Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 21, 2020

Sector PMIs reveal divergence in COVID-19 recovery

- Five of the eight broad PMI sectors showed signs of recovery from July

- Technology and Consumer Services lag, while Telecommunications Services sees second downturn

- Consumer Services, Telecommunications Services, Industrials and Financials likely to be hit hardest by further lockdowns

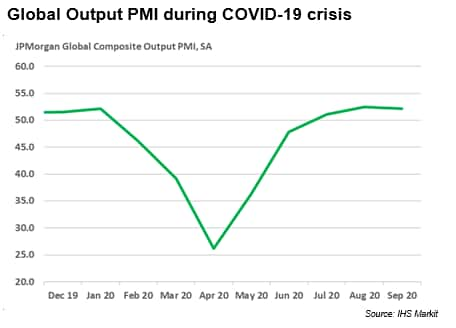

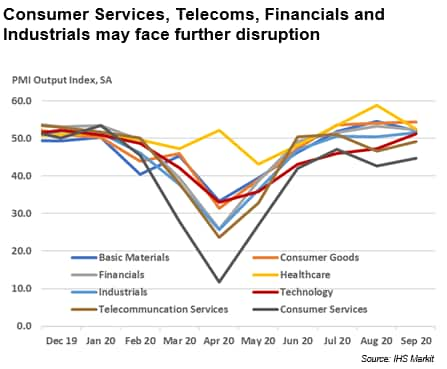

Following the downturn in global business activity driven by coronavirus disease 2019 (COVID-19), PMI data have pointed to early signs of economic recovery, with the JPMorgan Global Composite Output Index posting above 50.0 no-change threshold in each month of the third quarter. However, underlying PMI data have revealed diverging trends at the sector level.

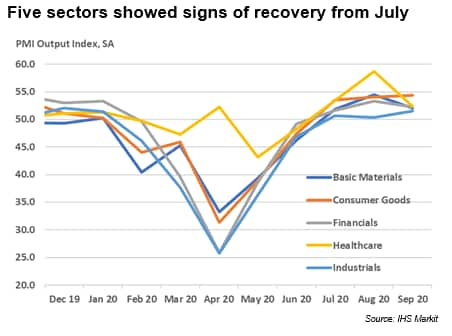

The global recovery that began in July was supported by output expansions in five of the eight broad PMI sectors, namely Basic Materials, Consumer Goods, Financials, Healthcare and Industrials. Those upturns followed contractions in each of the previous five months (except in the case of Healthcare), when widespread COVID-19 lockdowns stifled economic activity. Of these five industries, average third quarter growth was sharpest in Healthcare and Consumer Goods, while the expansion for Industrials was only marginal overall.

Consumer Services sector continues to struggle amid virus restrictions

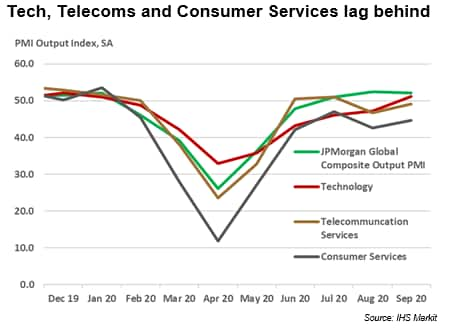

Comparatively, the three remaining broad PMI sectors have all exhibited weak performances in recent months. Firstly, the Consumer Services sector has continued to struggle amid COVID-19 restrictions. Activity has now fallen in each of the past eight months and the rate of contraction remained sharp overall during September. Meanwhile, the Technology sector has lagged the wider economy in terms of output recovery, returning to expansion territory only in September. Finally, Telecoms Services had been the first global sector to record an upturn in activity, but that recovery soon faded as firms posted further declines in both August and September.

PMI sub-sector data give further insight into underlying trends

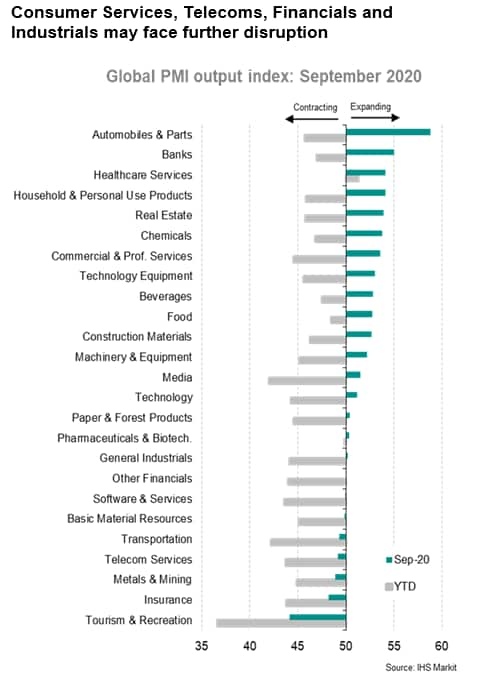

PMI sub-sector data help to further explain the divergence between industries in recent months. For example, the latest improvements in the Consumer Goods and Financials sectors have been driven by Automobiles & Auto Parts and Banks respectively. Meanwhile, Healthcare Services continued to support the broader Healthcare sector, and was the only sub-sector to record average output growth over the first three quarters of 2020. At the other end of the spectrum, the Tourism & Recreation sub-sector continued to weigh on the wider Consumer Services industry which has experienced sharp declines so far this year. Meanwhile, sub-sector data suggested that the recent rebound in the Technology industry was supported by growth at Technology Equipment manufacturers, which more than offset a fractional decline at Software & Services firms.

Rising infections rates likely to drive further disruption

With COVID-19 infection rates in both the US and Europe rising once again, the imposition of further restrictions looms large. When lockdown measures were at their most stringent in Western economies during April, sector PMI data indicated that the economic impact was most severe in the broad Consumer Services sector. However, declines were also marked in Telecommunication Services, Industrials and Financials. Although businesses will have taken measures to adjust to new working conditions, it is possible that these sectors could be severely hampered if restrictions were to retighten. The next release of global PMI sector data on the 5th of November will give an early insight into how the acceleration in infection rates has impacted different sectors during October.

Eliot Kerr, Economist, IHS Markit

Tel: +44 (0) 203 1593 381

eliot.kerr@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsector-pmis-reveal-divergence-in-covid19-recovery-oct2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsector-pmis-reveal-divergence-in-covid19-recovery-oct2020.html&text=Sector+PMIs+reveal+divergence+in+COVID-19+recovery+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsector-pmis-reveal-divergence-in-covid19-recovery-oct2020.html","enabled":true},{"name":"email","url":"?subject=Sector PMIs reveal divergence in COVID-19 recovery | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsector-pmis-reveal-divergence-in-covid19-recovery-oct2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sector+PMIs+reveal+divergence+in+COVID-19+recovery+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsector-pmis-reveal-divergence-in-covid19-recovery-oct2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}