Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 22, 2023

Philippines economy shows robust growth into the new year

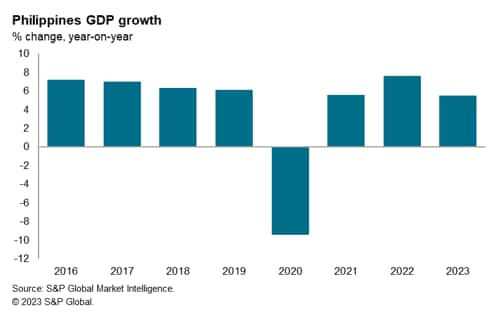

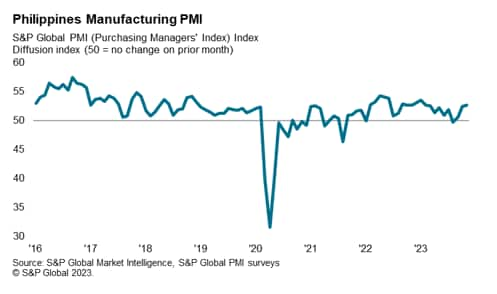

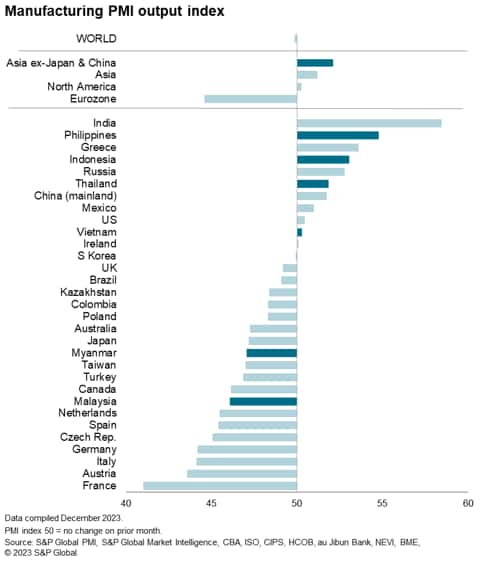

Recent economic data shows that the Philippines economy has continued to show robust expansion, with GDP growth of 5.9% year-over-year (y/y) in the third quarter of 2023. Latest S&P Global Purchasing Managers Index survey results for November 2023 also showed that the Philippines manufacturing sector is one of the fastest growing amongst the major economies worldwide.

Sustained remittance inflows from workers abroad, fast-growing IT-BPO sector exports and the continued recovery of the tourism sector are also expected to support economic growth momentum during 2024. International visitor arrivals are estimated to have doubled in 2023 compared to 2022, driving a significant rebound in international tourism revenues.

Philippines amongst world's fastest growing emerging markets

The Philippines economy has continued to show strong recovery from the COVID-19 pandemic during 2023, with GDP growth strengthening to a pace of 5.9% y/y in the third quarter of 2023, compared with GDP growth of 4.3% y/y in the second quarter of 2023.

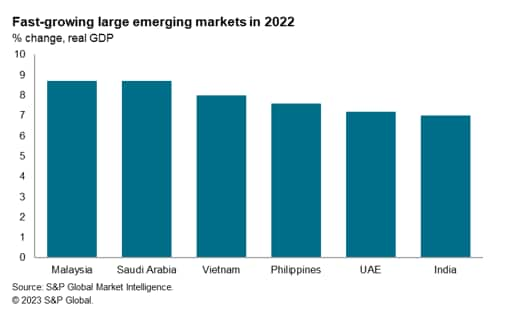

The continued rapid economic expansion in 2023 follows a strong rebound from the COVID-19 pandemic during 2022, which drove the pace of growth of the Philippines economy to the fastest rate since 1976. The Philippines GDP growth rate of 7.6% in 2022 was comparable to some of the world's fastest growing large emerging markets in 2022, including the Gulf Co-operation Council oil exporting nations of Saudi Arabia and United Arab Emirates, as well as other rapidly growing Asian emerging economies such as Malaysia, Vietnam and India.

The Philippines has also shown a much-improved economic growth performance over the past decade, apart from during the peak period of the COVID-19 pandemic during 2020-21 when there was widespread global disruption to economic activity. During the period from 2012 to 2019, real GDP growth in the Philippines each year ranged between 6% to 7%. The economic rebound in 2022 pushed real economic growth to the highest pace recorded since 1976, with household final consumption expenditure growing by 8.3% y/y while gross capital formation grew by 16.8% y/y.

Recent economic data has continued to show expansionary conditions in the Philippines economy during the fourth quarter of 2023. The headline S&P Global Philippines Manufacturing PMI rose from 52.4 in October to 52.7 in November, signalling continued expansionary operating conditions that was the strongest reading since February.

