven by a sharp uplift in service sector activity while growth in manufacturing production lags far behind.

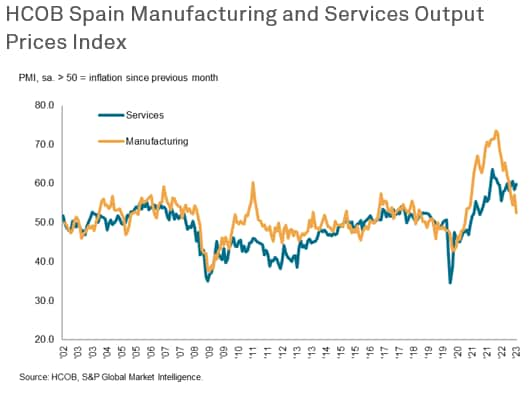

Inflationary pressures have meanwhile remained elevated, albeit softer than the survey peaks recorded in the early months of 2022. Recent drops in both input cost and output charges in the manufacturing sector have been helping in reducing overall inflationary pressures, but service providers have reportedly struggled to keep costs down amid current wage pressures. All things considered; the sustainability of the current upturn is certainly an aspect that can be called into question when looking to the future of the Spanish private economy, and certainly one which will be closely monitored in the months to come.

Marked improvement in economy supported by service sector buoyancy

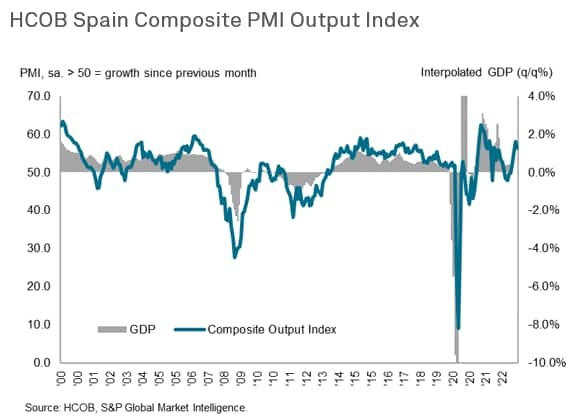

Conditions across the Spanish private sector remained resilient at the start of the second quarter of the year, as signalled by the headline HCOB Spain Composite PMI Output Index posting firmly above the neutral 50.0 threshold again in April. Albeit down slightly from March's 16-month high (58.2), the latest reading of 56.3 was indicative of another substantial improvement in the Spanish private economy that was the fourth in successive months. Notably, given the manufacturing sector's relatively underwhelming performance this month, recent success across the economy can be in large be pinned to the current buoyancy in the service sector. The data suggest that growth of GDP will pick up in Q2 following a 0.5% quarter-on-quarter expansion in Q1.

According to the latest HCOB PMI data, the Spanish services economy experienced a sixth consecutive monthly expansion in business activity. The uplift was the second-strongest since November 2021 and the most pronounced of the five monitored Eurozone countries. Panel members often mentioned that activity growth was largely a consequence of some further improvement in demand conditions, a notion which latest survey data supported heavily. In fact, amid a reported pick-up in the tourism industry, new business received by Spanish service providers increased at the sharpest rate in 17 months at the start of the second quarter of the year. Positive trends have subsequently ricocheted across other areas of the sector. Service companies added to their headcounts at the joint-fastest pace since February 2001 and firms' projections for their future output improved from the preceding month.

Manufacturing sector performance weakens

News, however, was slightly less positive on the manufacturing front. The goods-producing sector was weighed down by a fresh fall in new orders and a slowdown in output growth, linked in turn to customer spending shifting to services and other producers reducing their inventories. Subsequently, input buying was trimmed and pre-production inventories wound down further as firms adjusted to lower workloads.

More optimistic developments within the latest data set included the greatest shortening in suppliers' lead times since April 2009 and the first reduction in selling prices in almost two-and-a-half years.

Inflationary pressures still sharp, but driven solely by the services economy

Albeit somewhat eased from the survey peaks recorded in early 2022, inflationary pressures across Spain's private sector remained historically sharp in April. The increases in input prices and output charges were driven solely by the service sector, where rates of inflation quickened on the month. Here, firms seemingly struggled to keep costs down in the face of increasing labour costs.

By contrast, manufacturing firms reduced their selling prices for the first time since November 2020 and registered a second successive fall in average operating expenses. Moderations in energy and raw material prices were reportedly pivotal factors driving price cuts during April.

Outlook

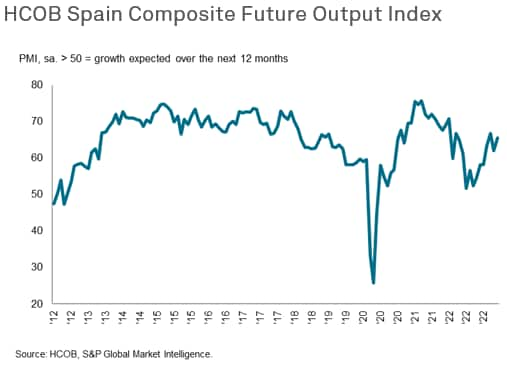

Looking to the future, the question that is still yet to be answered is whether or not the current upturn in the Spanish private sector is sustainable. With the wider recovery heavily reliant on the services economy and amid the ongoing cost-of-living crisis, the lack of any easing in inflationary pressures here is a particular cause for concern. Moreover, the recent uplift in service sector activity was reportedly, in large part, a reflection of a recent pick-up in the tourism industry which also has the potential to prove transitory. It remains to be seen how much pent-up demand exists, and the degree to which savings accumulated during the pandemic can sustain a consumer-led growth spurt.

With April data already indicative of a slight slowdown in the rate of Spanish private sector expansion, May's data release will be highly insightful in revealing whether the current upturn looks to be tailing off in coming months. The next PMI releases for Spain will be on the 1st (manufacturing) and 5th (services) of June.

S&P Global Market Intelligence currently forecasts slower growth in 2023 and 2024 (1.5%) with the expenditure breakdown revealing predictions of a sharp fall in consumer spending. However, some relief can be offered in the fact that projections have recently been upgraded 0.4 percentage points following the stronger than economic data flow at the start of the year - notably the PMIs and the signals of surprising consumer resilience. Companies responding to the PMI surveys were also more upbeat in their outlook for output in the coming 12-months, with sentiment even improving from that seen in March.

Laura Denman, Economist, S&P Global Market Intelligence

Tel: +44 1344 327 221

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fservice-sector-drives-growth-in-spain-as-divergence-with-manufacturing-widens-may23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fservice-sector-drives-growth-in-spain-as-divergence-with-manufacturing-widens-may23.html&text=Service+sector+drives+growth+in+Spain+as+divergence+with+manufacturing+widens+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fservice-sector-drives-growth-in-spain-as-divergence-with-manufacturing-widens-may23.html","enabled":true},{"name":"email","url":"?subject=Service sector drives growth in Spain as divergence with manufacturing widens | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fservice-sector-drives-growth-in-spain-as-divergence-with-manufacturing-widens-may23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Service+sector+drives+growth+in+Spain+as+divergence+with+manufacturing+widens+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fservice-sector-drives-growth-in-spain-as-divergence-with-manufacturing-widens-may23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}