Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 17, 2023

Reviewing the IMF global economic outlook and risks via PMI signals

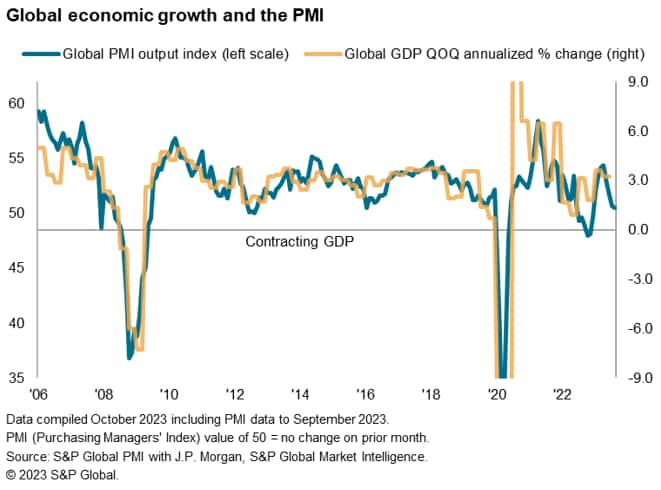

The IMF's latest assessment of the global economy corresponds closely with the picture portrayed in advance by the PMI surveys, with worldwide growth slowing albeit with widening regional divergences. Inflation is meanwhile headed lower, although some uncertainty persists regarding the final leg toward central bank targets. Monitoring the PMI data going forward will not only help determine how the assessment is likely to change in the months ahead, but will also allow us to gauge whether key risks identified by the IMF are developing.

Fading demand for services

In the latest Economic Outlook report, the IMF declares the global economy to be "limping along, with growing divergences". Its projections "are increasingly consistent with a 'soft-landing' scenario", where "inflation is brought down without a major downturn in economic activity". Three global forces are seen to be at play.

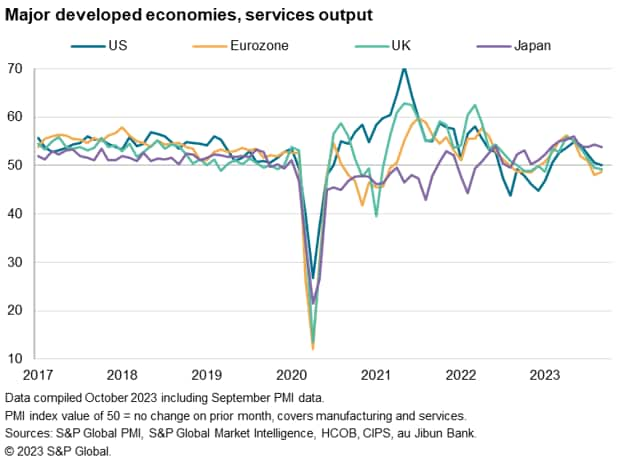

First, "the [post-pandemic] recovery in services is almost complete". In other words, don't expect pent-up demand for services to help boost global growth in the coming months, as we had seen earlier in the year, especially in tourism-oriented sectors and economies. Growth in the service sector is in fact already evaporating. However, there's an upside here, in that "services activity is now weakening alongside a persistent manufacturing slowdown, suggesting services inflation will decrease in 2024 and labour markets and activity will soften".

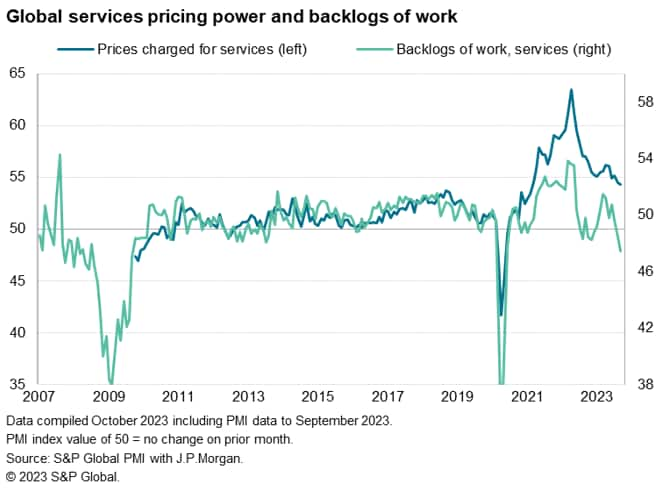

All of these are of course developments that have been flagged in advance by the PMI surveys. The July PMI surveys, for example, had already been warning of the short-lived nature of the second quarter growth spurt. More recently, the likely cooling of service sector inflationary pressure is something we have been eager to highlight, given the development of surplus operating capacity within the sector, as signalled by the PMIs' backlogs of work index.