The uptick in the headline PMI figure reflected gains across the top two PMI components of output and new orders. Firms noted that strong demand conditions both in domestic and foreign markets, new client wins and increased contract work boosted overall sales and in turn spurred greater production.

The latest international S&P manufacturing PMI survey results for November 2023 also show that the Philippines manufacturing sector was one of the fastest growing among all the countries surveyed worldwide.

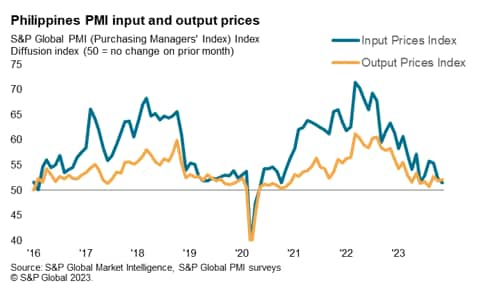

According to the November Manufacturing PMI survey results, the rate of input price inflation was the weakest recorded in over three years, resulting in a similarly modest uptick in manufacturers' selling prices.

Broader inflation pressures have remained a key concern for Bangko Sentral ng Pilipinas (BSP) during 2023. However, the headline CPI inflation rate has moderated to 4.1% y/y in late 2023, compared with 8.6% y/y in February 2023.

The CPI inflation rate had moved significantly above the BSP inflation target range of 2% to 4% due to the upsurge in inflation pressures during 2022 and the first half of 2023. As a result, the BSP tightened monetary policy by a total of 450 basis points (bps) since May 2022, with the most recent policy rate hike of 25bps on 27 October 2023. However, the BSP Monetary Board kept the policy rate unchanged at its November and December meetings, with its assessment that CPI inflation would come back within the BSP inflation target range during 2024.

Improving balance of payments position in 2023

The Philippines recorded a significant improvement in its balance of payments position during 2023, with a cumulative balance of payments surplus of USD 3 billion for the first eleven months of 2023, compared with a deficit of USD 7.9 billion for the same period a year ago. This reflected a significant moderation in the current account deficit during 2023 and was also helped by continued growth in worker remittances from abroad.

The current account has shifted into deficit since 2020. In 2020, the current account had reached a record surplus of USD 11.6 billion or 3.2% of GDP, boosted by the sharp slump in imports due to the severe contraction in domestic demand during the COVID-19 pandemic peak. However, the current account shifted back to a deficit of USD 6.0 billion in 2021, or 1.5% of GDP, as growth recovery triggered higher domestic demand and rising imports. In 2022, the current account deficit rose to USD 17.8 billion, equivalent to 4.4% of GDP. Imports soared during 2022, with surging prices for world oil and gas being important factor contributing to a further sharp deterioration in the current account balance for calendar 2022.

The current account deficit is estimated to have moderated to USD 11.2 billion or 2.5% of GDP for 2023, according to latest BSP estimates in December 2023. The BSP projects that the current account deficit will narrow to USD 9.5 billion in 2024, or around 2% of GDP.

External debt as a share of GDP remains moderate, at an estimated 28.5% of GDP in June 2023, according to BSP data.

An important stabilizing factor for the Philippines economy has been overseas worker remittances by Filipinos working abroad, equivalent to around 10% of GDP. Remittances sent home by workers are an important factor supporting domestic consumer spending in the Philippines. Despite concerns about job losses for workers abroad due to the impact of the pandemic on many industries such as tourism and aviation, remittances data continues to show resilient remittance inflows. Remittances by workers abroad rose by 5.1% y/y in 2021, to USD 34.9 billion. In 2022, remittances by workers abroad rose by 3.6% y/y, to USD 36.1 billion. In the first ten months of 2023, worker remittances rose further, by 2.8% y/y compared to the same period a year ago.

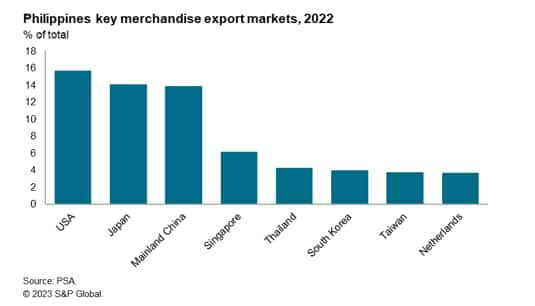

Rapid growth in exports from the IT-BPO sector have also become an important boost for the Philippines economy and for total exports. IT-BPO exports have risen from USD 9.5 billion in 2010 to USD 25.1 billion by 2021, according to BSP estimates.

