Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 28, 2021

Philippines remains mired in recession due to latest Covid-19 wave

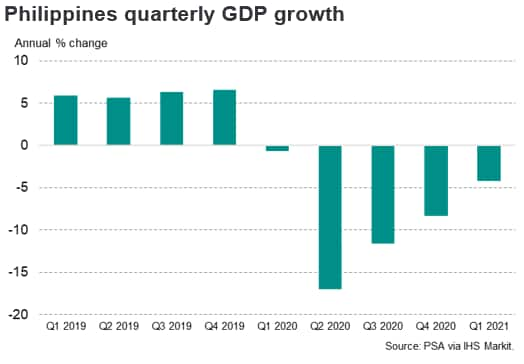

The Philippines has remained in protracted recession during early 2021, suffering its fifth consecutive quarter of economic contraction in the first quarter of 2021. Economic recovery has been delayed by the impact of the latest Covid-19 wave that has hit the Philippines during the first half of 2021, reflecting strict pandemic control measures in Metro Manila and other surrounding areas badly impacted by the latest pandemic surge.

Escalating new Covid-19 cases dampens recovery

The latest GDP statistics for the first quarter of 2021 showed that the Philippines economy contracted by 4.2% year-on-year, the fifth consecutive quarter of recession. This follows a severe contraction in GDP in the 2020 calendar year, with the Philippines economy having contracted by 9.6% year-on-year. This was the largest annual decline ever recorded since National Accounts data series for the Philippines commenced in 1946.

Household final consumption expenditure fell by 7.9% y/y in calendar 2020, while gross capital formation contracted by 34.4% y/y. Some sectors of the economy recorded severe declines in output, with the transport and storage sector recording a 30.9% y/y decline in output in 2020, while accommodation and food services output slumped by 45.4%.

In the first quarter of 2021, the pace of contraction in household final consumption expenditure moderated to a decline of 4.8% year-on-year, while gross capital expenditure contracted by 18.3% y/y. Strong growth in government final expenditure, which expanded by 16.1% y/y in the first quarter of 2021, helped to mitigate the net impact of these declines.

Although the severity of the economic contraction has moderated during the second half of 2020 and during the second half of 2020, with positive quarter-on-quarter GDP growth recorded in the fourth quarter of 2020, the new Covid-19 pandemic wave that gathered momentum since March 2021 has dampened near-term recovery prospects.

Reflecting the global slump in international trade, exports of goods and services fell by 16.3% y/y in 2020. The Philippines export sector has also remained weak in early 2021, with exports down 9.1% y/y in the first quarter of 2021.

Despite the large decline in exports in 2020, the current account surplus reached a record high of USD 13 billion or 3.6% of GDP, boosted by the sharp slump in imports due to the severe contraction in domestic demand. In March, the Philippines central bank, Bangko Sentral ng Pilipinas (BSP), has revised up its current account surplus projection for 2021 to USD 9.1 billion, or 2.3% of GDP

An important stabilizing factor for the Philippines economy has been overseas worker remittances by Filipinos working abroad, which remained quite stable during 2020, down only 0.8% y/y, and equivalent to around 10% of GDP. However, an estimated 400,000 Filipino workers were repatriated during 2020 as a result of job losses in their host countries, raising concerns about the impact on remittance flows during 2021. Remittances sent home by workers are an important factor supporting domestic consumer spending in the Philippines. Recent monthly data continues to show resilient remittance inflows, with remittances by workers abroad up by 5.3% y/y in February 2021.

Due to the severe escalation in daily new Covid-19 cases since mid-March 2021, the Philippines government has imposed a range of restrictive measures to try to contain the pandemic. A one-week lockdown was announced for Metro Manila and four surrounding provinces on 29th March but was extended progressively to 14th May. The Metro Manila lockdown was further extended to the end of May, although lockdown measures have been eased in other parts of the Philippines. The total number of people impacted by the lockdown measures for Metro Manila and surrounding provinces was estimated at around 26 million, or around one-quarter of the total population of the Philippines, as well as being the largest economic region of the Philippines economy.

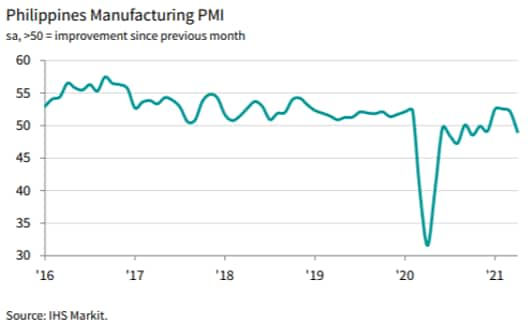

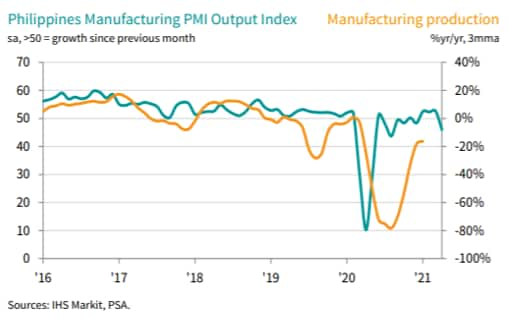

Manufacturing production contracted by 9.8% y/y in 2020, reflecting significant disruption to manufacturing output during the pandemic-related lockdown and restrictions on retail trading in Q2 and Q3 2020. Although economic conditions had been gradually improving in the fourth quarter of 2020 and during the first quarter of 2021, the recent severe escalation in the pandemic has created renewed uncertainty about the momentum of economic recovery in the near-term.