Visible policy impact

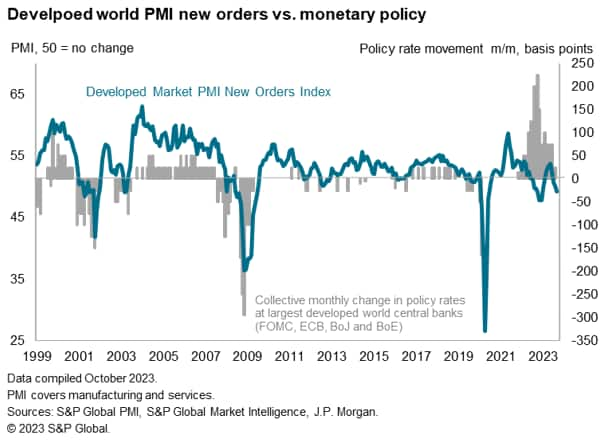

Second, the IMF notes how "part of the slowdown is the result of the tighter monetary policy necessary to bring inflation down. This is starting to bite", with the report citing how the impact of tighter credit conditions is affecting Europe and, to a lesser extent, the US to the greatest degrees.

Again, these are developments that had been warned of well in advance by the PMI surveys (See Flash PMIs signal developed world contraction as higher interest rates exert a growing toll, August 24, 2023), with business activity now falling in both the Eurozone and UK and close to stalling in the US. In Japan, which has been spared rate hikes, business activity - notably in the interest rate sensitive services economy is showing resounding resilience.

Comparisons of PMI data on new orders - a useful proxy for demand growth - meanwhile illustrates how rising interest rates have subdued demand growth in the developed world, the downward trend of which was interrupted by the fillip to demand received from the brief post-pandemic travel tailwind in early 2023, but now looks to be accelerating again (See Renewed fall in global demand fuelled by rising impact of higher interest rates, October 9, 2023).

Waning inflation

Third, the IMF notes important regional divergences in inflation, and in particular the causes of inflation, which help build the case for the soft landing. The IMF first identifies how the energy price spike following Russia's invasion of Ukraine disproportionally hit Europe, where "the pass through of higher energy prices played a large role in driving core inflation upward." However, that's in contrast to the United States, "where core inflation pressures reflect instead a tight labour market." The good news, in that the IMF finds "scant evidence of a wage-price spiral" which, alongside the cooling of energy prices in Europe, bodes well for the inflation outlook.

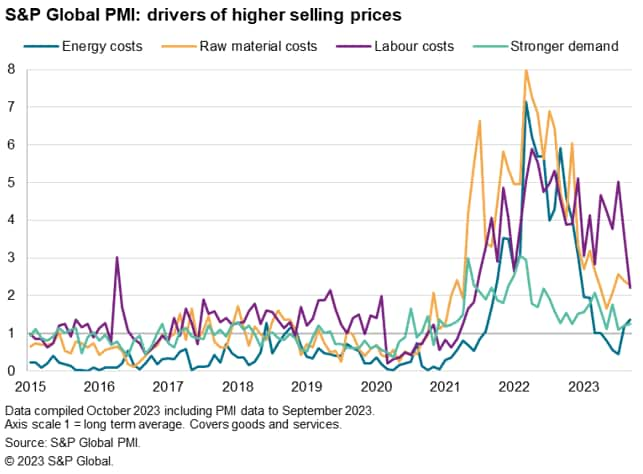

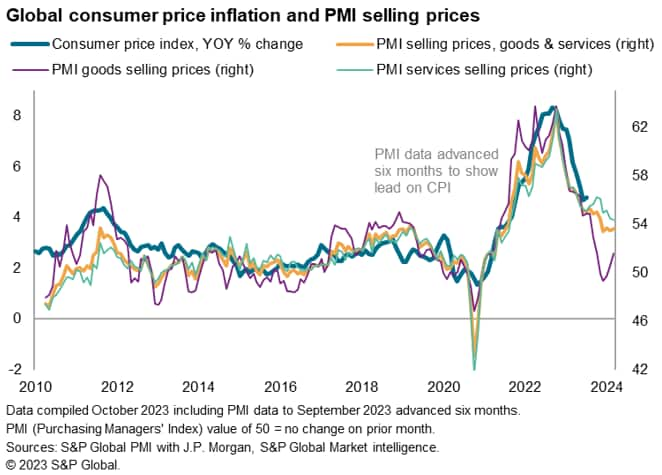

Anecdotal evidence, collected in the PMI surveys, corroborates this analysis, notably via the PMI Comment Tracker indicators, which reveal the factors which companies have determined to be the main drivers of price changes. From these data, the easing of the commodity price shock is clearly evident over the past year, both in terms of the reduced upward pressure on prices from raw materials and energy. Meanwhile, the upward pressure on prices from wages and salaries, which spiked higher earlier in the year amid the resurgence in demand for labour - notably in the service sector - is likewise moderating.

Risks to the outlook

As for risks, IMF alludes to the persistent possibility of renewed financial stress, in particular emanating from the real estate market, as well as the potential for further volatility in commodity markets, especially given how intensifying geopolitical uncertainties could cause prices to spike higher again.

