Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 23, 2019

Renewed Japanese manufacturing downturn in May amid fresh trade war escalations

- Nikkei Flash Japan Manufacturing PMI signals renewed deterioration in business conditions, as production and order books shrink further

- Export decline leads downturn

- Business confidence turns negative for first time since late-2012

Japan's manufacturing woes persisted in the middle of the second quarter, according to flash PMI data, as intensifying trade war fears weighed on sentiment. The outlook for the sector grew gloomier, with business expectations turning pessimistic for the first time since late-2012. Other PMI indicators also provided scant hopes that manufacturing conditions will improve in coming months.

An important question is whether the manufacturing malaise will spread to the service sector, which has acted as a key support for overall economic growth amid the manufacturing downturn.

Manufacturing malaise

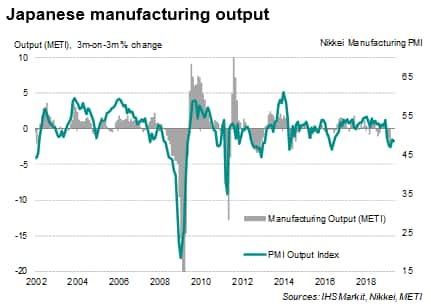

According to flash estimates, the Nikkei Japan Manufacturing PMI for May fell to 49.6 from 50.2 in April, signalling a deterioration of manufacturing conditions midway through the second quarter. The headline PMI, a composite indicator derived from various survey sub-indices, provides a quick snapshot of the health of the manufacturing economy.

Production cutbacks were reported for a fifth straight month during May as demand conditions continued to deteriorate. New export orders decreased further, marking five months of reduction. Firms responded to lower order book intakes by trimming input purchases as well as inventory holdings. Input buying fell for a fifth straight month, driving stock of purchases down at the fastest rate for a year.

Jobs growth also remained subdued as producers focused on curbing costs amid the downturn in sales.

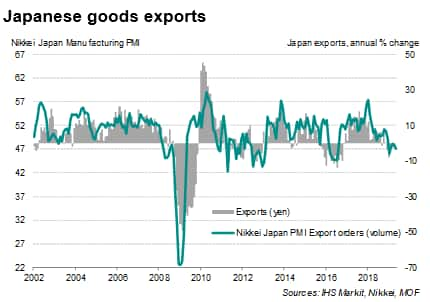

Japan's manufacturing downturn largely reflected a weakening of global demand. Goods exports have been shrinking since December last year, according to official data, in line with the signals from the PMI data. The survey's new export orders index signalled a fall in overseas sales for a sixth consecutive month in May, with exports dropping at one of the steepest rates seen in the past three years.

Negative sentiment

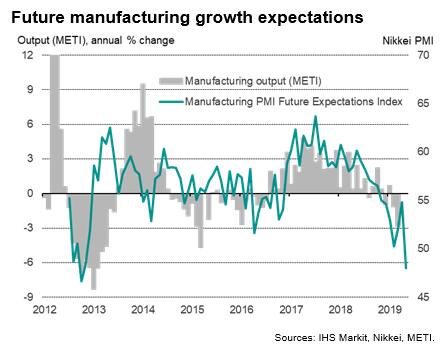

The re-escalation of trade tensions between the US and China, which together accounted for around 40% of Japan's exports in 2018, and the planned consumption tax hike in autumn have heightened concern among Japanese goods producers. Sentiment regarding future output turned pessimistic in May (meaning the number of pessimists exceeded optimists) for the first time since late- 2012.

While first quarter GDP came in better than expected, the flash manufacturing PMI data suggest that growth is set to weaken in the second quarter as Japanese manufacturers, particularly exporters, struggled with formidable challenges that show no signs of abating.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

For more information about the PMI surveys and the Nikkei PMI for Japan, please contact economics@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frenewed-japanese-manufacturing-downturn-in-may-amid-fresh-trade-war-escalations.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frenewed-japanese-manufacturing-downturn-in-may-amid-fresh-trade-war-escalations.html&text=Renewed+Japanese+manufacturing+downturn+in+May+amid+fresh+trade+war+escalations+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frenewed-japanese-manufacturing-downturn-in-may-amid-fresh-trade-war-escalations.html","enabled":true},{"name":"email","url":"?subject=Renewed Japanese manufacturing downturn in May amid fresh trade war escalations | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frenewed-japanese-manufacturing-downturn-in-may-amid-fresh-trade-war-escalations.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Renewed+Japanese+manufacturing+downturn+in+May+amid+fresh+trade+war+escalations+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frenewed-japanese-manufacturing-downturn-in-may-amid-fresh-trade-war-escalations.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}