Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 06, 2024

PMI surveys record faster global economy growth in October as confidence revives

Worldwide PMI survey - produced by J.P.Morgan and S&P Global in association with ISM and IFPSM - signalled faster economic growth in October, albeit driven by the service sector - and especially financial services - as the goods-producing economy remained largely stalled.

The latest PMI survey data from S&P Global Market Intelligence also showed business confidence about the year ahead reviving, after having slumped in September, albeit remaining historically subdued.

Much of the improvement in future output expectations could be traced to marked upturns in confidence in the US and mainland China. More broadly, sentiment remained subdued by geopolitical uncertainty and weak demand, causing companies to trim employment worldwide for the second time in three months.

Steady global economic growth

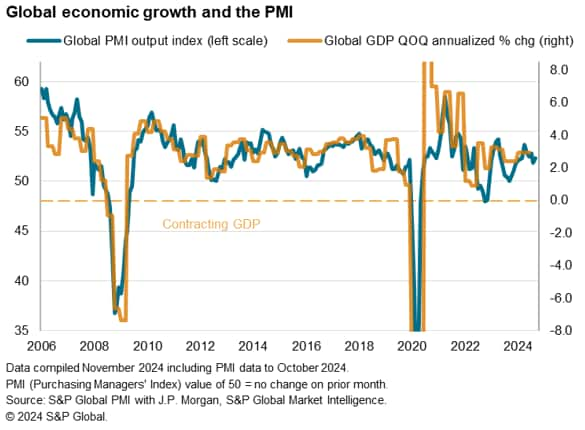

S&P Global Market Intelligence's PMI surveys indicated that global business activity expanded for a twelfth straight month in October, the rate of expansion ticking up from September's eight-month low. The headline J.P. Morgan Global Composite PMI® Output Index, covering manufacturing and services in over 40 economies, rose from 51.9 in September to 52.3, its highest since August.

At its current level, historical comparisons indicate that the PMI is broadly consistent with the global economy growing at an annualized rate of 2.6%. That follows the most recent GDP data having registered a 2.9% expansion in the second quarter, and compares with an average GDP growth rate of 3.1% in the decade prior to the pandemic. The current growth rate signalled by the PMI is therefore one of just below trend.