Philippines economic outlook

The Philippines economy has recorded a third successive year of strong economic growth in 2023, after GDP growth for calendar 2021 rebounded to 5.6% y/y and strong growth momentum continued in 2022 at a pace of over 7.6% y/y.

The easing of pandemic-related travel restrictions since 2022 has also allowed a gradual recovery of domestic and international tourism travel during 2022 and 2023. International visitor arrivals were estimated to have reached 5.1 million by mid-December 2023, exceeding the government's international tourism arrival target of 4.8 million for calendar 2023. International tourism arrivals have approximately doubled compared to total arrivals of 2.6 million in 2022.

Prior to the pandemic, in 2019, gross direct tourism value added as a share of GDP was estimated at 12.7% of GDP, including both international and domestic tourism spending. International tourism spending was estimated at PHP 549 billion, while domestic tourism spending was estimated at PHP 3.1 trillion. Due to the importance of domestic tourism in the overall contribution of tourism to GDP, the continued recovery of tourism could be a significant growth driver in 2024.

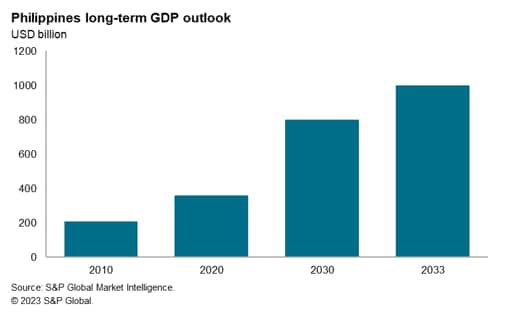

Continued rapid GDP growth of around 5.6% y/y is forecast for 2024, helped by sustained strong private consumption spending, an upturn in government infrastructure spending and improving remittance inflows. Over the next decade the Philippines economy is forecast to continue to grow rapidly, with total GDP increasing from USD 440 billion in 2023 to USD 800 billion in 2030. A key growth driver will be rapid growth in private consumption spending, buoyed by strong growth in urban household incomes.

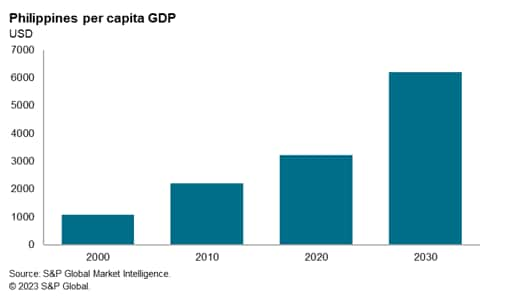

By 2033, the Philippines is forecast to become on the Asia-Pacific region's one trillion-dollar economies, joining mainland China, Japan, India, South Korea, Australia, Taiwan and Indonesia in this grouping of the largest economies in APAC. This strong growth in the size of the Philippines economy is also expected to drive rapidly rising per capita GDP, from USD 3,700 in 2023 to USD 6,200 by 2030. This represents a remarkable improvement in the per capita GDP of the Philippines since 2000, when the GDP per person was just USD 1,100 per head. The rapid growth of household incomes over the next decade will help to underpin the growth of the Philippines domestic consumer market, catalysing foreign and domestic investment into many sectors of the Philippines economy.

The Philippines will also benefit from its membership of the recently implemented RCEP trade deal, particularly due to its very favourable rules of origin treatment, which provide cumulative benefits that will help to build manufacturing supply chains within the RCEP region across different countries. This will help to attract foreign direct investment flows for a wide range of manufacturing and infrastructure projects into the RCEP member nations, particularly into low-cost manufacturing hubs such as the Philippines.

Consequently, the outlook for the Philippines economy over the next decade is very favourable, with significant progress in economic development expected. In 2021, the Family Income and Expenditure Survey of the Philippines government indicated that 20 million people, or around 18.1% of the total population, still live below the poverty threshold. Rapidly rising per capita GDP and standards of living will help to underpin a broad improvement in human development indicators and should deliver a significant reduction in the share of the population living in extreme poverty by 2030.

Access the Philippines Manufacturing PMI press releases here.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-economy-shows-robust-growth-into-the-new-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-economy-shows-robust-growth-into-the-new-year.html&text=Philippines+economy+shows+robust+growth+into+the+new+year+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-economy-shows-robust-growth-into-the-new-year.html","enabled":true},{"name":"email","url":"?subject=Philippines economy shows robust growth into the new year | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-economy-shows-robust-growth-into-the-new-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Philippines+economy+shows+robust+growth+into+the+new+year+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fphilippines-economy-shows-robust-growth-into-the-new-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}