Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 05, 2018

Risk trade tariffs

Research Signals - November 2018

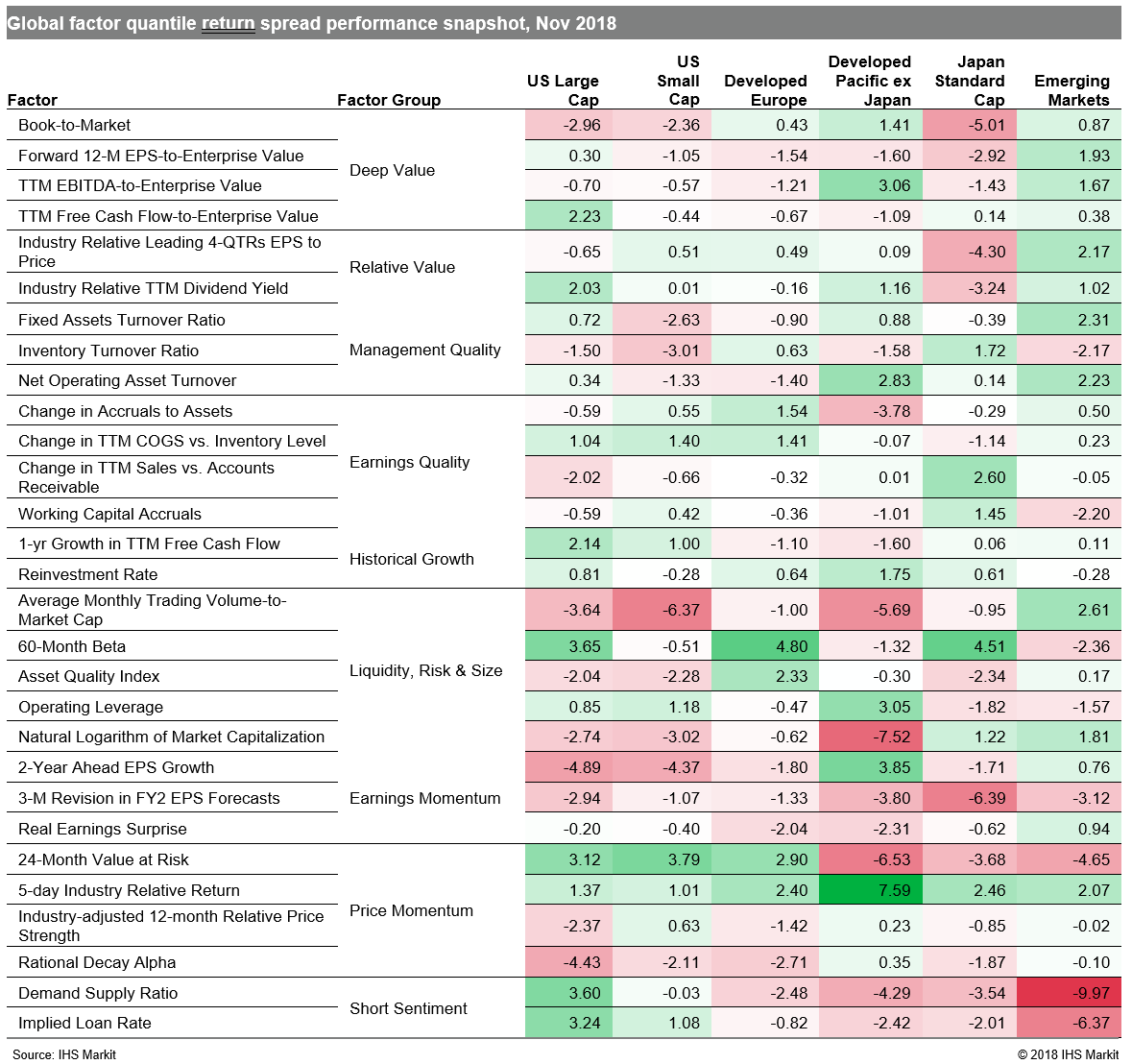

The risk-off trade, which prevailed in October, carried over to November, as markets reacted to trade and tariff headlines over the course of a month that culminated with the G-20 summit in Buenos Aires. In turn, low beta was again a successful signal in several of our developed market coverage universes (Table 1). While crude oil prices slumped and Brexit uncertainty loomed, US-China relations and their impact on global growth remain forefront, as international trade flows were the main drag on the new orders component of the J.P.Morgan Global Manufacturing PMI which remained unchanged last month.

- US: 60-Month Beta posted a second month of strong performance, complemented by Demand Supply Ratio and Implied Loan Rate, gauges of short sentiment

- Developed Europe: Measures based on analyst outlook were negative signals for the month, as captured by the downturn in 3-M Revision in FY2 EPS Forecasts, reversing its trend of positive performance in two-thirds of months since the start of 2017

- Developed Pacific: Investors favored recently underperforming shares, as gauged by short-term reversal metrics such as 5-day Industry Relative Return

- Emerging markets: Valuation was a highly rewarded style, represented by factors such as Forward 12-M EPS-to-Enterprise Value

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisk-trade-tariffs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisk-trade-tariffs.html&text=Risk+trade+tariffs+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisk-trade-tariffs.html","enabled":true},{"name":"email","url":"?subject=Risk trade tariffs | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisk-trade-tariffs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Risk+trade+tariffs+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frisk-trade-tariffs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}