Service sector drives global expansion

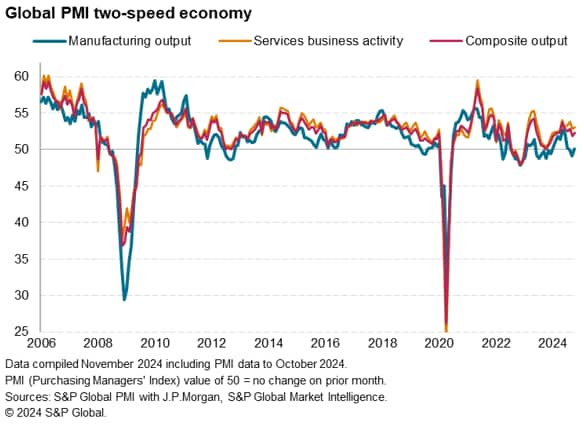

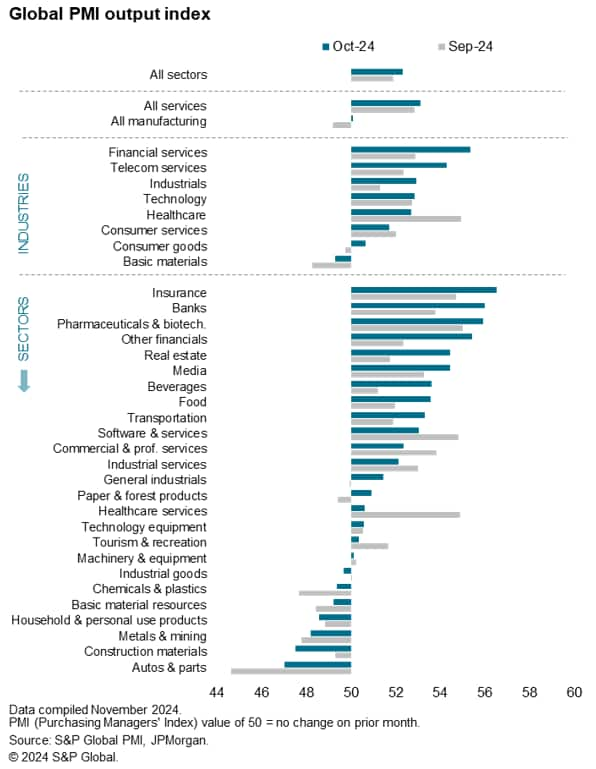

The global expansion continued to be driven by the services economy, which showed sustained, resilient strong growth despite a further disappointing performance from the manufacturing sector. The latter recorded only a marginal rise in output in October after production fell for the first time in nine months during September.

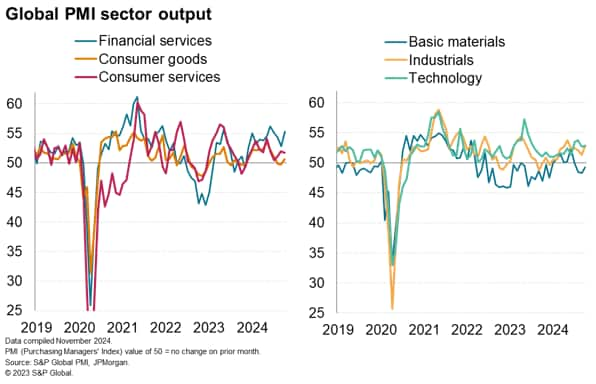

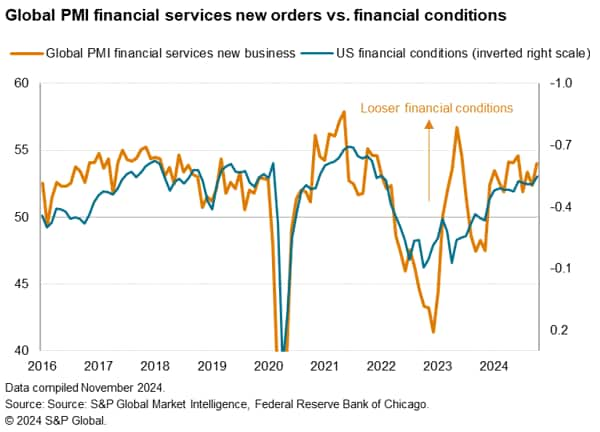

Prior data hints that a weakened manufacturing sector often feeds through to softer services growth in the near future, but so far the PMI data have shown little sign of the services economy becoming infected by the malaise that has subdued the goods producing sector. Instead, services growth has been driven in particular by strong financial services activity, linked to looser financial conditions, including lower interest rates.

Not only was financial services the strongest performer of the eight broad industries tracked by the global PMI in five of the last six survey periods, but four of the top five sub-sectors were all financial services based.

US maintains its lead in the developed markets, Japan lags

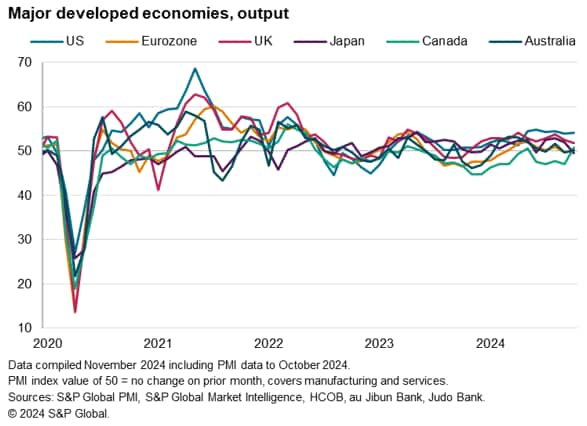

Among the major developed economies, the US recorded the strongest expansion for a sixth straight month, the rate of growth edging up but with growth dependent on the services economy as manufacturing output fell for a third successive month.