The persistent elevated nature of inflation therefore remains a key risk identified by the IMF, raising the likelihood of stubbornly high inflation expectations becoming entrenched.

The future ability of governments to fight downturns or crises is meanwhile seen to be impeded by the erosion of fiscal buffers amid higher debt levels, with higher interest rates making state support more costly and therefore more difficult to put in place. A final concern of the IMF is that a sharp repricing of risk, especially in emerging markets, could drive the US dollar higher, triggering debt distress.

The PMI data can help to monitor these risks.

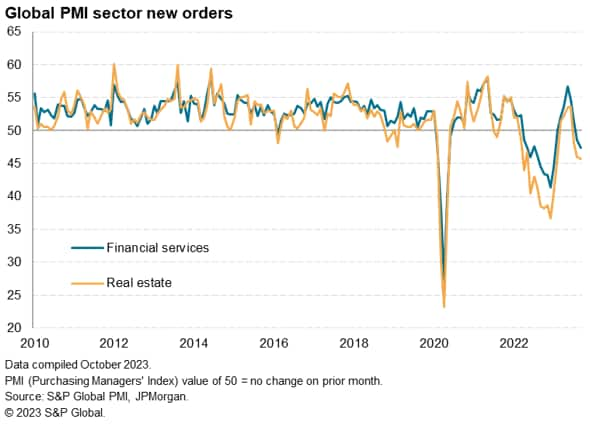

Sector PMI detail is already demonstrating how real estate activity is slumping worldwide, leading a broader financial services downturn, and any further deterioration in this sector risks driving down prices further and raises the likelihood of escalating defaults.

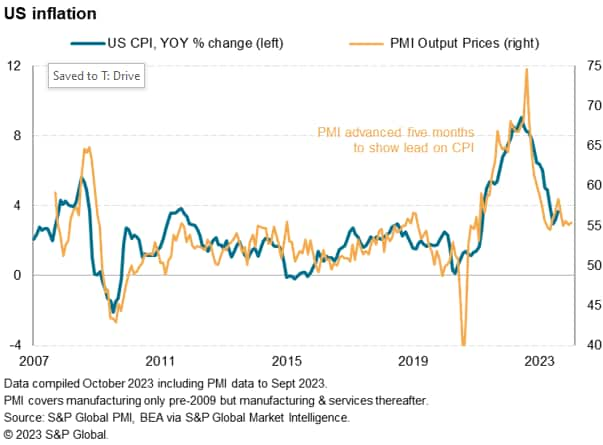

Although easing, inflation remains stubbornly high globally, with the PMI data point to some stickiness in the US most importantly, at 3-4% in the coming months. It is our expectation that the demand slowdown will help lower inflation, as per the comparison of prices with backlogs of work above, but the full cooling of global inflation to central bank target is not yet currently being signalled, meaning the PMI data on costs and selling prices need to be monitored carefully.

Indeed, the very latest PMI data already point to some reversal of commodity-driven disinflation, linked to higher oil prices and fewer supply-chain-related price cuts (See Global PMI data hint at higher goods prices offsetting cooler service sector inflation, October 6, 2023).

As for the risks to the economic outlook from the lack of fiscal leeway and debt distress, these again are developments that will likely first appear via the PMI data on emerging market growth and the global demand environment more generally. One aspect to note is that the risk aversion caused by recent weaker economic growth indicators and the uncertainty caused by geopolitical tensions is already driving safe haven demand for the US dollar higher, adding to all of the problems that would be associated with renewed dollar strength.

As for the broader theme of the soft landing, the latest PMI data perhaps provide some word of caution. If pandemic lockdown months are excluded, the headline global PMI's output index is already down to one of its lowest levels since the eurozone debt crisis of 2012, and backlogs of work are drying up at a rate not seen since the global financial crisis (See Global PMI signals near-term downturn risks amid falling backlogs of work, October 5, 2023).

With such weak forward-looking indicators amid intensifying global uncertainty caused by events in the Middle East, it could be argued that growth risks remain firmly tilted to the downside while inflation risks have nudged higher.

We will know more about how these risks and the current economic environment are developing with the release of flash PMI data for the US, eurozone, UK, Japan and Australia on 24th October. To find out more, contact economics@spglobal.com.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2freviewing-the-imf-global-economic-outlook-and-risks-via-pmi-signals-Oct2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2freviewing-the-imf-global-economic-outlook-and-risks-via-pmi-signals-Oct2023.html&text=Reviewing+the+IMF+global+economic+outlook+and+risks+via+PMI+signals+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2freviewing-the-imf-global-economic-outlook-and-risks-via-pmi-signals-Oct2023.html","enabled":true},{"name":"email","url":"?subject=Reviewing the IMF global economic outlook and risks via PMI signals | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2freviewing-the-imf-global-economic-outlook-and-risks-via-pmi-signals-Oct2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Reviewing+the+IMF+global+economic+outlook+and+risks+via+PMI+signals+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2freviewing-the-imf-global-economic-outlook-and-risks-via-pmi-signals-Oct2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}