Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 03, 2018

Philippines manufacturing growth regains pace at end of first quarter

- Manufacturing PMI rises to 51.5 in March from 50.8 in February

- Rising inflationary pressures add to rate hike expectations

- Business confidence improves to eight-month high

The Philippines manufacturing sector is on course for its weakest quarterly growth in recent years, according to the Nikkei PMI data. However, a rise in the headline index in March suggests that the adverse impact on demand from new excise taxes is starting to fade.

Weakest quarter in survey history

The headline Nikkei Philippines Manufacturing PMI™ rose from 50.8 in February to 51.5 in March, indicating a faster rate of improvement in the health of the sector. The headline PMI is a single-figure indicator that provides a quick snapshot of manufacturing performance, derived from questions on output, new orders, employment, inventories and supply chains.

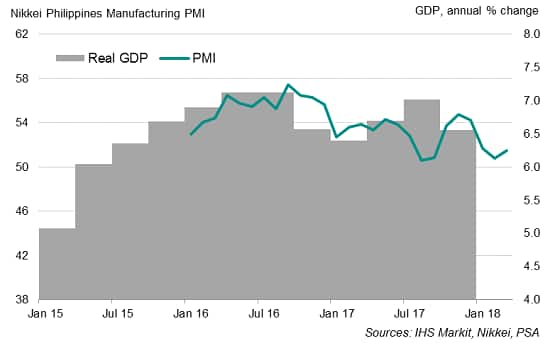

Philippines PMI and economic growth

Despite the rise, the average PMI reading for the first quarter was the lowest since data collection started in January 2016, suggesting that the overall pace of economic growth is likely to have slowed compared to late last year.

Brighter outlook

Recent PMI surveys signalled that demand for Philippines goods has been hurt by new excise taxes on tobacco, petroleum products, minerals and automobiles (effective from January), albeit with the March PMI data pointing to some softening of the impact.

Order book growth hit a three-month high, supported by revived export growth. Not only did export sales return to expansion, but the rate of growth was also the fastest since the end of 2016. The upturn encouraged firms to step up their purchasing activity and build up stocks. Optimism towards the outlook also improved to an eight-month high.

Rising inflation adds to calls for rate hike

One area of concern is the extent to which sharp cost increases could feed through to higher consumer prices which, in turn, would affect future monetary policy. Factory input cost inflation reached a new survey-record high during March, according to the PMI, matched by a sharp rise in selling prices as companies sought to protect their margins.

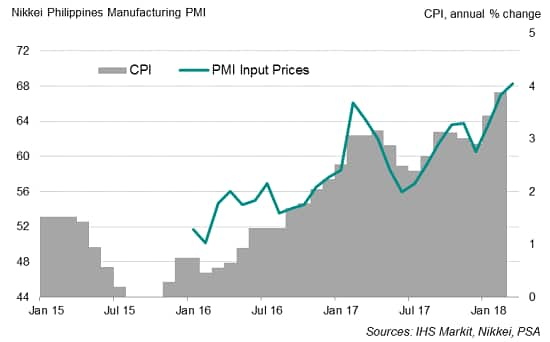

Philippines PMI and inflation

The recent implementation of the new excise tax was cited as a key reason for higher prices, especially for gasoline. Retail pump prices for RON95 have risen nearly 9% since the start of the year, according to the Philippines’ Department of Energy. Similarly, official statistics showed consumer price inflation reaching 3.9% in February, the highest in almost three-and-a-half years. Higher input price inflation signalled by the PMI surveys suggests consumer price inflation could reach 4% in March.

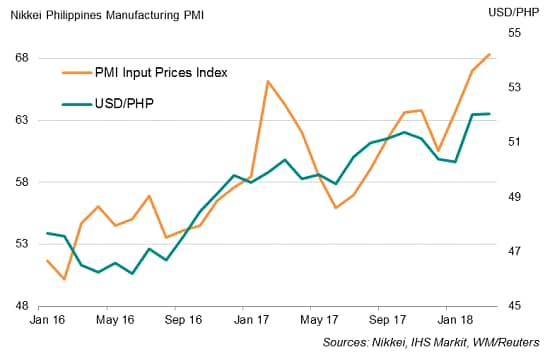

Philippines PMI and the peso

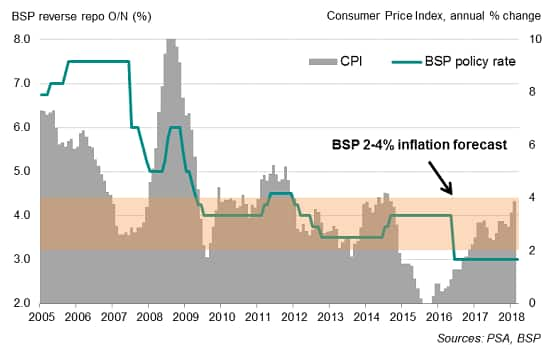

Rising inflation will add to already widespread expectations that the Bangko Sentral ng Pilipinas (BSP) will raise interest rates soon. When CPI went beyond 4% in July 2014, the BSP hiked rates.

Although monetary policy was left unchanged at the latest central bank meeting, the BSP highlighted efforts to continue monitoring for signs of second-round price effects and inflation becoming more entrenched. The central bank expressed confidence that the Philippines economy is able to withstand higher interest rates, seemingly paving the way for a future rate hike. The policy rate has remained at 3.0% since June 2016.

Philippines CPI and monetary policy

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-manufacturing-growth-regains-pace.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-manufacturing-growth-regains-pace.html&text=Philippines+manufacturing+growth+regains+pace+at+end+of+first+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-manufacturing-growth-regains-pace.html","enabled":true},{"name":"email","url":"?subject=Philippines manufacturing growth regains pace at end of first quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-manufacturing-growth-regains-pace.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Philippines+manufacturing+growth+regains+pace+at+end+of+first+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-manufacturing-growth-regains-pace.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}