Reflecting the impact of the latest domestic Covid-19 wave, the IHS Markit Philippines Manufacturing PMI fell to 49.0 in April, down sharply from 52.2 in March, to signal a marginal contraction in operating conditions across the Filipino manufacturing sector. Manufacturers in the Philippines highlighted a steep decline in output at the start of the quarter, which was largely attributed to enhanced community quarantine measures, undertaken to control the spread of the disease.

As a result of tightening lockdown measures, many clients suspended their operations, with demand faltering for the first time since December 2020. Domestic demand was especially subdued with the rate of reduction among the sharpest in the series. However, export sales to European markets which have begun to gradually reopen, helped to narrow the pace of contraction for manufacturing export orders.

Input shortages and higher raw material costs were widely reported in the April survey period. Input price inflation accelerated for the sixth month running, with the latest uptick the strongest in over two-and-a-half years, and contributed to an upturn in manufacturing output prices, as firms sought to partially pass on greater costs to clients. Declines in production and new orders also hit business confidence in April, with the optimism about an expansion in output over the coming year dropping to an eight-month low impacted by renewed uncertainties about the ongoing impact of the pandemic.

Progress of vaccine rollout

As a developing country with a population of 108 million, the Philippines confronts significant challenges in vaccinating its population with Covid-19 vaccines due to difficulties in obtaining sufficient vaccine supplies as well as the logistical problems of implementing a large-scale vaccination rollout nationwide. The Covid-19 vaccination program began on 1st March 2021, after the arrival of shipments of China's Sinovac vaccine. The Philippines has contracted to acquire 25 million doses of the Sinovac vaccine, with one million already delivered and a further 1 million doses provided as a gift by the Chinese government. The Philippines is also due to receive 9.3 million doses of the Oxford/AstraZeneca vaccine through the global COVAX facility. So far 2.5 million doses had been delivered to the Philippines through this COVX facility by the end of May 2021.

The COVAX facility, which is a global vaccine sharing initiative, has faced delays in receiving AstraZeneca vaccine supplies from the Serum Institute of India, a key manufacturer of the AstraZeneca vaccine. This is because India has also faced a sharply accelerating Covid-19 wave similar to the Philippines, and the Indian government has placed temporary restrictions on export of Covid-19 vaccines in order to accelerate vaccination of the Indian population.

The Philippines government is negotiating with seven global Covid-19 vaccine makers to secure sufficient supplies. A contract for 13 million doses has been agreed with Moderna, with a further contract for an additional 7 million doses also having been subsequently negotiated, providing a total of 20 million Moderna vaccine doses. The Philippines also signed a contract for 40 million doses of the Pfizer vaccine in May 2021.

The Philippines government had planned to vaccinate 70 million persons by end-2021, with a total of 2.5 million doses having been administered by mid-May 2021. An estimated 2.3% of the total population had received first dose vaccinations by 18th May 2021. A key problem confronting the Philippines, like many other developing countries, is that it is relying on imported vaccine supplies and is therefore vulnerable to supply disruptions due to "vaccine nationalism", as some nations with vaccine production facilities prioritize supplies to their own domestic populations due to the mounting human toll of the pandemic.

Philippines economic outlook for 2021

While the Philippines economy is still expected to show a positive growth rebound in 2021, the near-term outlook has been dampened by the sharply rising wave of new Covid-19 cases since mid-March 2021.

This is expected to constrain the pace of economic recovery in the near-term, as strict pandemic control measures were imposed in Metro Manila and other surrounding areas badly impacted by the latest surge in pandemic cases. Vaccine rollout in the Philippines has also been constrained by lack of sufficient supplies of imported vaccines.

Consequently, the pace of economic recovery in 2021 is likely to be less buoyant than previously expected, with renewed pandemic control measures constraining the momentum of growth recovery in the near-term. GDP growth in 2021 is expected to be in the 5% to 6% range, with stronger GDP growth in 2022 as the pandemic is gradually constrained by widening vaccine rollout in the Philippines, resulting in more normal economic conditions.

Rajiv Biswas, Asia Pacific Chief Economist, IHS Markit

Rajiv.biswas@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-remains-mired-in-recession-due-to-latest-covid19-wave-May21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-remains-mired-in-recession-due-to-latest-covid19-wave-May21.html&text=Philippines+remains+mired+in+recession+due+to+latest+Covid-19+wave+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-remains-mired-in-recession-due-to-latest-covid19-wave-May21.html","enabled":true},{"name":"email","url":"?subject=Philippines remains mired in recession due to latest Covid-19 wave | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-remains-mired-in-recession-due-to-latest-covid19-wave-May21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Philippines+remains+mired+in+recession+due+to+latest+Covid-19+wave+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-remains-mired-in-recession-due-to-latest-covid19-wave-May21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}