Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 18, 2021

PMI™ as a tool for equity portfolio adjustment

Following on from our previous work (see here) related to PMI and its application in financial markets settings, this paper provides another fruitful avenue for the applicability of PMI data.

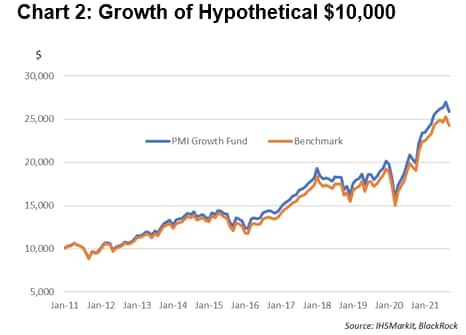

We conduct a simulation exercise whereby we split investment capital of $10,000 into two separate Exchange Traded Funds (ETFs) which respectively provide direct exposure to equities in both developed and emerging markets.

We then use monthly changes in aggregated PMI numbers as a guide to adjust and facilitate changes in exposure to these developed and emerging markets ETFs over a period stretching back over a decade.

Our PMI "growth fund" is found, since its inception (January 2011), to provide a return of 159% to the end of September 2021, compared to a passive benchmark equivalent of 143%. Results are also positive for YTD (2021), one-year, and five-year time horizons, thus providing a compelling case of using PMI data to navigate any difference between equity market trends owing to macroeconomic growth developments.

The paper proceeds as follows.

Sections 1 and 2 provide some background to the PMI datasets and details of our theoretical and methodological approach. Section 3 assesses fund performance over different time horizons, including a short discussion on trends in 2021 to date. Section 4 offers some concluding thoughts.

To download the full paper, please click the "Download Full Report" button at the top of the page.

Paul Smith, Economics Director, IHS Markit

Tel: +44 (0) 1491 461038

paul.smith@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-as-a-tool-for-equity-portfolio-adjustment-oct21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-as-a-tool-for-equity-portfolio-adjustment-oct21.html&text=PMI%e2%84%a2+as+a+tool+for+equity+portfolio+adjustment+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-as-a-tool-for-equity-portfolio-adjustment-oct21.html","enabled":true},{"name":"email","url":"?subject=PMI™ as a tool for equity portfolio adjustment | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-as-a-tool-for-equity-portfolio-adjustment-oct21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI%e2%84%a2+as+a+tool+for+equity+portfolio+adjustment+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-as-a-tool-for-equity-portfolio-adjustment-oct21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}