Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 03, 2018

PMI surveys show UK economy enjoying robust growth up to September

- 'All-sector' PMI dips to second-lowest since April but remains consistent with 0.3-0.4% GDP rise in Q3

- Broad-based steady growth signalled, though construction lags manufacturing and services

- Cost pressures rise amid higher oil prices

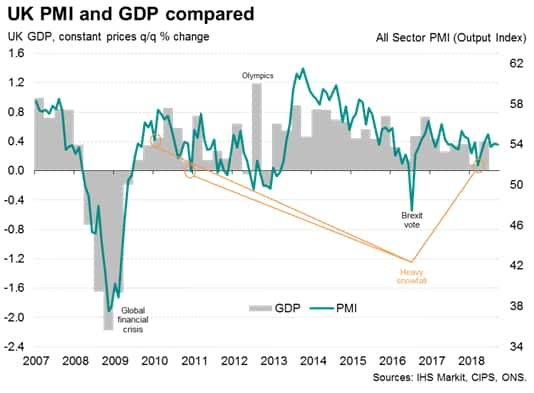

PMI survey data showed business activity rising in September, albeit with the rate of growth cooling fractionally to the second-lowest since April. The ongoing solid expansion in September means the survey data indicate that the pace of economic growth likely slowed only marginally during the third quarter amid a continuing broad-based expansion. Cost pressures meanwhile intensified, suggesting consumer price inflation will remain elevated in coming months.

Third quarter set for 0.3-0.4% growth

At 54.0, the IHS Markit/CIPS 'all-sector' PMI output index slipped from 54.1 in August, but the still solid monthly expansion ended a third quarter in which the PMI averaged 53.9, down only slightly from 54.1 in the second quarter. Our models indicate that the PMI data in the three months to September are consistent with GDP rising by 0.35%, which compares with 0.4% in the second quarter .

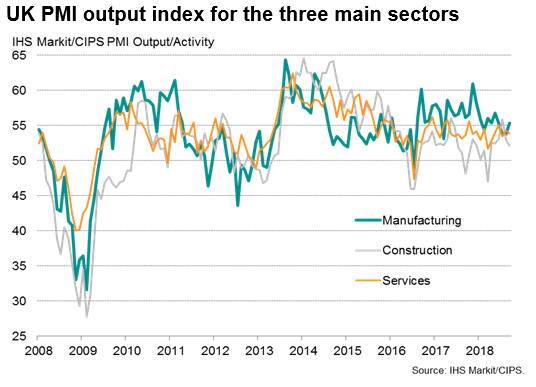

All three main business sectors reported growth in September, but only manufacturing reported an increased rate of expansion. Service sector business activity growth eased to the second-lowest since April, while construction output grew at the slowest rate since the snow-related downturn in March.

The survey data suggest the vast service sector will have provided the main thrust behind the third quarter expansion, growing by approximately 0.3-0.4% in the three months to September, though both construction and manufacturing look to have recorded similar rates of increase in the region of 0.3%.

Within the service sector, the strongest third quarter performance was recorded for financial services, which has seen the best trend growth throughout the year to date followed by computing & IT and transport services. Consumer-facing sectors such as hotels and restaurants, and sporting and leisure activities, remained the weakest performing sub-sectors, though continued to report growth.

Brighter near-term outlook?

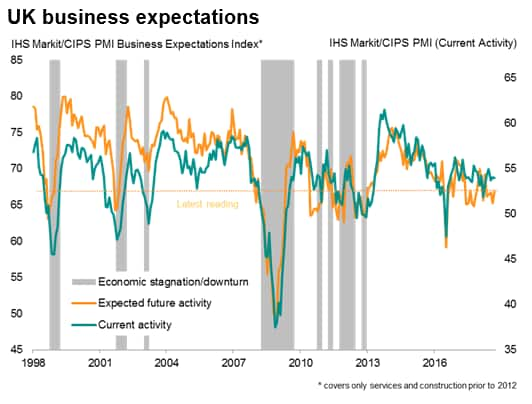

Several sub-indices suggest that solid growth could be sustained, or even improved upon, in coming months. Inflows of new business grew marginally faster in September, rising at the steepest rate for three months, and backlogs of uncompleted work returned to modest growth after declining in August, albeit with the rise limited to services.

Perhaps most encouragingly, employment showed the largest monthly gain since February as firms stepped up their hiring alongside an improvement in optimism about the year ahead, which hit the highest since April. Employment growth accelerated in all three main business sectors, though the improvement in future optimism was limited to manufacturing and services.

However, despite the rise in business optimism, the level of confidence remained subdued by the historical standards of the survey, principally reflecting widespread reports Brexit uncertainty.

Furthermore, growth of manufacturing input buying fell behind that of production during the month, hinting that producers may scale back output in coming months, and certainly showed no signs yet of building safety stocks to prepare for supply chain disruptions in the event of a 'hard' Brexit.

Slower rise in prices despite higher costs

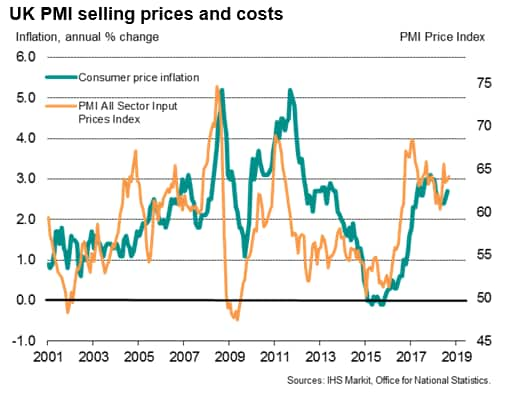

The September surveys brought mixed news on inflation again. Average prices charged for goods and services rose at the slowest rate since May, mainly due to service sector charges showing the smallest monthly increase since June of last year.

However, costs rose at an increased rate, which could feed through to higher selling prices in coming months. The all-sector prices index showed the second-largest monthly increase in firms' costs seen over the past year. All three sectors saw input cost inflation accelerate, in part due to higher oil prices during the month, which fed through to fuel, transport and other oil-based costs.

Rates on hold despite hawkish signals

The rise in cost pressures, and the still-elevated level of selling price inflation, suggests consumer prices will have continued to rise at a pace above the Bank of England's 2% target in September, and will likely remain closer to 3% than 2% in coming months. Consumer price inflation showed a 'surprise' rise to 2.7% in August, although the increase was broadly in line with the signal from the PMI surveys.

The steady and solid pace of economic expansion indicated by the surveys at the end of the third quarter and the intensification of cost pressures will add to views that the next move in interest rates will be another hike. However, with Brexit uncertainty intensifying in recent weeks, any rise seems unlikely prior to the scheduled March 29th exit from the EU.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-show-uk-economy-enjoying-robust-growth-up-to-september.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-show-uk-economy-enjoying-robust-growth-up-to-september.html&text=PMI+surveys+show+UK+economy+enjoying+robust+growth+up+to+September+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-show-uk-economy-enjoying-robust-growth-up-to-september.html","enabled":true},{"name":"email","url":"?subject=PMI surveys show UK economy enjoying robust growth up to September | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-show-uk-economy-enjoying-robust-growth-up-to-september.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+surveys+show+UK+economy+enjoying+robust+growth+up+to+September+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-show-uk-economy-enjoying-robust-growth-up-to-september.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}