The UK, which had seen a strong performance in September, saw a marked loss of growth momentum to result in the slowest expansion since November 2023, with a near-stalled manufacturing sector accompanied by subdued services growth.

Canada meanwhile returned to growth for the first time in five months amid revivals in both manufacturing and services, and the eurozone stabilised following a contraction in September. A marginal return to growth was also recorded in Australia. That left Japan as the only major developed economy reporting lower output in October. Although only modest, the decline reflected falling output in both manufacturing and services.

Emerging markets see broad-based improvement

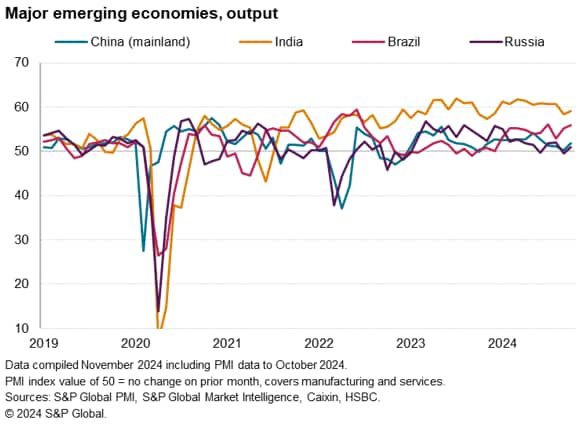

India meanwhile continued to lead the four BRIC 'emerging' economies by a wide margin, as has been the case since July 2022, with faster growth reported in both manufacturing and services.

Brazil closed the gap with India, however, as a broad-based improvement in output drove the second-fastest overall expansion for 28 months, marginally weaker than the growth rate observed in July.

Growth also improved markedly in mainland China after the near-stalled picture seen in September, as the Caixin PMI produced by S&P Global signalled the sharpest expansion for four months. Stronger rates of growth were recorded in both manufacturing and services.

Finally, output returned to modest growth in Russia, albeit fuelled only by higher service sector activity.

Consequently, all four BRIC economies reported higher composite PMI readings in October.

Improved confidence limited to the US and mainland China

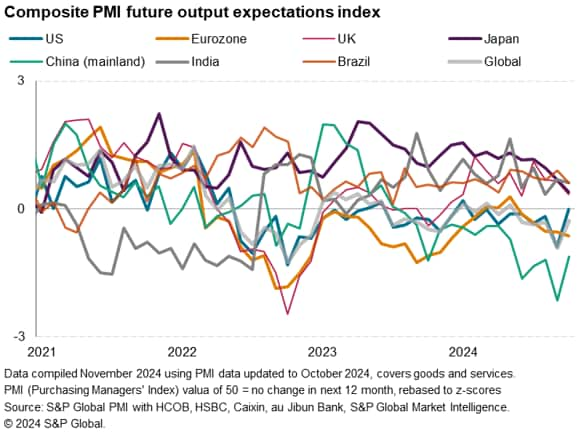

In addition to current output growth edging higher globally in October, business expectations for output in the year ahead also revived. Having fallen to a near-two-year low in September, future expectations rose to the highest since May, recovering in both manufacturing and services.

However, the improvement in confidence was largely limited to the US, where businesses were more optimistic about the environment after the US election, and in mainland China, the latter following recent stimulus measures. Confidence fell elsewhere among most of the other major economies.

