Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 14, 2021

Relative underperformance of major cities continues into 2021, but brighter outlook forecast

The following is an extract. To download the full paper, please click the link below:

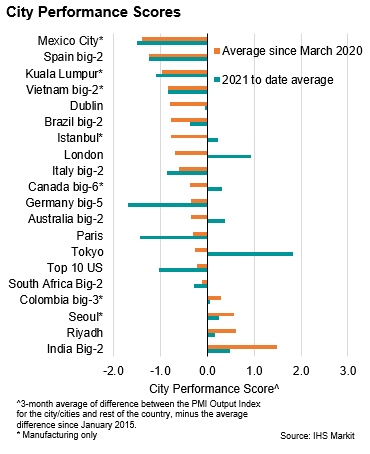

- Cities around the world continued to underperform through to the first quarter of 2021

- Metropolises in Europe and Americas see worsening performance in March as lockdown measures tighten

- But London registers most upbeat outlook for output across Q1, followed by Tokyo

As was the case throughout much of 2020, a range of major cities across the world have continued to underperform relative to the rest of their respective nations into the first quarter of the year, as ongoing containment measures continue to stifle many economies. This paper follows our earlier research into the relative performance of cities amid COVID-19 with extended coverage around the globe - now covering cities in 20 nations - and the inclusion of the PMI™ Future Activity Index, to analyse how the outlook for output over the coming year differs both between major metropolises themselves, and between the cities and the rest of their nations. These additional data suggest that companies in large cities are generally confident that their fortunes will revive as vaccine rollouts help to subdue the virus and enable a return to more normal conditions.

We again utilise our City Performance Scores to analyse the relative performance of cities compared to the rest of the respective nation, and relative to one another. These scores use the Composite Output Index and Future Activity Index data across manufacturing and private sector services firms in a range of cities. The scores are a three-month moving average of the difference between the PMI index for the city and that for the rest of the country, minus the average difference between the two since January 2015. This figure is then normalized to ensure comparability between scores.

These scores provide us with valuable insights into the relative performance of cities with respect to output, as well as in terms of business confidence, through the inclusion of the PMI's principal forward looking indicator.

Our expanded coverage to 20 metropolises across the globe, each of which were selected as a large population centre and/or city economy in countries for which we produce PMI data, were guided by panel sample sizes to ensure robust results. Where a country has several cities of economic or population importance and panel members are evenly spread, these have been combined to produce a single city score for that country, which again compares the relative performance of these areas combined against the rest of the respective nation.

Lewis Cooper, Economist, IHS Markit

Tel: +44 1491 461019

lewis.cooper@ihsmarkit.com

Andrew Harker, Economics Director, IHS Markit

Tel: +44 1491 461016

andrew.harker@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frelative-underperformance-of-major-cities-continues-into-2021-but-brighter-outlook-forecast.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frelative-underperformance-of-major-cities-continues-into-2021-but-brighter-outlook-forecast.html&text=Relative+underperformance+of+major+cities+continues+into+2021%2c+but+brighter+outlook+forecast+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frelative-underperformance-of-major-cities-continues-into-2021-but-brighter-outlook-forecast.html","enabled":true},{"name":"email","url":"?subject=Relative underperformance of major cities continues into 2021, but brighter outlook forecast | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frelative-underperformance-of-major-cities-continues-into-2021-but-brighter-outlook-forecast.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Relative+underperformance+of+major+cities+continues+into+2021%2c+but+brighter+outlook+forecast+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frelative-underperformance-of-major-cities-continues-into-2021-but-brighter-outlook-forecast.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}