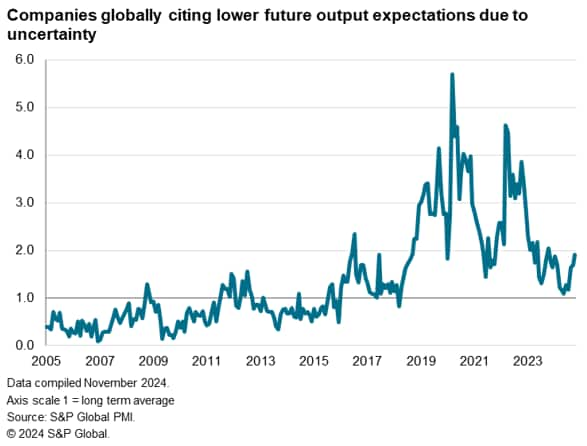

Lower confidence was often blamed on geopolitical uncertainty, especially in relation to concerns over the outcome of the US Presidential Election alongside worries over escalating conflicts in the Middle East and Ukraine, as well as more general concerns over trade barriers, the high cost of living in many countries, and a reticence among customers to spend. Reports of 'uncertainty' dampening global future output expectations climbed to a one-year high and are now running at close to twice the long-run average. Though this remains low by standards seen over the pandemic, such a degree of uncertainty had been rarely seen prior to the pandemic.

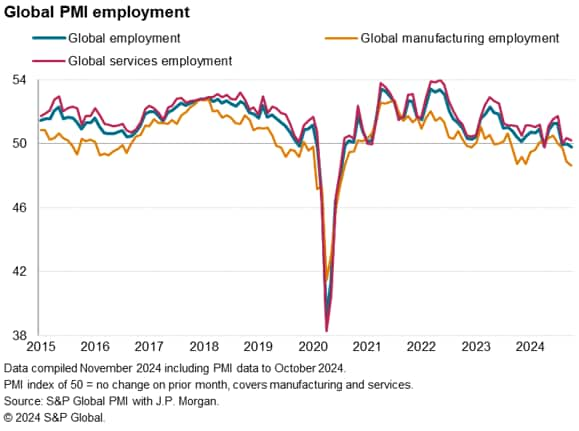

Global employment trimmed for second time in three months

The heightened economic uncertainty recorded in October fed through to growing caution in relation to employment. Global payrolls fell marginally in October as a result, with no employment growth having now been recorded since July. Only a minor rise in service sector jobs was seen while factory jobs were cut at the sharpest rate for over four years.

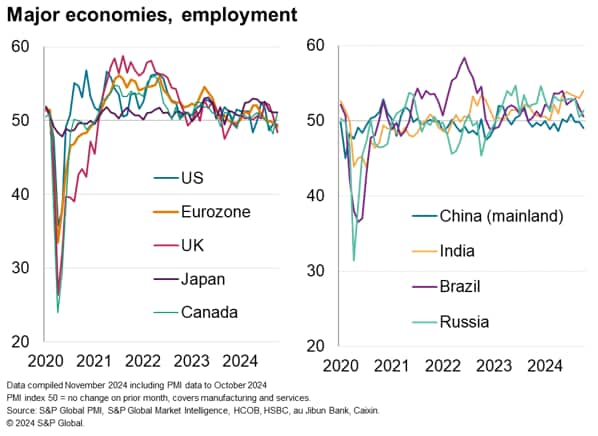

In the major developed markets, job cuts were recorded in the US, eurozone and the UK, with only slight gains reported in Japan, Australia and Canada.

In the major emerging markets, the fastest rate of job creation in India since 2006 contrasted notably with a steepening rate of job losses in mainland China to the highest recorded for six months.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-record-faster-global-economy-growth-in-october-as-confidence-revives-Nov24.html%3futm_id%3dPC024015","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-record-faster-global-economy-growth-in-october-as-confidence-revives-Nov24.html%3futm_id%3dPC024015&text=PMI+surveys+record+faster+global+economy+growth+in+October+as+confidence+revives+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-record-faster-global-economy-growth-in-october-as-confidence-revives-Nov24.html%3futm_id%3dPC024015","enabled":true},{"name":"email","url":"?subject=PMI surveys record faster global economy growth in October as confidence revives | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-record-faster-global-economy-growth-in-october-as-confidence-revives-Nov24.html%3futm_id%3dPC024015","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+surveys+record+faster+global+economy+growth+in+October+as+confidence+revives+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-record-faster-global-economy-growth-in-october-as-confidence-revives-Nov24.html%3futm_id%3dPC024015","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}